19462 Crystal Springs Ln Apple Valley, CA 92308

High Desert NeighborhoodEstimated Value: $343,000 - $354,000

2

Beds

2

Baths

1,205

Sq Ft

$289/Sq Ft

Est. Value

About This Home

This home is located at 19462 Crystal Springs Ln, Apple Valley, CA 92308 and is currently estimated at $347,932, approximately $288 per square foot. 19462 Crystal Springs Ln is a home located in San Bernardino County with nearby schools including Rio Vista School of Applied Learning, Apple Valley High School, and Excelsior Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 22, 2020

Sold by

Castillo Adelfia

Bought by

Castillo Adelfia and The Adelfia Castillo Living Tr

Current Estimated Value

Purchase Details

Closed on

Nov 18, 2014

Sold by

Vazquez Antonio R and Varquez Antonio R

Bought by

Castillo Aldelfia

Purchase Details

Closed on

Jan 30, 2012

Sold by

Federal National Mortgage Association

Bought by

Castillo Adelfia and Varquez Antonio R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,000

Interest Rate

3.83%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 14, 2011

Sold by

Davis Luther D and Davis Kathleen L

Bought by

Fannie Mae and Federal National Mortgage Association

Purchase Details

Closed on

Sep 7, 2006

Sold by

Pulte Home Corp

Bought by

Davis Luther D and Davis Kathleen L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,628

Interest Rate

6.56%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Castillo Adelfia | -- | None Available | |

| Castillo Aldelfia | -- | None Available | |

| Castillo Adelfia | $120,000 | Stewart Title Of California | |

| Fannie Mae | $227,283 | Accommodation | |

| Davis Luther D | $238,000 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Castillo Adelfia | $96,000 | |

| Previous Owner | Davis Luther D | $212,628 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,727 | $150,727 | $37,681 | $113,046 |

| 2024 | $1,727 | $147,771 | $36,942 | $110,829 |

| 2023 | $1,709 | $144,874 | $36,218 | $108,656 |

| 2022 | $1,682 | $142,033 | $35,508 | $106,525 |

| 2021 | $1,642 | $139,248 | $34,812 | $104,436 |

| 2020 | $1,660 | $137,820 | $34,455 | $103,365 |

| 2019 | $1,629 | $135,117 | $33,779 | $101,338 |

| 2018 | $1,588 | $132,468 | $33,117 | $99,351 |

| 2017 | $1,564 | $129,871 | $32,468 | $97,403 |

| 2016 | $1,479 | $127,324 | $31,831 | $95,493 |

| 2015 | $1,456 | $125,412 | $31,353 | $94,059 |

| 2014 | $1,436 | $122,956 | $30,739 | $92,217 |

Source: Public Records

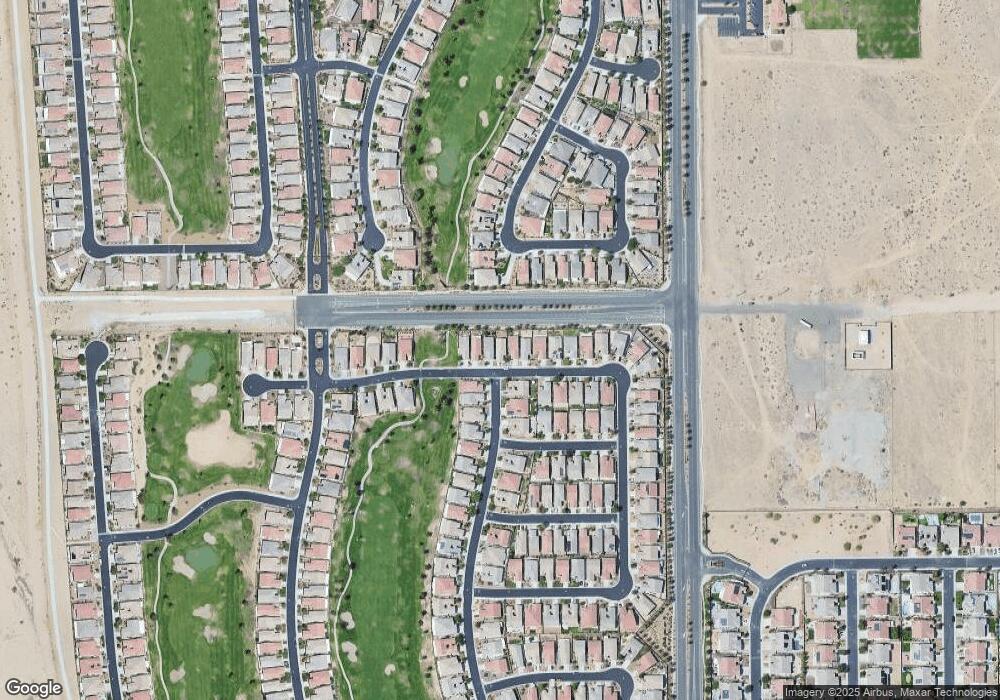

Map

Nearby Homes

- 10485 Nobleton Rd

- 19478 Big Horn St

- 10479 Bridge Haven Rd

- 19385 Boulder St

- 10577 Bridge Haven Rd

- 10215 Wascana Ln

- 10645 Green Valley Rd

- 10301 Darby Rd

- 10065 Wilmington Ln

- 10030 El Dorado St

- 19369 Glaslyn Ct

- 10041 Wilmington Ln

- 19453 Maple Creek Rd

- 10767 Katepwa St

- 10803 Katepwa St

- 10854 Aster Ln

- 10939 Rockaway Glen Rd

- 10852 Katepwa St

- 19506 Vermillion Ln

- 10858 Katepwa St

- 19466 Crystal Springs Ln

- 19456 Crystal Springs Ln

- 19452 Crystal Springs Ln

- 19446 Crystal Springs Ln

- 19476 Crystal Springs Ln

- 10497 Wilmington Ln

- 19482 Crystal Springs Ln

- 10480 Wilmington Ln

- 19471 Crystal Springs Ln

- 10478 Wilmington Ln

- 19483 Crystal Springs Ln

- 10400 Nobleton Rd

- 19511 Hanely St

- 19474 Del Ray Rd

- 19492 Crystal Springs Ln

- 19485 Crystal Springs Ln

- 19519 Hanely St

- 10402 Nobleton Rd

- 19478 Del Ray Rd

- 19527 Hanely St