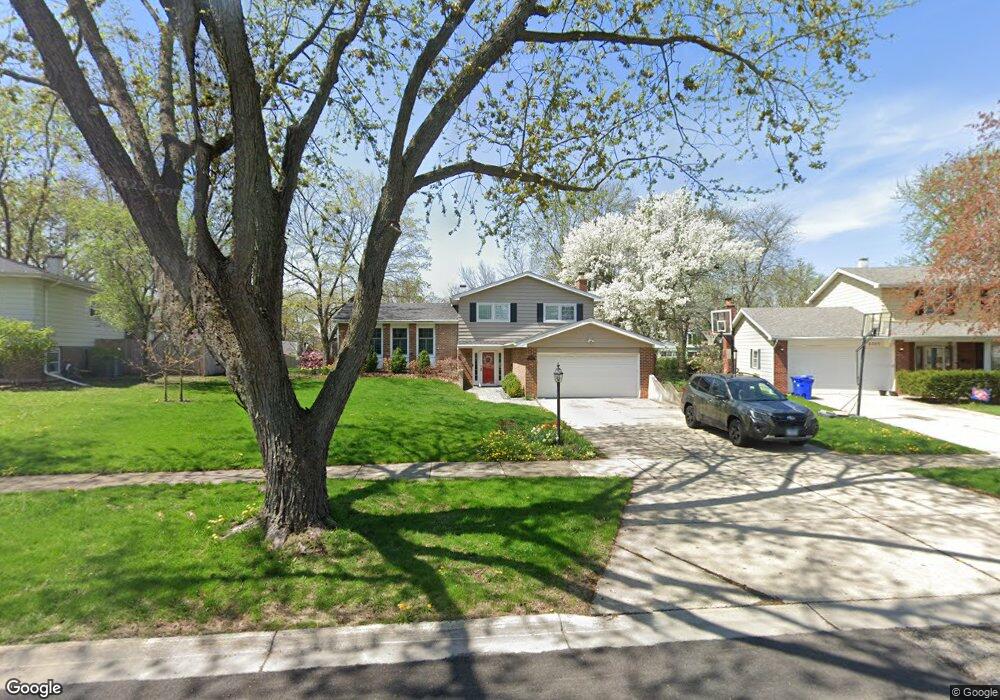

2006 Briarcliffe Blvd Unit 1 Wheaton, IL 60189

North Danada NeighborhoodEstimated Value: $454,348 - $503,000

3

Beds

2

Baths

1,228

Sq Ft

$387/Sq Ft

Est. Value

About This Home

This home is located at 2006 Briarcliffe Blvd Unit 1, Wheaton, IL 60189 and is currently estimated at $475,087, approximately $386 per square foot. 2006 Briarcliffe Blvd Unit 1 is a home located in DuPage County with nearby schools including Briar Glen Elementary School, Glen Crest Middle School, and Glenbard South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 11, 2023

Sold by

Coleman Brian R and Coleman Mylene A

Bought by

Mylene A Coleman Trust and Coleman

Current Estimated Value

Purchase Details

Closed on

Aug 19, 2011

Sold by

Coluzzi Lisa V and Coluzzi Howard J

Bought by

Coleman Brian A and Coleman Mylene A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$277,875

Interest Rate

4.55%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 30, 2002

Sold by

Kendra Diane M and Kendra Gregory D

Bought by

Coluzzi Howard J and Coluzzi Lisa V

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

6.18%

Purchase Details

Closed on

May 14, 1998

Sold by

American National Bk & Tr Co Of Chicago

Bought by

Kendra Diane M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,000

Interest Rate

6.75%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mylene A Coleman Trust | -- | None Listed On Document | |

| Coleman Brian A | $292,500 | Fidelity | |

| Coluzzi Howard J | $250,000 | -- | |

| Kendra Diane M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Coleman Brian A | $277,875 | |

| Previous Owner | Coluzzi Howard J | $200,000 | |

| Previous Owner | Kendra Diane M | $112,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,516 | $133,975 | $36,970 | $97,005 |

| 2023 | $9,083 | $123,320 | $34,030 | $89,290 |

| 2022 | $8,705 | $116,540 | $32,160 | $84,380 |

| 2021 | $8,706 | $113,780 | $31,400 | $82,380 |

| 2020 | $8,790 | $112,720 | $31,110 | $81,610 |

| 2019 | $8,562 | $109,750 | $30,290 | $79,460 |

| 2018 | $7,860 | $100,110 | $28,540 | $71,570 |

| 2017 | $7,314 | $96,420 | $27,490 | $68,930 |

| 2016 | $7,201 | $92,570 | $26,390 | $66,180 |

| 2015 | $7,143 | $88,320 | $25,180 | $63,140 |

| 2014 | $6,752 | $82,600 | $24,400 | $58,200 |

| 2013 | $6,547 | $82,840 | $24,470 | $58,370 |

Source: Public Records

Map

Nearby Homes

- 1580 College Ln S

- 1265 Windsor Dr

- 1720 Lakecliffe Dr Unit A

- 1705 Lakecliffe Dr Unit D

- 23W070 Mulberry Ln

- 953 Cordova Ct

- 2S744 Lakeside Dr Unit 21

- 1129 Rhodes Ct

- 1678 Groton Ct

- 570 Riva Ct

- 1581 Groton Ln

- 429 Sandhurst Cir Unit 1

- 448 Raintree Ct Unit 1C

- 30 Danada Dr

- 453 Raintree Dr Unit 5A

- 453 Raintree Dr Unit 1H

- 1026 Briarcliffe Blvd

- 3S481 Osage Dr

- 470 Fawell Blvd Unit 510

- 470 Fawell Blvd Unit 203

- 2000 Briarcliffe Blvd Unit 1

- 2014 Briarcliffe Blvd

- 2009 Nottingham Ln

- 2003 Nottingham Ln

- 2015 Nottingham Ln

- 1994 Briarcliffe Blvd

- 2022 Briarcliffe Blvd

- 1999 Nottingham Ln

- 2027 Nottingham Ln

- 1993 Nottingham Ln

- 2028 Briarcliffe Blvd

- 2007 Briarcliffe Blvd

- 1988 Briarcliffe Blvd

- 2017 Briarcliffe Blvd

- 1993 Briarcliffe Blvd Unit 1

- 1987 Nottingham Ln

- 2033 Nottingham Ln

- 2036 Briarcliffe Blvd Unit 1

- 1982 Briarcliffe Blvd

- 2004 Nottingham Ln

Your Personal Tour Guide

Ask me questions while you tour the home.