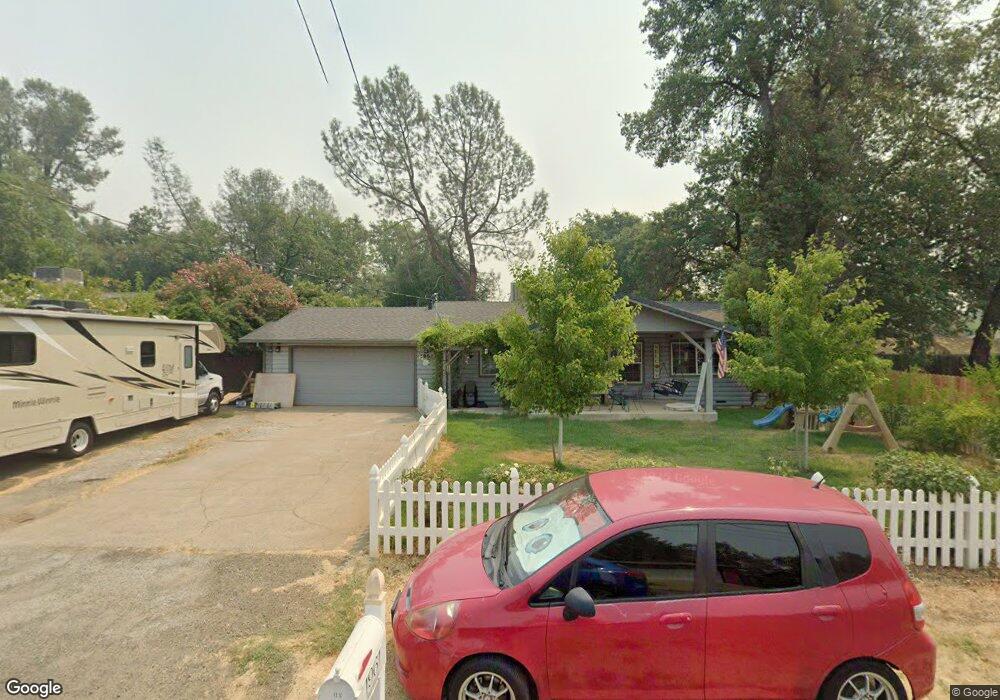

1961 Deerfield Ave Unit 1 Redding, CA 96002

Mistletoe NeighborhoodEstimated Value: $318,000 - $350,089

3

Beds

2

Baths

1,450

Sq Ft

$233/Sq Ft

Est. Value

About This Home

This home is located at 1961 Deerfield Ave Unit 1, Redding, CA 96002 and is currently estimated at $337,772, approximately $232 per square foot. 1961 Deerfield Ave Unit 1 is a home located in Shasta County with nearby schools including Mistletoe Elementary School, Enterprise High School, and Montessori Children's House of Shady Oaks.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 16, 2017

Sold by

Ladd Daniel and Ladd Anna

Bought by

Connor Johnathan N and Connor Crystal E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Outstanding Balance

$149,692

Interest Rate

4.1%

Mortgage Type

New Conventional

Estimated Equity

$188,080

Purchase Details

Closed on

May 19, 2005

Sold by

Pena Miguel and Pena Christy S

Bought by

Ladd Daniel and Ladd Anna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,000

Interest Rate

5.41%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Sep 21, 2000

Sold by

Camann Chris

Bought by

Pena Miguel and Pena Christy S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,625

Interest Rate

11.2%

Purchase Details

Closed on

Mar 22, 2000

Sold by

Mcphee David M and Mcphee Denna G

Bought by

Federal Home Loan Mortgage Corporation

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Connor Johnathan N | $200,000 | First American Title Company | |

| Ladd Daniel | $260,000 | Placer Title Company | |

| Pena Miguel | $112,500 | First American Title Co | |

| Federal Home Loan Mortgage Corporation | $76,000 | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Connor Johnathan N | $180,000 | |

| Previous Owner | Ladd Daniel | $78,000 | |

| Previous Owner | Ladd Daniel | $182,000 | |

| Previous Owner | Pena Miguel | $95,625 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,509 | $237,199 | $58,026 | $179,173 |

| 2024 | $2,472 | $232,549 | $56,889 | $175,660 |

| 2023 | $2,472 | $227,990 | $55,774 | $172,216 |

| 2022 | $2,401 | $223,521 | $54,681 | $168,840 |

| 2021 | $2,267 | $214,439 | $53,609 | $160,830 |

| 2020 | $2,257 | $212,241 | $53,060 | $159,181 |

| 2019 | $2,237 | $208,080 | $52,020 | $156,060 |

| 2018 | $2,210 | $204,000 | $51,000 | $153,000 |

| 2017 | $2,270 | $195,000 | $50,000 | $145,000 |

| 2016 | $2,056 | $185,000 | $45,000 | $140,000 |

| 2015 | $1,949 | $174,000 | $38,000 | $136,000 |

| 2014 | $1,940 | $171,000 | $35,000 | $136,000 |

Source: Public Records

Map

Nearby Homes

- 1939 Cameo Ct

- 2093 Victor Ave

- 1701 E Cypress Ave

- 1556 Minor St

- 2385 Shining Star Way

- 1877 Wheeler St

- 1110 Grouse Dr

- 1285 Lancers Ln

- 2820 Alfreda Way

- 2295 Chelsa Cir

- 2906 Regal Ave

- 1088 Burton Dr

- 2115 Hawn Ave

- 2571 Erin Ln

- 1637 French Lace Ln

- 1968 Bechelli Ln

- 1090 Gibralter Rd

- 0 Churn Creek Rd Unit 25-496

- 0 Churn Creek Rd Unit 26-609

- 0 Churn Creek Rd Unit 25-5491

- 1961 Deerfield Ave

- 1941 Deerfield Ave Unit 1

- 1941 Deerfield Ave

- 1698 Mistletoe Ln

- 1917 Deerfield Ave

- 1686 Mistletoe Ln

- 1962 Deerfield Ave Unit A

- 1962 Deerfield Ave

- 1710 Mistletoe Ln

- 1950 Deerfield Ave

- 1976 Deerfield Ave

- 1938 Deerfield Ave Unit 2

- 1938 Deerfield Ave

- 1901 Deerfield Ave

- 1990 Deerfield Ave

- 1920 Deerfield Ave

- 1770 Mistletoe Ln

- 1905 Deerfield Ave

- 1912 Deerfield Ave

- 1961 Lindeena Ln

Your Personal Tour Guide

Ask me questions while you tour the home.