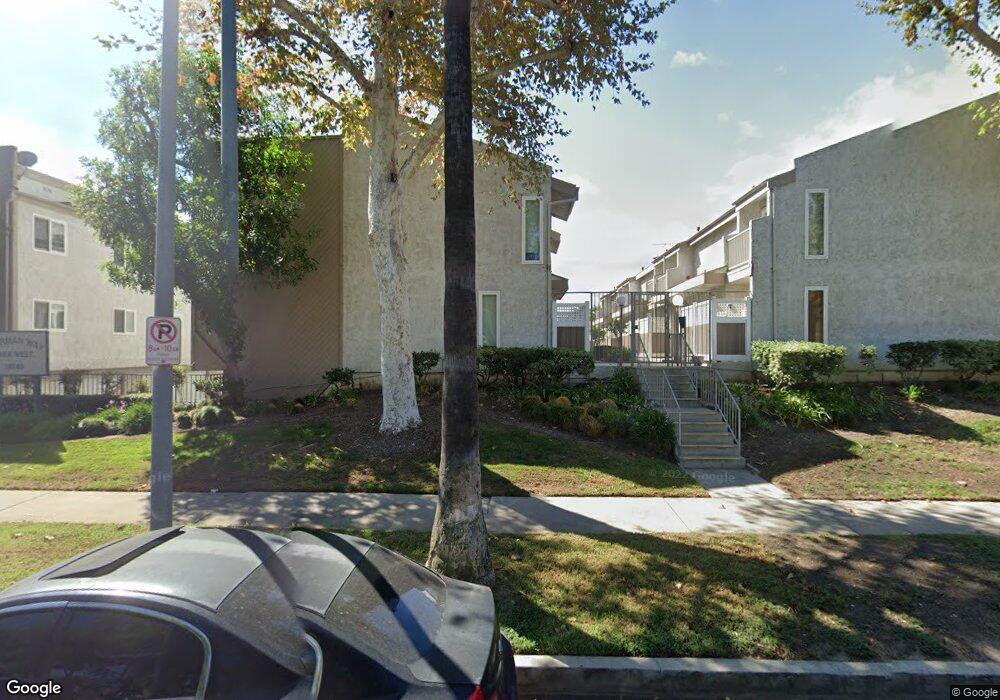

19540 Sherman Way Unit 106 Reseda, CA 91335

Estimated Value: $475,685 - $527,000

2

Beds

2

Baths

1,074

Sq Ft

$467/Sq Ft

Est. Value

About This Home

This home is located at 19540 Sherman Way Unit 106, Reseda, CA 91335 and is currently estimated at $501,421, approximately $466 per square foot. 19540 Sherman Way Unit 106 is a home located in Los Angeles County with nearby schools including Shirley Avenue Elementary School, John A. Sutter Middle School, and Ingenium Charter Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 13, 2023

Sold by

Osullivan Jean

Bought by

Jean Osullivan Living Trust

Current Estimated Value

Purchase Details

Closed on

Aug 23, 2009

Sold by

Williams Sharon

Bought by

Osullivan Jean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,830

Interest Rate

5%

Mortgage Type

FHA

Purchase Details

Closed on

May 6, 1999

Sold by

Williams Darrell

Bought by

Williams Sharon

Purchase Details

Closed on

Feb 19, 1999

Sold by

Montgomery William E and Montgomery Barbara R

Bought by

Williams Sharon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,180

Interest Rate

6.94%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jean Osullivan Living Trust | -- | None Listed On Document | |

| Osullivan Jean | $175,000 | Fidelity National Title | |

| Williams Sharon | -- | Investors Title Company | |

| Williams Sharon | $600,727 | Investors Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Osullivan Jean | $171,830 | |

| Previous Owner | Williams Sharon | $117,180 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,740 | $225,879 | $45,171 | $180,708 |

| 2024 | $2,740 | $221,451 | $44,286 | $177,165 |

| 2023 | $2,688 | $217,110 | $43,418 | $173,692 |

| 2022 | $2,561 | $212,854 | $42,567 | $170,287 |

| 2021 | $2,524 | $208,682 | $41,733 | $166,949 |

| 2019 | $2,447 | $202,496 | $40,497 | $161,999 |

| 2018 | $2,417 | $198,526 | $39,703 | $158,823 |

| 2016 | $2,298 | $190,818 | $38,162 | $152,656 |

| 2015 | $2,264 | $187,952 | $37,589 | $150,363 |

| 2014 | $2,276 | $184,271 | $36,853 | $147,418 |

Source: Public Records

Map

Nearby Homes

- 19540 Sherman Way Unit 602

- 19545 Sherman Way Unit 44

- 19545 Sherman Way Unit 99

- 19545 Sherman Way Unit 74

- 19545 Sherman Way Unit 97

- 19545 Sherman Way Unit 66

- 19431 Sherman Way Unit 10

- 19431 Sherman Way Unit 24

- 19431 Sherman Way Unit 6

- 7304 Corbin Ave Unit F

- 7306 Jumilla Ave

- 19350 Sherman Way Unit 125

- 7420 Corbin Ave Unit 12

- 7430 Corbin Ave Unit 19

- 7331 1/2 Tampa Ave

- 7414 Quartz Ave

- 19230 Wyandotte St Unit 14

- 19832 Schoolcraft St

- 6900 Aura Ave

- 6800 Corbin Ave Unit 308

- 19540 Sherman Way Unit 105

- 19540 Sherman Way Unit 104

- 19540 Sherman Way Unit 103

- 19540 Sherman Way Unit 102

- 19540 Sherman Way Unit 101

- 19540 Sherman Way Unit 206

- 19540 Sherman Way Unit 205

- 19540 Sherman Way Unit 204

- 19540 Sherman Way Unit 203

- 19540 Sherman Way Unit 202

- 19540 Sherman Way Unit 201

- 19540 Sherman Way Unit 305

- 19540 Sherman Way Unit 304

- 19540 Sherman Way Unit 303

- 19540 Sherman Way Unit 302

- 19540 Sherman Way Unit 301

- 19540 Sherman Way Unit 405

- 19540 Sherman Way Unit 404

- 19540 Sherman Way Unit 403

- 19540 Sherman Way Unit 402