18983 S Van Allen Rd Escalon, CA 95320

Estimated Value: $472,000 - $692,000

2

Beds

1

Bath

1,090

Sq Ft

$527/Sq Ft

Est. Value

About This Home

This home is located at 18983 S Van Allen Rd, Escalon, CA 95320 and is currently estimated at $574,044, approximately $526 per square foot. 18983 S Van Allen Rd is a home located in San Joaquin County with nearby schools including Van Allen Elementary School, El Portal Middle School, and Escalon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 24, 2013

Sold by

Gonzalez Leopoldo N

Bought by

Gonzalez Leopoldo N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,500

Outstanding Balance

$35,427

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$538,617

Purchase Details

Closed on

Apr 23, 2010

Sold by

Gonzalez Leopoldo N

Bought by

Gonzalez Leopoldo N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,500

Interest Rate

4.92%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 7, 1994

Sold by

Gonzalez Antonia N

Bought by

Gonzalez Antonia N

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gonzalez Leopoldo N | -- | Stewart Title Of California | |

| Gonzalez Leopoldo N | -- | Stewart Title Of California | |

| Gonzalez Leopoldo N | -- | Stewart Title Of California | |

| Gonzalez Antonia N | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gonzalez Leopoldo N | $166,500 | |

| Closed | Gonzalez Leopoldo N | $48,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,937 | $205,614 | $134,891 | $70,723 |

| 2024 | $2,808 | $201,584 | $132,247 | $69,337 |

| 2023 | $2,426 | $197,632 | $129,654 | $67,978 |

| 2022 | $2,249 | $193,758 | $127,112 | $66,646 |

| 2021 | $2,272 | $189,960 | $124,620 | $65,340 |

| 2020 | $2,252 | $188,014 | $123,343 | $64,671 |

| 2019 | $2,221 | $184,328 | $120,925 | $63,403 |

| 2018 | $2,197 | $180,714 | $118,554 | $62,160 |

| 2017 | $2,143 | $177,172 | $116,230 | $60,942 |

| 2016 | $2,115 | $173,698 | $113,951 | $59,747 |

| 2014 | $1,902 | $167,739 | $110,042 | $57,697 |

Source: Public Records

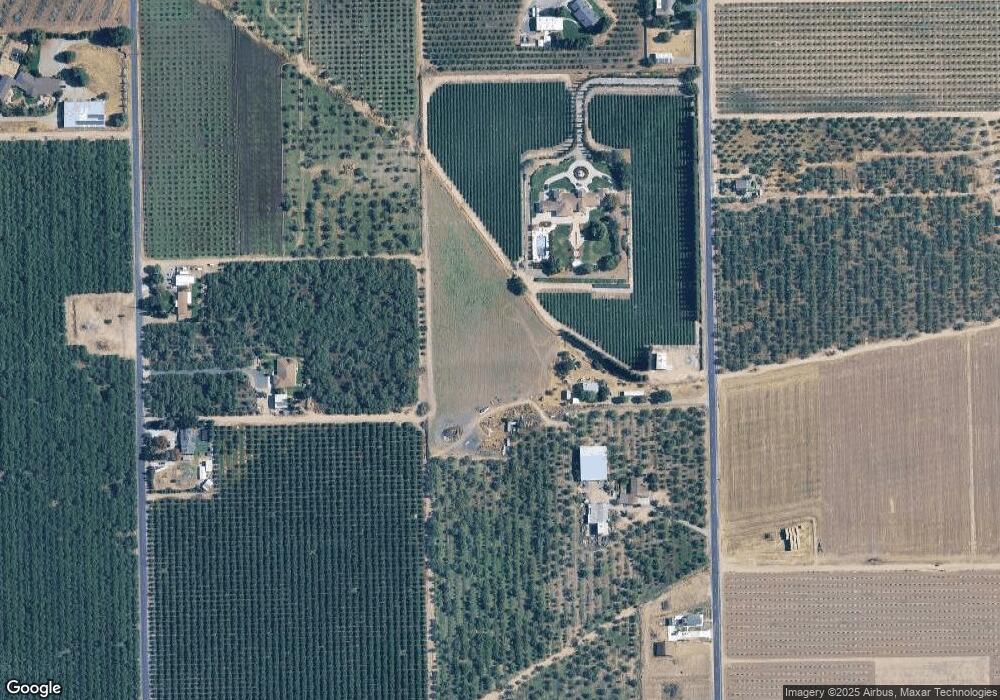

Map

Nearby Homes

- 19535 S Carrolton Ave

- 20592 Ayers Rd

- 16221 Carrolton Rd

- 16948 Lawrence Rd

- 23873 State Highway 120

- 0 Escalon_belotta Rd Unit 222110729

- 20328 E River Rd

- 16929 Louise Ave

- 812 California St

- 0 James St

- 1970 Mchenry Ave

- 2507 Escalon-Bellota Rd

- 1510 Deborah Cir

- 1521 Deborah Cir

- 1518 Glenwood Ct

- 1525 Crestwood Dr

- 1534 Oakwood Dr

- 7434 River Nine Dr

- 1855 Coley Ave

- 16161 Murphy Rd

- 19105 S Van Allen Rd

- 18697 S Van Allen Rd

- 18794 S Van Allen Rd

- 19189 S Van Allen Rd

- 18661 S Van Allen Rd

- 19299 S Van Allen Rd

- 18673 S Van Allen Rd

- 19022 von Glahn Ave

- 18900 von Glahn Ave

- 18565 S Van Allen Rd

- 19240 S Van Allen Rd

- 18707 von Glahn Rd

- 18707 von Glahn Ave

- 18572 von Glahn Ave

- 18437 S Van Allen Rd

- 19388 von Glahn Ave

- 19388 von Glahn Ave

- 20455 Allen Rd

- 20650 Allen Rd

- 18312 S Van Allen Rd