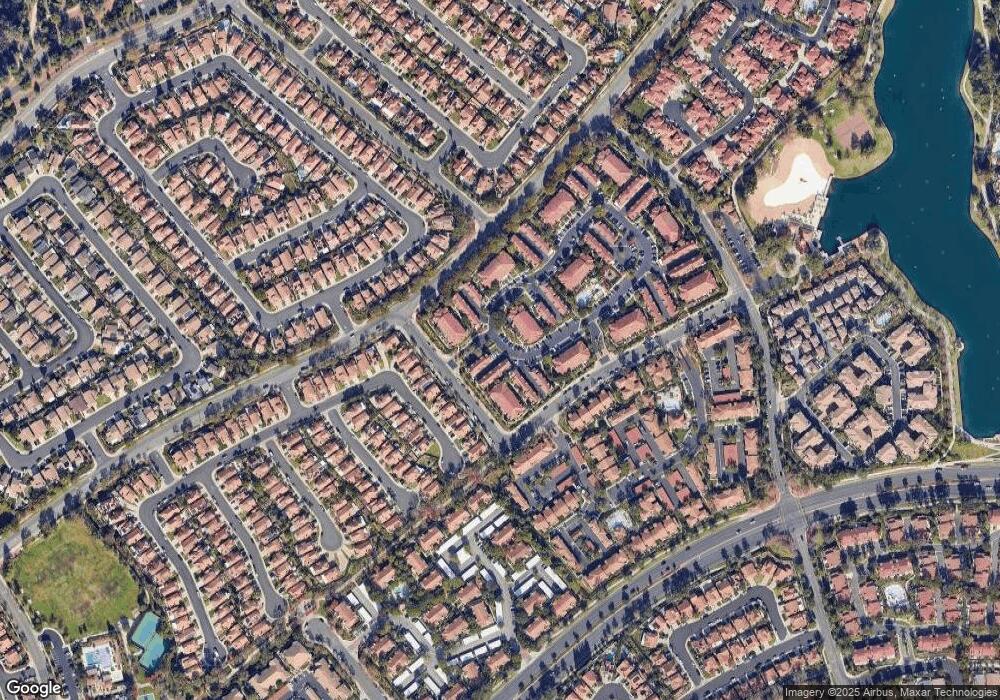

2 Dogwood Unit 76 Rancho Santa Margarita, CA 92688

Estimated Value: $553,073 - $596,000

2

Beds

2

Baths

832

Sq Ft

$697/Sq Ft

Est. Value

About This Home

This home is located at 2 Dogwood Unit 76, Rancho Santa Margarita, CA 92688 and is currently estimated at $580,018, approximately $697 per square foot. 2 Dogwood Unit 76 is a home located in Orange County with nearby schools including Trabuco Mesa Elementary School, Rancho Santa Margarita Intermediate School, and Trabuco Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 27, 2013

Sold by

Armenta Jorden D and Armenta Debra

Bought by

Fagerstrom Kristofor T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$277,875

Outstanding Balance

$205,097

Interest Rate

4.28%

Mortgage Type

New Conventional

Estimated Equity

$374,921

Purchase Details

Closed on

Jun 10, 2008

Sold by

Virtualbank

Bought by

Armenta Jorden D and Armenta Debra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$228,375

Interest Rate

6%

Mortgage Type

FHA

Purchase Details

Closed on

May 15, 2008

Sold by

Eichler Geoff and Mckenzie Robbin

Bought by

Virtual Bank

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$228,375

Interest Rate

6%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 15, 2005

Sold by

Audiss Jack N and Ramirez Melinda D

Bought by

Eichler Geoff and Mckenzie Robbin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,000

Interest Rate

7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 4, 2001

Sold by

Williams Brett

Bought by

Audiss Jack N and Ramirez Melinda D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,750

Interest Rate

6.62%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 29, 1999

Sold by

Costello Mary T

Bought by

Williams Brett

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,100

Interest Rate

7.75%

Purchase Details

Closed on

Aug 29, 1997

Sold by

Falk Bernie

Bought by

Falk Michelle

Purchase Details

Closed on

Aug 5, 1993

Sold by

Webster Gary

Bought by

Webster Kimberly Thayne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,100

Interest Rate

7.16%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 29, 1993

Sold by

Webster Kimberly Thayne and Thayne Kimbery K

Bought by

Falk Bernie and Falk Michelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$101,100

Interest Rate

7.16%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fagerstrom Kristofor T | $286,500 | Equity Title Orange County-I | |

| Armenta Jorden D | $250,000 | Ticor Title Company Brea | |

| Virtual Bank | $172,000 | Fidelity Natl Title Ins Co | |

| Eichler Geoff | $380,000 | Fidelity National Title | |

| Audiss Jack N | $183,000 | Fidelity National Title Ins | |

| Williams Brett | -- | First American Title Ins Co | |

| Williams Brett | $130,000 | First American Title Ins Co | |

| Falk Michelle | -- | -- | |

| Webster Kimberly Thayne | -- | Continental Lawyers Title Co | |

| Falk Bernie | $104,000 | Continental Lawyers Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fagerstrom Kristofor T | $277,875 | |

| Previous Owner | Armenta Jorden D | $228,375 | |

| Previous Owner | Eichler Geoff | $304,000 | |

| Previous Owner | Audiss Jack N | $177,750 | |

| Previous Owner | Williams Brett | $126,100 | |

| Previous Owner | Falk Bernie | $101,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,685 | $358,559 | $269,013 | $89,546 |

| 2024 | $3,685 | $351,529 | $263,738 | $87,791 |

| 2023 | $3,602 | $344,637 | $258,567 | $86,070 |

| 2022 | $3,541 | $337,880 | $253,497 | $84,383 |

| 2021 | $3,028 | $331,255 | $248,526 | $82,729 |

| 2020 | $3,449 | $327,859 | $245,978 | $81,881 |

| 2019 | $3,878 | $321,431 | $241,155 | $80,276 |

| 2018 | $3,823 | $315,129 | $236,427 | $78,702 |

| 2017 | $3,879 | $308,950 | $231,791 | $77,159 |

| 2016 | $4,144 | $302,893 | $227,246 | $75,647 |

| 2015 | $4,253 | $298,344 | $223,833 | $74,511 |

| 2014 | $4,170 | $292,500 | $219,448 | $73,052 |

Source: Public Records

Map

Nearby Homes

- 16 Las Piedras

- 73 Gaviota

- 21 Silktassel

- 31 Gaviota Unit 136

- 54 Gavilan

- 70 Gavilan Unit 18

- 28 Montana Del Lago Dr Unit 159

- 25 Dewberry

- 231 Montana Del Lago Dr Unit 22

- 250 Montana Del Lago Dr

- 225 Montana Del Lago Dr

- 4 Pica Flor Unit 54

- 1 El Canto

- 15 Temecula Ct

- 31 Brisa Del Lago

- 1 Brisa Del Lago

- 12 El Vaquero

- 27 Calle Melinda

- 34 Dianthus

- 21 Lobelia