1937 Vollmar Rd Chillicothe, OH 45601

Estimated Value: $372,000 - $514,000

3

Beds

3

Baths

1,900

Sq Ft

$231/Sq Ft

Est. Value

About This Home

This home is located at 1937 Vollmar Rd, Chillicothe, OH 45601 and is currently estimated at $438,798, approximately $230 per square foot. 1937 Vollmar Rd is a home located in Ross County with nearby schools including Adena Elementary School, Adena Middle School, and Adena High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 22, 2022

Sold by

Lenegar Jessica R

Bought by

Guarnieri Krystle and Guarnieri Joseph

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$302,400

Outstanding Balance

$288,628

Interest Rate

5.13%

Mortgage Type

New Conventional

Estimated Equity

$150,170

Purchase Details

Closed on

Mar 4, 2010

Sold by

Hamilton Keith E and Hamilton Laura L

Bought by

Franklin Tad E and Lenegar Jessica R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,087

Interest Rate

5.02%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 26, 2006

Sold by

Metzler Steven P and Metzler Karen G

Bought by

Hamilton Keith E and Hamilton Laura L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,700

Interest Rate

6.24%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Guarnieri Krystle | $378,000 | -- | |

| Guarnieri Krystle | $378,000 | None Listed On Document | |

| Franklin Tad E | $216,000 | Title First | |

| Hamilton Keith E | $186,000 | Title First Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Guarnieri Krystle | $302,400 | |

| Closed | Guarnieri Krystle | $302,400 | |

| Previous Owner | Franklin Tad E | $212,087 | |

| Previous Owner | Hamilton Keith E | $76,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,816 | $113,750 | $11,840 | $101,910 |

| 2023 | $3,816 | $113,750 | $11,840 | $101,910 |

| 2022 | $3,901 | $113,750 | $11,840 | $101,910 |

| 2021 | $3,131 | $84,940 | $10,700 | $74,240 |

| 2020 | $3,213 | $84,940 | $10,700 | $74,240 |

| 2019 | $3,216 | $84,940 | $10,700 | $74,240 |

| 2018 | $2,746 | $71,030 | $12,130 | $58,900 |

| 2017 | $2,755 | $71,030 | $12,130 | $58,900 |

| 2016 | $2,680 | $71,030 | $12,130 | $58,900 |

| 2015 | $2,591 | $68,190 | $12,130 | $56,060 |

| 2014 | $2,529 | $68,190 | $12,130 | $56,060 |

| 2013 | $2,541 | $68,190 | $12,130 | $56,060 |

Source: Public Records

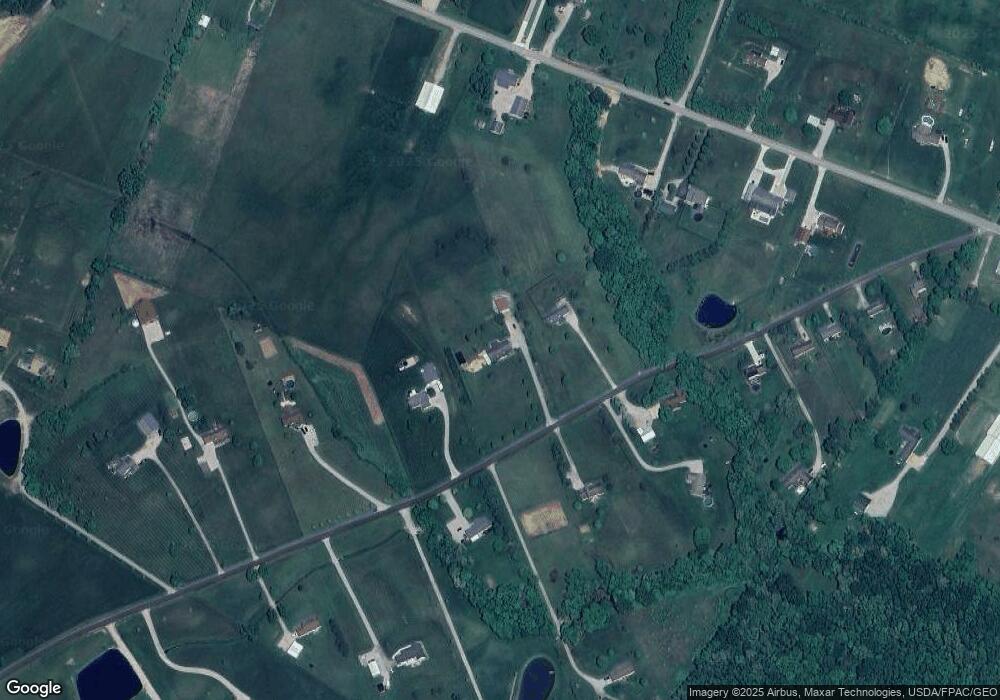

Map

Nearby Homes

- 9942 Egypt Pike

- 14839 Westfall Road Lot 8

- 14839 Westfall Road Lot 20

- 14839 Westfall Road Lot 4

- 14839 Westfall Road Lot 2

- 10217 County Road 550

- 1667 Stone Rd Unit Lot 59

- 435 Mount Carmel Rd

- 420 Steiner Rd

- 11303 County Road 550

- 500 Old Elm Rd

- 290 N 2nd St

- 2719 Sulphur Lick Rd

- 54 Moccasin Dr

- 33 E High St

- 43 N Main St

- 115 N 2nd St

- 365 Golfview Dr

- 40 N 2nd St

- 45 Church St

- 2019 Vollmar Rd

- 1944 Vollmar Rd

- 1944 Vollmar Rd

- 2022 Vollmar Rd

- 1900 Vollmar Rd

- 1825 Vollmar Rd

- 8059 Egypt Pike

- 1974 Vollmar Rd

- 8043 Egypt Pike

- 8171 Egypt Pike

- 8236 Egypt Pike

- 2090 Vollmar Rd

- 1773 Vollmar Rd

- 1773 Vollmar Rd

- 2134 Vollmar Rd

- 1830 Vollmar Rd

- 2112 Vollmar Rd

- 8201 Egypt Pike

- 2152 Vollmar Rd

- 2152 Vollmar Rd