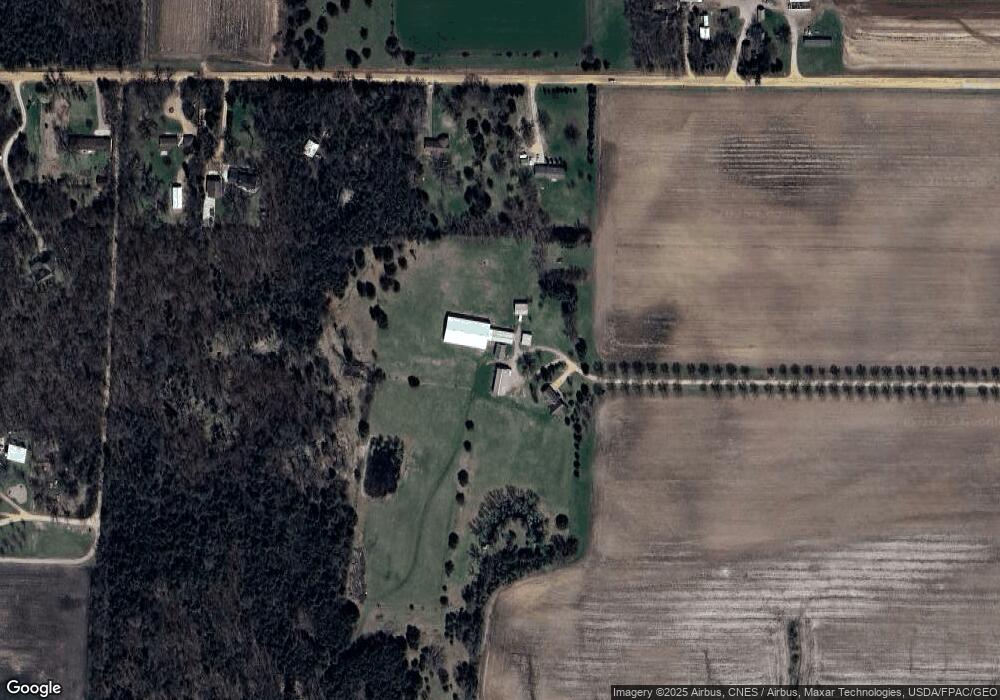

19650 Delaware Ave Jordan, MN 55352

Estimated Value: $684,000 - $1,007,000

5

Beds

3

Baths

1,978

Sq Ft

$415/Sq Ft

Est. Value

About This Home

This home is located at 19650 Delaware Ave, Jordan, MN 55352 and is currently estimated at $819,925, approximately $414 per square foot. 19650 Delaware Ave is a home located in Scott County with nearby schools including Jordan Elementary School, Jordan Middle School, and Jordan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2023

Sold by

Mary Jo Marks Revocable Trust

Bought by

Scott County Ventures Llc

Current Estimated Value

Purchase Details

Closed on

Jul 1, 2016

Sold by

Marks Mary Jo

Bought by

Scott County Ventures Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$550,000

Interest Rate

3.64%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jun 15, 2016

Sold by

Marks Mary Jo and Leonard Mecque L

Bought by

Marks Mary Jo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$550,000

Interest Rate

3.64%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scott County Ventures Llc | $750,000 | None Listed On Document | |

| Scott County Ventures Llc | $750,000 | Scott County Abstract & Titl | |

| Marks Mary Jo | -- | Scott County Abstract & Titl |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Scott County Ventures Llc | $550,000 | |

| Previous Owner | Marks Mary Jo | $315,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,398 | $714,000 | $252,100 | $461,900 |

| 2024 | $6,222 | $676,700 | $249,900 | $426,800 |

| 2023 | $5,358 | $644,900 | $249,900 | $395,000 |

| 2022 | $4,698 | $652,900 | $221,900 | $431,000 |

| 2021 | $4,614 | $505,600 | $196,600 | $309,000 |

| 2020 | $4,698 | $490,600 | $183,000 | $307,600 |

| 2019 | $4,766 | $479,900 | $174,000 | $305,900 |

| 2018 | $4,514 | $0 | $0 | $0 |

| 2016 | $4,612 | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 20801 Johnson Memorial Dr

- 1295 Beaumont Blvd

- 6305 W 190th 15c St

- 6305 X 46A W 190th St

- 6305 W 190th St

- 1266 Beaumont Blvd

- 1258 Beaumont Blvd

- 1274 Highland Ln

- 1259 Highland Ln

- 1281 Edge Way

- 706 Highland Cir

- 1018 Shoreview Dr

- 1261 Edge Way

- 1257 Edge Way

- The Eldorado Plan at Bridle Creek

- The Elder Plan at Bridle Creek

- The Pine Plan at Bridle Creek

- The Elm Plan at Bridle Creek

- 1083 Shoreview Dr

- 963 Huntington Way

- 7775 W 195th St

- 7825 W 195th St

- 7875 W 195th St

- 7951 W 195th St

- 7780 W 195th St

- 7780 W 195th St

- 7975 W 195th St

- 8051 W 195th St

- 8025 W 195th St

- 8001 W 195th St

- 19775 Delaware Ave

- 19815 Delaware Ave

- 19851 Delaware Ave

- 8101 W 195th St

- 19895 Delaware Ave

- 20020 Delaware Ave

- XX Delaware Ave

- XX Delaware Ave

- 19995 Delaware Ave

- 7436 W 195th St