1982 Pueblo Ct Hide A Way Hills, OH 43107

Estimated Value: $283,056 - $388,000

2

Beds

2

Baths

1,037

Sq Ft

$324/Sq Ft

Est. Value

About This Home

This home is located at 1982 Pueblo Ct, Hide A Way Hills, OH 43107 and is currently estimated at $335,514, approximately $323 per square foot. 1982 Pueblo Ct is a home located in Fairfield County with nearby schools including Bremen Elementary School and Fairfield Union High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2021

Sold by

Shaw Mark H and Shaw Pauline

Bought by

Kesser James F and Kesser Toni Jo

Current Estimated Value

Purchase Details

Closed on

Nov 2, 2020

Sold by

Given Not

Bought by

Shaw Mark H and Shaw Pauline

Purchase Details

Closed on

Aug 23, 2010

Sold by

Brewer Ralph W and Brewer Tani L

Bought by

Shaw Mark H and Shaw Pauline

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,000

Interest Rate

4.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 29, 2008

Sold by

Bobo Gary E

Bought by

Brewer Ralph W and Brewer Tani L

Purchase Details

Closed on

Apr 27, 2005

Sold by

Bobo Suzanne

Bought by

Bobo Gary E

Purchase Details

Closed on

Nov 26, 2003

Sold by

Bobo Gary E and Bobo Suzanne

Bought by

Bobo Gary E and Bobo Suzanne

Purchase Details

Closed on

Oct 29, 1998

Sold by

Shaw Ronald A

Bought by

Bobo Gary E

Purchase Details

Closed on

Oct 9, 1992

Bought by

Shaw Ronald A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kesser James F | $225,000 | Acs Gahanna Title | |

| Shaw Mark H | -- | -- | |

| Shaw Mark H | $147,000 | Valmer Land Title Agency | |

| Brewer Ralph W | $173,500 | Title First Agency | |

| Bobo Gary E | -- | -- | |

| Bobo Gary E | -- | -- | |

| Bobo Gary E | $8,000 | -- | |

| Shaw Ronald A | $1,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shaw Mark H | $117,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,401 | $70,740 | $10,030 | $60,710 |

| 2023 | $2,828 | $70,740 | $10,030 | $60,710 |

| 2022 | $2,829 | $70,740 | $10,030 | $60,710 |

| 2021 | $2,426 | $55,600 | $9,560 | $46,040 |

| 2020 | $2,381 | $55,600 | $9,560 | $46,040 |

| 2019 | $2,333 | $55,600 | $9,560 | $46,040 |

| 2018 | $2,013 | $46,490 | $9,020 | $37,470 |

| 2017 | $2,013 | $46,490 | $9,020 | $37,470 |

| 2016 | $1,905 | $44,610 | $9,020 | $35,590 |

| 2015 | $1,869 | $43,050 | $9,020 | $34,030 |

| 2014 | $1,790 | $43,050 | $9,020 | $34,030 |

| 2013 | $1,790 | $43,050 | $9,020 | $34,030 |

Source: Public Records

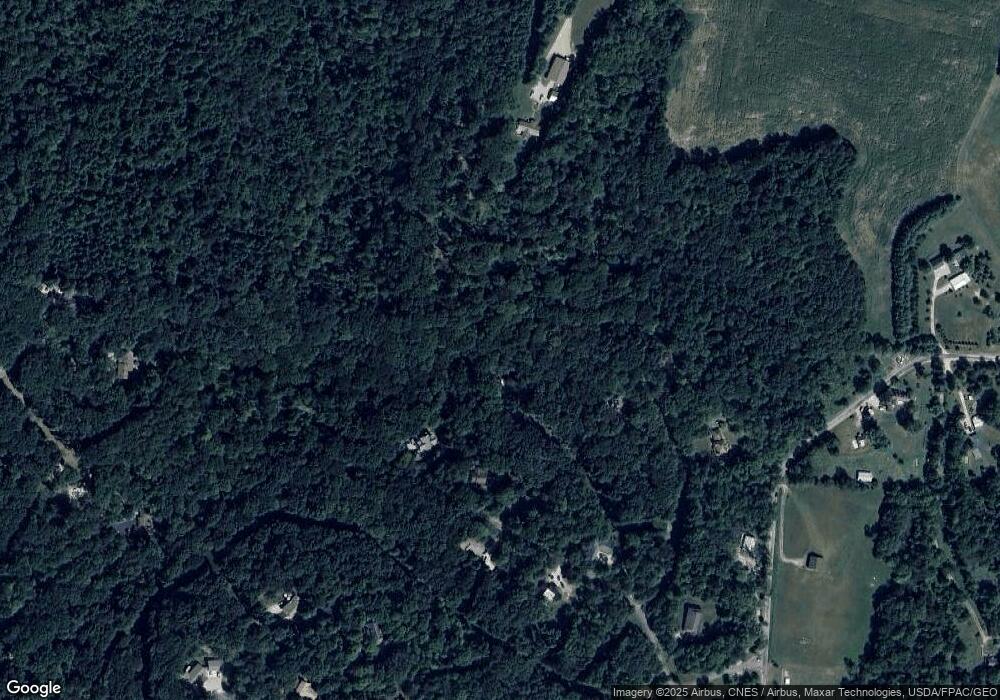

Map

Nearby Homes

- 1665 Alpine Dr

- 2091 Bearclaw Ct

- 1893 Beaver Ln

- 298 Tillamook Ln

- 849 Papago Ln

- 144 Hide-A-way Rd

- 2098 Maya Ln

- 1275 Taos Ln

- 8215 Pleasantview Rd SE

- Reserve A Osage Ln

- 599-600 Navajo Ln

- 1201 Taos Ln

- 201 Apache Ln

- 1756 Mohican Ln

- 408 Mohican Ln

- 2445 Pumpkin Vine Rd SE

- 1832 Piegan Ct

- 4 Hide A Way Hills Ln

- 2145 W Point Rd SE

- 1015 Taos Ln

- 1978 Montezuma Ln

- 1991 Blackfoot Ct SE

- 1985 Montezuma Ln

- 1986 Montezuma Ln

- 0 Montezuma Ln Unit 1976 2214728

- 0 Montezuma Ln

- 1991 Blackfoot Ct

- 2032 Montezuma Ln

- 1992 Blackfoot Ct SE

- 2004 Montezuma Ln

- 2002 Montezuma Ln

- 2004-5-6 Montezuma Ln

- 2002-2003 Montezuma Ln

- 2016,2017 Montezuma Ln

- 2004-2006 Montezuma Ln

- 1977-1980 Montezuma Ln

- 2016 Montezuma Ln

- 1998 Blackfoot Ct

- 2039 Montezuma Ln SE

- 2037 Montezuma Ln