1926 SE Emerald Ct Stuart, FL 34997

South Stuart NeighborhoodEstimated Value: $605,000 - $650,000

3

Beds

2

Baths

2,174

Sq Ft

$292/Sq Ft

Est. Value

About This Home

This home is located at 1926 SE Emerald Ct, Stuart, FL 34997 and is currently estimated at $634,744, approximately $291 per square foot. 1926 SE Emerald Ct is a home located in Martin County with nearby schools including Pinewood Elementary School, Dr. David L. Anderson Middle School, and Martin County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 10, 2018

Sold by

Stanford Margaret

Bought by

Stanford John

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,000

Outstanding Balance

$91,139

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$543,605

Purchase Details

Closed on

Nov 12, 2009

Sold by

Multiple Owners

Bought by

Peay Phyllis A Estate and Stanford Margaret

Purchase Details

Closed on

Jan 1, 1986

Bought by

Peay Phyllis A Estate and Stanford Margaret

Purchase Details

Closed on

Jan 1, 1901

Bought by

Peay Phyllis A Estate and Stanford Margaret

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stanford John | $75,300 | Attorney | |

| Stanford John | $59,800 | Attorney | |

| Peay Phyllis A Estate | $100 | -- | |

| Peay Phyllis A Estate | $129,000 | -- | |

| Peay Phyllis A Estate | $116,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stanford John | $108,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,737 | $311,113 | -- | -- |

| 2024 | $4,639 | $302,345 | -- | -- |

| 2023 | $4,639 | $293,539 | $0 | $0 |

| 2022 | $4,474 | $284,990 | $0 | $0 |

| 2021 | $4,480 | $276,690 | $130,000 | $146,690 |

| 2020 | $4,404 | $274,543 | $0 | $0 |

| 2019 | $4,349 | $268,370 | $130,000 | $138,370 |

| 2018 | $4,731 | $252,560 | $110,000 | $142,560 |

| 2017 | $4,126 | $253,110 | $135,000 | $118,110 |

| 2016 | $4,018 | $218,500 | $100,000 | $118,500 |

| 2015 | $3,327 | $217,230 | $100,000 | $117,230 |

| 2014 | $3,327 | $185,130 | $75,000 | $110,130 |

Source: Public Records

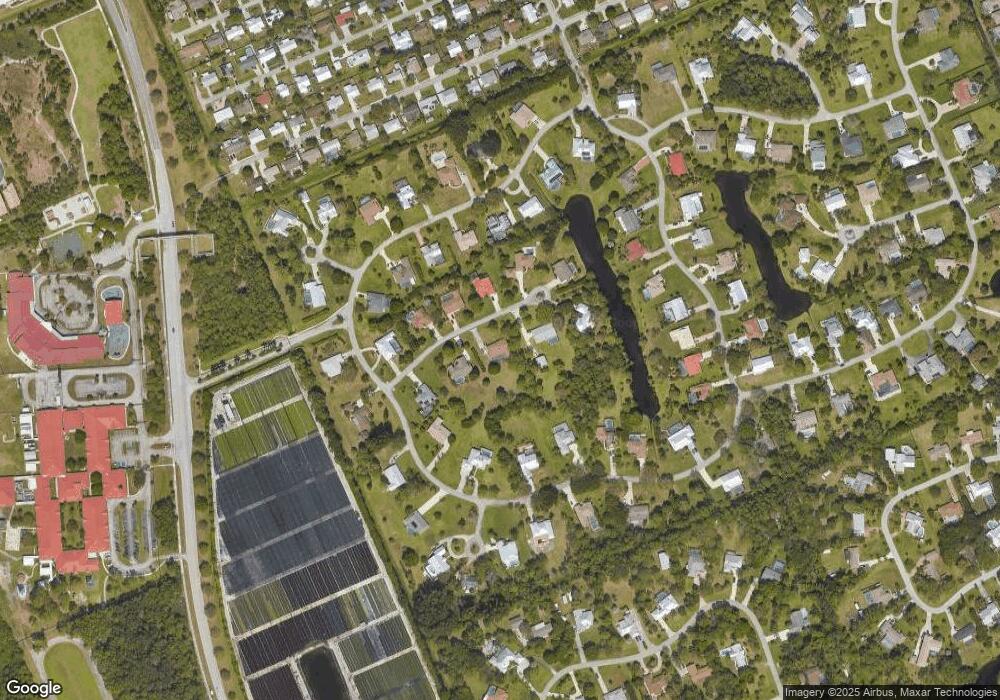

Map

Nearby Homes

- 5321 SE Sterling Cir

- 1705 SE Darling St

- 5624 SE Edgewater Cir

- 5609 SE Lamay Dr

- 1879 SE Madison St

- 1991 SE Jackson St

- 5766 SE Edgewater Cir

- 5746 SE Edgewater Cir

- 2480 SE Springtree Place

- 5735 SE Edgewater Cir

- 4800 SE Federal Hwy Unit 17

- 4800 SE Federal Hwy Unit 76

- 4800 SE Federal Hwy Unit 93

- 4800 SE Federal Hwy

- 4800 SE Federal Hwy Unit 53

- 4620 SE Winter Haven Ct

- 1255 SE Kirk St

- 1231 SE Kirk St

- 1040 SE Fleming Way

- 1581 SE Pomeroy St Unit 8-2

- 1906 SE Emerald Ct

- 1946 SE Emerald Ct

- 0 SE Emerald Ct

- 1925 SE Emerald Ct

- 1915 SE Emerald Ct

- 5221 SE Sterling Cir

- 5201 SE Sterling Cir

- 1896 SE Emerald Ct

- 1966 SE Emerald Ct

- 5241 SE Sterling Cir

- 1905 SE Emerald Ct

- 5261 SE Sterling Cir

- 1965 SE Emerald Ct

- 5301 SE Sterling Cir

- 5181 SE Sterling Cir

- 5361 SE Sterling Cir

- 5341 SE Sterling Cir

- 5371 SE Sterling Cir

- 5311 SE Sterling Cir

- 5280 SE Sterling Cir

Your Personal Tour Guide

Ask me questions while you tour the home.