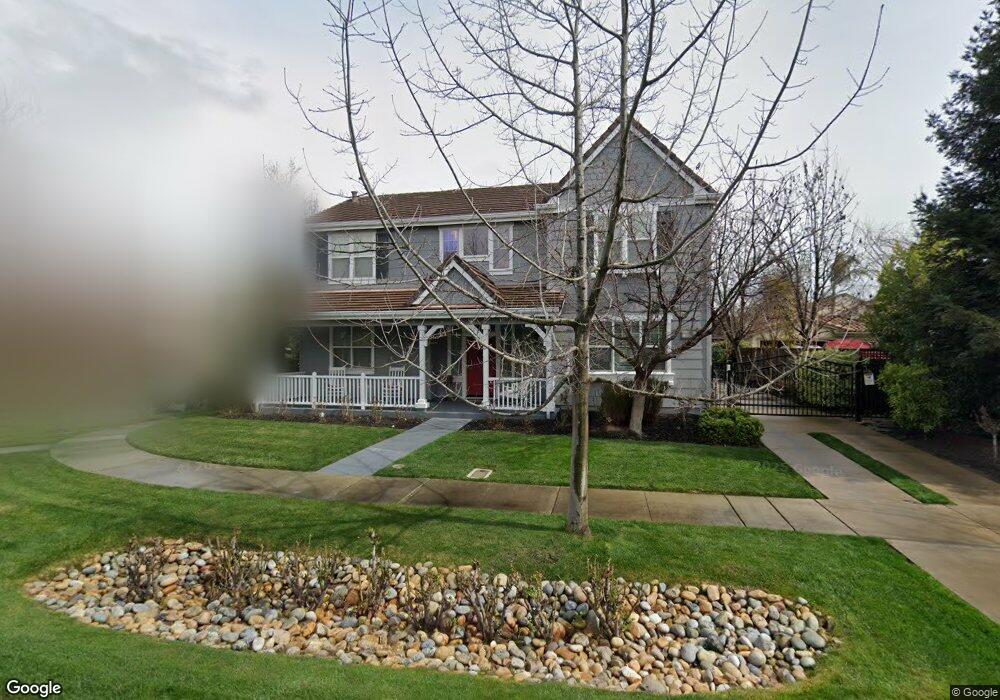

1972 Staghorn Way Livermore, CA 94550

Estimated Value: $1,922,000 - $2,036,000

6

Beds

4

Baths

3,544

Sq Ft

$559/Sq Ft

Est. Value

About This Home

This home is located at 1972 Staghorn Way, Livermore, CA 94550 and is currently estimated at $1,981,892, approximately $559 per square foot. 1972 Staghorn Way is a home located in Alameda County with nearby schools including Arroyo Seco Elementary School, East Avenue Middle School, and Livermore High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 5, 2025

Sold by

Jones Arthur B and Jones Wendy S

Bought by

Jones Family Trust and Jones

Current Estimated Value

Purchase Details

Closed on

May 26, 2016

Sold by

Shehtanian John Henry and Shehtanian Charity Lee

Bought by

Jones Arthur B and Jones Wendy S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$625,000

Interest Rate

3.59%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 18, 2013

Sold by

Shehtanian John Harry and Shehtanian Charity Lee

Bought by

Shehtanian John Henry and Shehtanian Charity Lee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$625,500

Interest Rate

3.49%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 19, 2005

Sold by

Shehtanian John Harry and Shehtanian Charity Lee

Bought by

Shehtanian John Harry and Shehtanian Charity Lee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$649,975

Interest Rate

3.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 18, 2004

Sold by

Shehtanian John Harry and Shehtanian Charity Lee

Bought by

Shehtanian John Harry and Shehtanian Charity Lee

Purchase Details

Closed on

Feb 3, 2004

Sold by

Ghc Investments Llc

Bought by

Shehtanian John H and Shehtanian Charity L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$650,000

Interest Rate

3.1%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Family Trust | -- | None Listed On Document | |

| Jones Arthur B | $1,125,000 | Chicago Title Company | |

| Shehtanian John Henry | -- | Chicago Title Company | |

| Shehtanian John Harry | -- | Chicago Title Company | |

| Shehtanian John Harry | -- | Alliance Title Company | |

| Shehtanian John Harry | -- | Alliance Title Company | |

| Shehtanian John Harry | -- | -- | |

| Shehtanian John H | -- | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jones Arthur B | $625,000 | |

| Previous Owner | Shehtanian John Harry | $625,500 | |

| Previous Owner | Shehtanian John Harry | $649,975 | |

| Previous Owner | Shehtanian John H | $650,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,666 | $1,324,741 | $355,131 | $976,610 |

| 2024 | $16,666 | $1,298,630 | $348,168 | $957,462 |

| 2023 | $16,429 | $1,280,036 | $341,343 | $938,693 |

| 2022 | $16,184 | $1,247,937 | $334,650 | $920,287 |

| 2021 | $15,888 | $1,223,333 | $328,089 | $902,244 |

| 2020 | $15,428 | $1,217,722 | $324,726 | $892,996 |

| 2019 | $15,593 | $1,193,850 | $318,360 | $875,490 |

| 2018 | $15,236 | $1,170,450 | $312,120 | $858,330 |

| 2017 | $14,782 | $1,147,500 | $306,000 | $841,500 |

| 2016 | $12,590 | $975,811 | $292,743 | $683,068 |

| 2015 | $11,839 | $961,154 | $288,346 | $672,808 |

| 2014 | $10,852 | $870,000 | $261,000 | $609,000 |

Source: Public Records

Map

Nearby Homes

- 5590 Hopps Ln

- 5218 Norma Way

- 5454 Stockton Loop

- 1762 Cheryl Dr

- 1411 Justine Ct

- 1368 Pegan Common

- 838 Hazel St

- 4669 Almond Cir

- 973 Jessica Dr

- 1147 Rebecca Dr

- 732 Hazel St

- 2779 Silverado Ct

- 5143 Tesla Rd

- 4844 Mulqueeney Common

- 4671 Laurie Common Unit 105

- 4671 Laurie Common Unit 103

- 337 Chris Common Unit 111

- 5221 Lenore Ave

- 4115 Freeda Ct

- 3992 Yale Way

- 1986 Staghorn Way

- 5874 Dresslar Cir

- 5897 Dresslar Cir

- 2010 Staghorn Way

- 5866 Dresslar Cir

- 5630 Elder Cir

- 5561 Maybeck Ln

- 5871 Dresslar Cir

- 5642 Elder Cir

- 5562 Hopps Ln

- 5583 Hopps Ln

- 5858 Dresslar Cir

- 5863 Dresslar Cir

- 5533 Maybeck Ln

- 5601 Dresslar Cir

- 5656 Elder Cir

- 5617 Dresslar Cir

- 5537 Hopps Ln

- 5639 Dresslar Cir

- 5849 Dresslar Cir

Your Personal Tour Guide

Ask me questions while you tour the home.