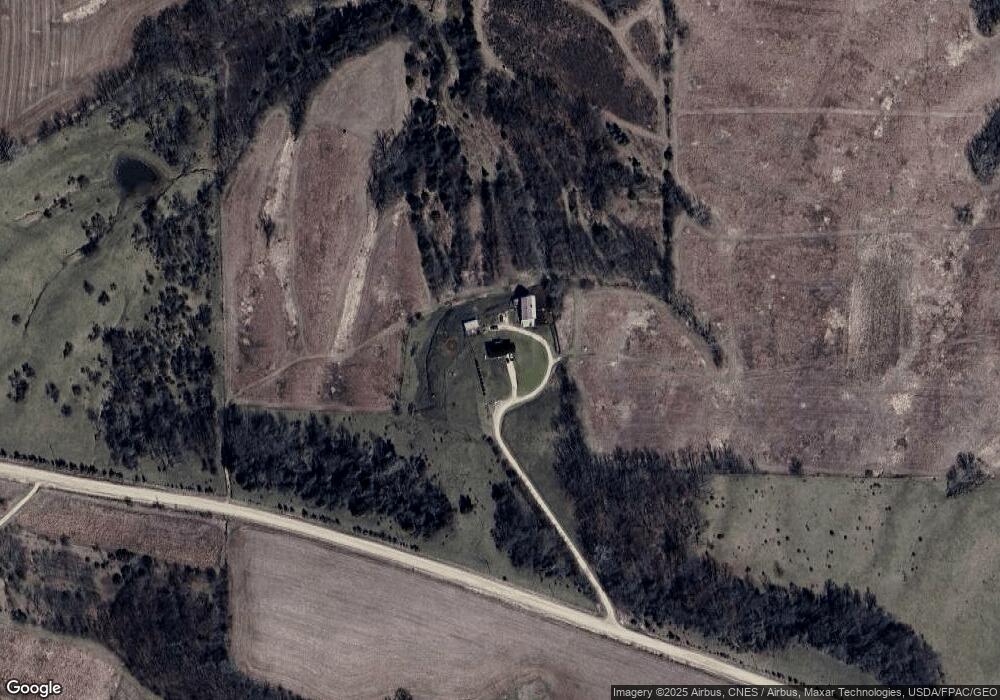

19205 Chicken Ridge Rd Elkader, IA 52043

Estimated Value: $60,000 - $354,066

3

Beds

2

Baths

1,232

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 19205 Chicken Ridge Rd, Elkader, IA 52043 and is currently estimated at $241,355, approximately $195 per square foot. 19205 Chicken Ridge Rd is a home located in Clayton County with nearby schools including Central Elementary School and Central Middle School/High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2022

Sold by

Bergan Kevin J

Bought by

Rupard Kayla Jo and Rupard Timothy Sherman

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$551,000

Outstanding Balance

$521,959

Interest Rate

5.1%

Mortgage Type

New Conventional

Estimated Equity

-$280,604

Purchase Details

Closed on

Jun 1, 2016

Sold by

Hansel Timmy J

Bought by

Rupard Timothy S and Bergan Kayla

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rupard Kayla Jo | $1,102,000 | None Listed On Document | |

| Rupard Timothy S | $109,875 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rupard Kayla Jo | $551,000 | |

| Closed | Rupard Kayla Jo | $550,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,990 | $285,333 | $101,626 | $183,707 |

| 2024 | $2,904 | $242,998 | $88,370 | $154,628 |

| 2023 | $2,696 | $242,998 | $88,370 | $154,628 |

| 2022 | $2,602 | $193,945 | $71,510 | $122,435 |

| 2021 | $2,400 | $193,945 | $71,510 | $122,435 |

| 2020 | $2,400 | $173,613 | $60,580 | $113,033 |

| 2019 | $2,340 | $173,613 | $60,580 | $113,033 |

| 2018 | $2,340 | $164,548 | $60,580 | $103,968 |

| 2017 | $2,402 | $164,548 | $60,580 | $103,968 |

| 2015 | $1,884 | $166,474 | $53,622 | $112,852 |

| 2014 | $1,866 | $142,622 | $35,413 | $107,209 |

Source: Public Records

Map

Nearby Homes

- 27766 Highway 13

- 26642 Iowa 13

- 209 2nd St SW

- 117 S Main St

- 301 N 1st St

- 710 Woodland Dr NW

- 707 N Main St

- 702 N Main St

- 302 N 3rd St

- 0 E Bridge St

- 247 Franzen Ridge Rd

- 249 Franzen Ridge Rd

- 0 Grandview Rd

- TBD Birch Rd

- 14149 Iowa 56

- 27455 Harbor Rd

- 0 13 Hwy Unit NBR20255145

- 10766 Bush Rd

- Impala Rd

- 0 Trail Unit 731028

- 18918 Chicken Ridge Rd

- 28473 Highway 13

- 28357 Highway 13

- 27855 Empire Rd

- 28526 Highway 13

- 18616 Chicken Ridge Rd

- 19594 295th St

- 28898 Highway 13

- 29194 Highway 13

- 0 Emerald Dr Unit 20221150

- 0 Emerald Dr Unit LOT 6 20200744

- 0 Emerald Dr Unit LOT 5 20200743

- 0 Emerald Dr Unit LOT 4 20200742

- 0 Emerald Dr Unit LOT 2 20200741

- 0 Emerald Dr Unit LOT 1 20200740

- 0 Emerald Dr Unit 20200738

- 19996 Grandview Rd

- 29305 Highway 13

- 20264 Grandview Rd