195 Guadalupe Dr Unit 2 Sonoma, CA 95476

Estimated Value: $686,000 - $760,000

2

Beds

2

Baths

1,146

Sq Ft

$627/Sq Ft

Est. Value

About This Home

This home is located at 195 Guadalupe Dr Unit 2, Sonoma, CA 95476 and is currently estimated at $718,519, approximately $626 per square foot. 195 Guadalupe Dr Unit 2 is a home located in Sonoma County with nearby schools including Prestwood Elementary School, Adele Harrison Middle School, and Creekside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 4, 2014

Sold by

Chew Rose

Bought by

Weed Peter B and Brooks Barbara J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$382,500

Outstanding Balance

$287,869

Interest Rate

4%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$430,650

Purchase Details

Closed on

May 16, 2003

Sold by

Eaton Judith

Bought by

Eaton Marshall H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,400

Interest Rate

5.77%

Mortgage Type

Balloon

Purchase Details

Closed on

May 15, 2003

Sold by

Eaton Marshall H and Eaton Henry W

Bought by

Chew Rose

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,400

Interest Rate

5.77%

Mortgage Type

Balloon

Purchase Details

Closed on

Dec 19, 2002

Sold by

Eaton Marshall H and Eaton Henry W

Bought by

Eaton Marshall H and Eaton Henry W

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weed Peter B | $515,000 | Fidelity National Title Co | |

| Eaton Marshall H | -- | California Land Title Marin | |

| Chew Rose | $368,000 | Financial Title Co | |

| Eaton Marshall H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Weed Peter B | $382,500 | |

| Previous Owner | Chew Rose | $294,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,285 | $631,310 | $306,461 | $324,849 |

| 2024 | $8,285 | $618,932 | $300,452 | $318,480 |

| 2023 | $8,285 | $606,797 | $294,561 | $312,236 |

| 2022 | $7,966 | $594,900 | $288,786 | $306,114 |

| 2021 | $7,807 | $583,236 | $283,124 | $300,112 |

| 2020 | $7,783 | $577,256 | $280,221 | $297,035 |

| 2019 | $7,739 | $565,938 | $274,727 | $291,211 |

| 2018 | $7,700 | $554,842 | $269,341 | $285,501 |

| 2017 | $7,549 | $543,963 | $264,060 | $279,903 |

| 2016 | $7,129 | $533,298 | $258,883 | $274,415 |

| 2015 | $6,901 | $525,289 | $254,995 | $270,294 |

| 2014 | $5,590 | $408,000 | $200,000 | $208,000 |

Source: Public Records

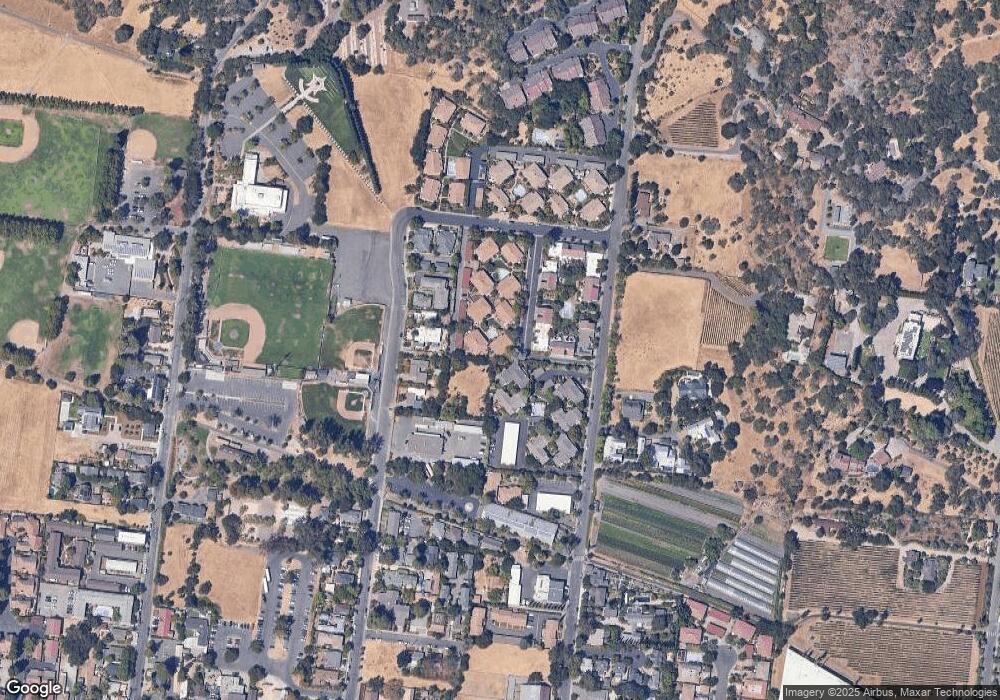

Map

Nearby Homes

- 197 Guadalupe Dr

- 193 Guadalupe Dr

- 191 Guadalupe Dr Unit 3

- 189 Guadalupe Dr Unit 6

- 187 Guadalupe Dr

- 31 2nd St E Unit 31

- 31 2nd St E

- 175 Guadalupe Dr Unit 12

- 185 Guadalupe Dr

- 36 2nd St E Unit 36

- 177 Guadalupe Dr

- 183 Guadalupe Dr

- 194 Guadalupe Dr

- 181 Guadalupe Dr Unit 10

- 179 Guadalupe Dr

- 182 Guadalupe Dr

- 180 Guadalupe Dr

- 182 Padre Dr

- 171 Guadalupe Dr

- 178 Guadalupe Dr