1898 Longmire Rd Unit 40 Conroe, TX 77304

Estimated Value: $263,000 - $331,000

3

Beds

3

Baths

2,032

Sq Ft

$141/Sq Ft

Est. Value

About This Home

This home is located at 1898 Longmire Rd Unit 40, Conroe, TX 77304 and is currently estimated at $285,868, approximately $140 per square foot. 1898 Longmire Rd Unit 40 is a home located in Montgomery County with nearby schools including Giesinger Elementary School, Cryar Intermediate School, and Peet Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 21, 2018

Sold by

Clark Mariana Lai Sim

Bought by

Trantham Erin Kathleen and Trantham Joshua K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,900

Outstanding Balance

$144,996

Interest Rate

4.8%

Mortgage Type

New Conventional

Estimated Equity

$140,872

Purchase Details

Closed on

Jul 26, 2014

Sold by

Clark George Clinton

Bought by

Sim Clark Mariana Lai

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,629

Interest Rate

4.2%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 3, 2006

Sold by

Tuscany At Longmire Inc

Bought by

Clark Mariana L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,900

Interest Rate

6.28%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trantham Erin Kathleen | -- | First American Title | |

| Sim Clark Mariana Lai | -- | None Available | |

| Clark Mariana L | -- | -- | |

| Clark George C | -- | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Trantham Erin Kathleen | $164,900 | |

| Previous Owner | Sim Clark Mariana Lai | $102,629 | |

| Previous Owner | Clark George C | $110,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,370 | $222,005 | $17,500 | $204,505 |

| 2024 | $2,992 | $249,207 | $17,500 | $231,707 |

| 2023 | $2,992 | $227,480 | $17,500 | $215,380 |

| 2022 | $4,289 | $206,800 | $17,500 | $221,980 |

| 2021 | $4,413 | $201,830 | $35,000 | $173,640 |

| 2020 | $4,186 | $183,480 | $35,000 | $173,640 |

| 2019 | $3,890 | $166,800 | $35,000 | $131,800 |

| 2018 | $4,278 | $183,460 | $35,000 | $148,460 |

| 2017 | $4,415 | $188,580 | $35,000 | $153,580 |

| 2016 | $3,546 | $151,460 | $35,000 | $116,460 |

| 2015 | $3,628 | $153,890 | $35,000 | $118,890 |

| 2014 | $3,628 | $153,890 | $35,000 | $118,890 |

Source: Public Records

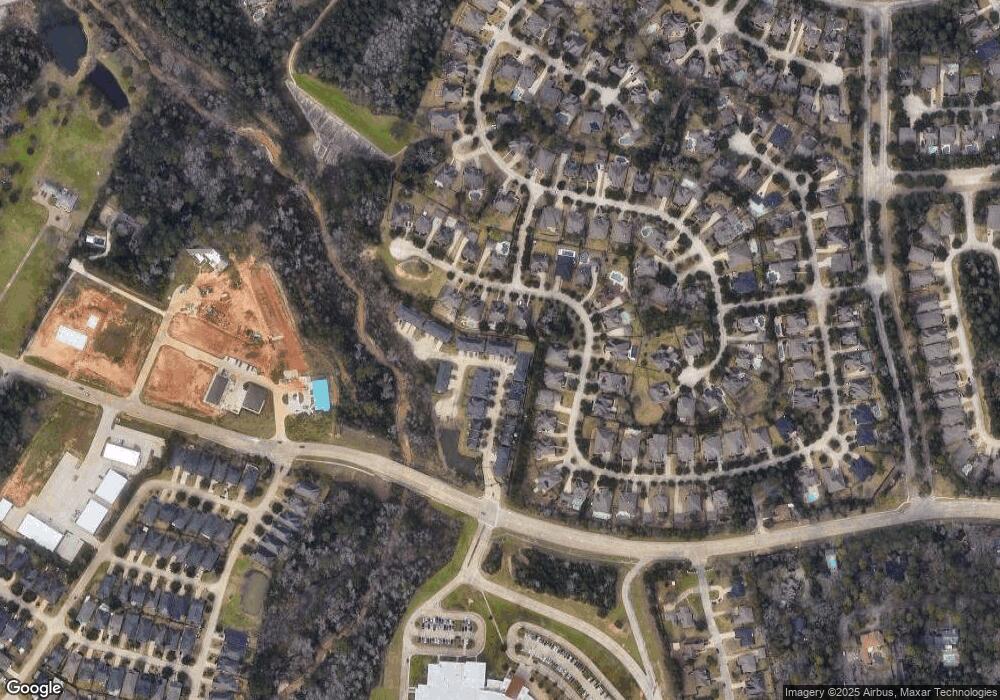

Map

Nearby Homes

- 1898 Longmire Rd Unit 20

- 2446 W Bramlet Dr

- 2404 Bramlet Dr

- 2402 Bramlet Dr

- 2400 Bramlet Dr

- 2512 Eagle Post Dr

- 2510 Eagle Post Dr

- 2113 Graystone Ridge Dr

- 2508 Kimberly Dawn Dr

- 2505 Kimberly Dawn Dr

- 1904 Cliff Manor Dr

- 2500 Amy Lee Dr

- 1719 Summergate Dr

- 2513 Kimberly Dawn Dr

- 2515 Kimberly Dawn Dr

- Duval Plan at Clear View Estates

- Caldwell Plan at Clear View Estates

- Stonewall Plan at Clear View Estates

- Trinity Plan at Clear View Estates

- Hardin Plan at Clear View Estates

- 1898 Longmire Rd Unit 36

- 1898 Longmire Rd Unit 37

- 1898 Longmire Rd Unit 39

- 1898 Longmire Rd Unit 38

- 1898 Longmire Rd Unit 9

- 1898 Longmire Rd Unit 8

- 1898 Longmire Rd Unit 7

- 1898 Longmire Rd Unit 6

- 1898 Longmire Rd Unit 5

- 1898 Longmire Rd Unit 4

- 1898 Longmire Rd Unit 39

- 1898 Longmire Rd Unit 31

- 1898 Longmire Rd

- 1898 Longmire Rd

- 1898 Longmire Rd

- 1898 Longmire Rd Unit 19

- 1898 Longmire Rd Unit 20

- 1898 Longmire Rd Unit 21

- 1898 Longmire Rd Unit 24

- 1898 Longmire Rd Unit 26