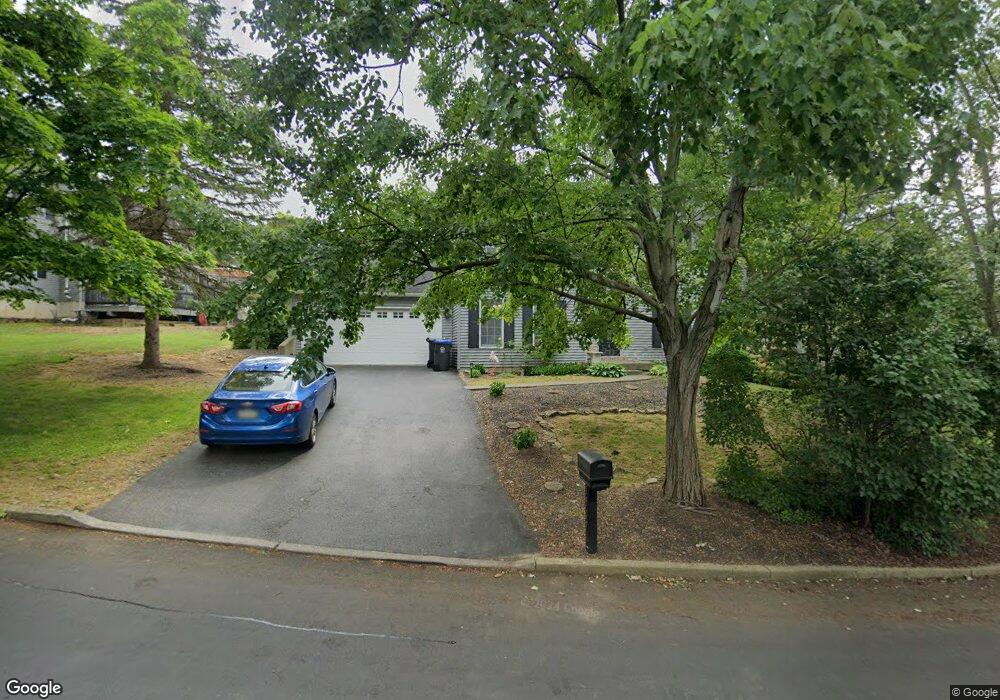

1917 Box Elder Rd Allentown, PA 18103

Southside NeighborhoodEstimated Value: $479,924 - $508,000

4

Beds

3

Baths

2,072

Sq Ft

$238/Sq Ft

Est. Value

About This Home

This home is located at 1917 Box Elder Rd, Allentown, PA 18103 and is currently estimated at $493,981, approximately $238 per square foot. 1917 Box Elder Rd is a home located in Lehigh County with nearby schools including Salisbury Elementary School, Salisbury Middle School, and Salisbury Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2006

Sold by

Ambriano Yob Rosemarie and Ambriano Rosemarie

Bought by

Yob James W and Ambriano Yob Rosemarie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,000

Outstanding Balance

$26,654

Interest Rate

6.8%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$467,327

Purchase Details

Closed on

May 29, 2001

Sold by

Ambriano John Robert and Ambriano Rosemarie

Bought by

Ambriano Rosemarie

Purchase Details

Closed on

Nov 30, 1990

Sold by

Mirth Thomas A and Mirth Deborah L

Bought by

Ambriano John Robert and Ambriano Rosemarie

Purchase Details

Closed on

Oct 5, 1987

Sold by

Ruhe Park Corporation

Bought by

Mirth Thomas A and Mirth Deborah L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yob James W | -- | None Available | |

| Ambriano Rosemarie | -- | -- | |

| Ambriano John Robert | $153,200 | -- | |

| Mirth Thomas A | $789,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yob James W | $45,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,499 | $238,100 | $32,800 | $205,300 |

| 2024 | $7,164 | $238,100 | $32,800 | $205,300 |

| 2023 | $6,796 | $238,100 | $32,800 | $205,300 |

| 2022 | $6,625 | $238,100 | $205,300 | $32,800 |

| 2021 | $6,360 | $238,100 | $32,800 | $205,300 |

| 2020 | $6,112 | $238,100 | $32,800 | $205,300 |

| 2019 | $5,890 | $238,100 | $32,800 | $205,300 |

| 2018 | $5,784 | $238,100 | $32,800 | $205,300 |

| 2017 | $5,637 | $238,100 | $32,800 | $205,300 |

| 2016 | -- | $238,100 | $32,800 | $205,300 |

| 2015 | -- | $238,100 | $32,800 | $205,300 |

| 2014 | -- | $238,100 | $32,800 | $205,300 |

Source: Public Records

Map

Nearby Homes

- 3601 Country Club Rd

- 1 E Pine St

- 141 E Berger St

- 137 E Harrison St

- 101 E George St

- 704 Evergreen St

- 507 Iroquois St

- 943 N 6th St

- 3113 Devonshire Rd

- 3103 Roxford Rd

- 118 N 2nd St

- 120 N 2nd St

- 3105 Sussex Rd

- 106 Garden Ct

- 3020 W Fairbanks St

- 104 Garden Ct

- 2830 Lehigh St

- 543 Long St

- 3043 Ithaca St

- 41 S 2nd St

- 1913 Box Elder Rd

- 3525 Country Club Rd

- 1909 Box Elder Rd

- 3609 Country Club Rd

- 1905 Duffield Ct

- 1918 Box Elder Rd

- 1922 Box Elder Rd

- 3521 Country Club Rd

- 1914 Box Elder Rd

- 1909 Duffield Ct

- 1905 Box Elder Rd

- 3613 Country Club Rd

- 3606 Country Club Rd

- 3602 Country Club Rd

- 1910 Box Elder Rd

- 3618 Country Club Rd

- 3517 Country Club Rd

- 3614 Country Club Rd

- 3610 Country Club Rd

- 2001 Wells Ct