1928 Cattail Point Unit 48 Springfield, OH 45502

Estimated Value: $244,000 - $301,000

3

Beds

3

Baths

1,659

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 1928 Cattail Point Unit 48, Springfield, OH 45502 and is currently estimated at $285,246, approximately $171 per square foot. 1928 Cattail Point Unit 48 is a home located in Clark County with nearby schools including Rolling Hills Elementary School, Northridge Middle School, and Kenton Ridge Middle & High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2011

Sold by

Walter Paul C and Walter Lois M

Bought by

Mcatee Patrick T and Mcatee Susan L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,600

Outstanding Balance

$74,697

Interest Rate

4.55%

Mortgage Type

New Conventional

Estimated Equity

$210,549

Purchase Details

Closed on

Feb 2, 2011

Sold by

Bankunited

Bought by

Walter Paul C and Walter Lois M

Purchase Details

Closed on

Nov 8, 2010

Sold by

Emery Glenda R and Case #10 Cv 365

Bought by

Bankunited and Fdic

Purchase Details

Closed on

May 14, 2004

Sold by

Hbh Builders Ltd

Bought by

Emery Glenda R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,100

Interest Rate

5.63%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcatee Patrick T | $134,500 | Ohio Real Estate Title | |

| Walter Paul C | $103,500 | Landcastle Title Llc | |

| Bankunited | $110,000 | None Available | |

| Emery Glenda R | $142,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcatee Patrick T | $107,600 | |

| Previous Owner | Emery Glenda R | $135,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,665 | $63,010 | $11,100 | $51,910 |

| 2023 | $2,665 | $63,010 | $11,100 | $51,910 |

| 2022 | $2,675 | $63,010 | $11,100 | $51,910 |

| 2021 | $2,858 | $57,000 | $9,100 | $47,900 |

| 2020 | $2,860 | $57,000 | $9,100 | $47,900 |

| 2019 | $2,914 | $57,000 | $9,100 | $47,900 |

| 2018 | $2,754 | $51,590 | $9,630 | $41,960 |

| 2017 | $2,361 | $45,147 | $9,625 | $35,522 |

| 2016 | $2,345 | $45,147 | $9,625 | $35,522 |

| 2015 | $2,159 | $44,272 | $8,750 | $35,522 |

| 2014 | $2,159 | $44,272 | $8,750 | $35,522 |

| 2013 | $2,109 | $44,272 | $8,750 | $35,522 |

Source: Public Records

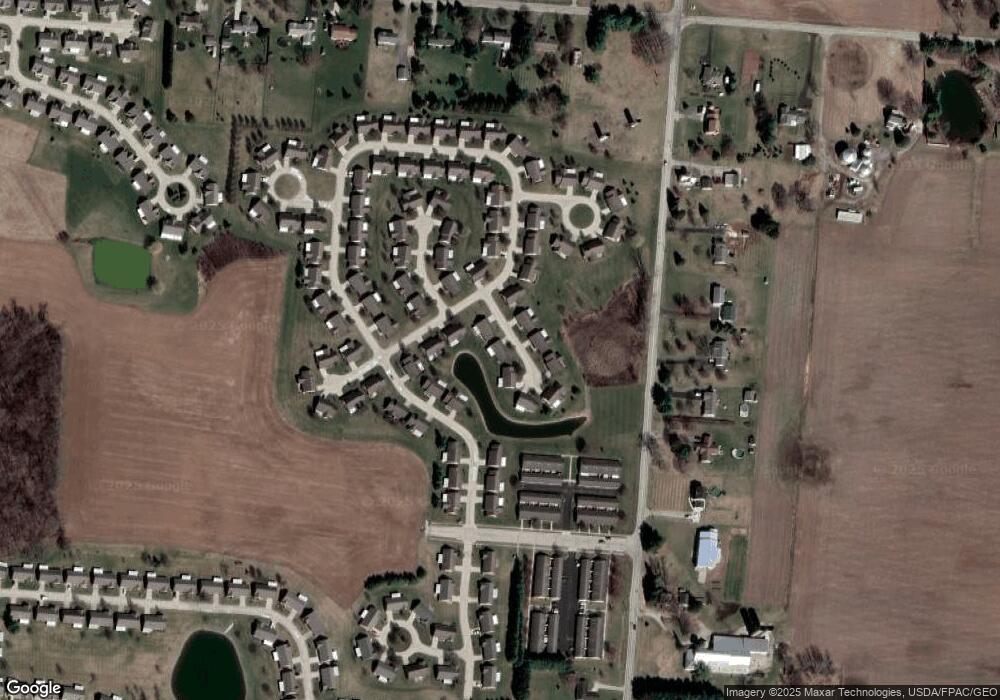

Map

Nearby Homes

- 1902 Willow Lakes Dr Unit 71

- 1888 Birchwood Ct

- 1527 Oldham Dr

- 1470 Oldham Dr Unit 12

- 5794 Winfield Dr

- 5220 Ridgewood Rd E

- 5249 Taywell Dr

- 5127 Stoneridge Dr

- 4924 Brannan Dr E Unit 4924

- 1709 Thomas Dr

- 4849 Ashley Dr

- 4825 Chippendale Dr

- 4740 Merrimont Ave

- 4620 Eldora St

- 4620 Eldora Dr

- 4644 Middle Urbana Rd

- 4524 Ridgewood Rd E

- 4512 Ridgewood Rd E

- 1835 Sierra Ave

- 1926 Cattail Point

- 1926 Cattail Point Unit 47

- 1930 Cattail Point Unit 49

- 1930 Cattail Point

- 1916 Cattail Point

- 1918 Cattail Point Unit 43

- 1932 Willow Lakes Dr Unit 50

- 1920 Cattail Point Unit 44

- 1912 Willow Lakes Dr Unit 41

- 1924 Cattail Point Unit 46

- 1952 Willow Lakes Dr Unit 51

- 1756 Willow Lakes Dr

- 1922 Cattail Point Unit 45

- 1760 Willow Lakes Dr

- 1914 Willow Lakes Dr Unit 73

- 1934 Shady Oak Ct

- 1910 Willow Lakes Dr Unit 40

- 1764 Willow Lakes Dr Unit 52

- 1764 Willow Lakes Dr

- 1950 Shady Oak Ct Unit 82