2010 Cold Tree Ln Unit 33A Watkinsville, GA 30677

Estimated Value: $441,627 - $526,000

--

Bed

3

Baths

1,888

Sq Ft

$262/Sq Ft

Est. Value

About This Home

This home is located at 2010 Cold Tree Ln Unit 33A, Watkinsville, GA 30677 and is currently estimated at $493,907, approximately $261 per square foot. 2010 Cold Tree Ln Unit 33A is a home located in Oconee County with nearby schools including Oconee County Elementary School, Oconee County Primary School, and Oconee County Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 9, 2023

Sold by

Foditsch Carla

Bought by

Foditsch Sakai Liv Tr

Current Estimated Value

Purchase Details

Closed on

Apr 11, 2019

Sold by

Scout Construction Llc

Bought by

Matsumoto Foditsch Carla and Matsumoto Sakai Daniel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,405

Interest Rate

4.3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 4, 2016

Sold by

Equity Trust Co

Bought by

Scout Construction Llc

Purchase Details

Closed on

Aug 23, 2012

Sold by

Bank Of The Ozarks

Bought by

Equity Trust Co Custodian Fbo

Purchase Details

Closed on

Aug 17, 2012

Sold by

Federal Deposit Insurance Corporation

Bought by

Bank Of The Ozarks

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Foditsch Sakai Liv Tr | -- | -- | |

| Matsumoto Foditsch Carla | $289,900 | -- | |

| Scout Construction Llc | $240,000 | -- | |

| Equity Trust Co Custodian Fbo | $240,000 | -- | |

| Bank Of The Ozarks | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Matsumoto Foditsch Carla | $275,405 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,096 | $167,945 | $27,000 | $140,945 |

| 2023 | $3,101 | $156,110 | $18,000 | $138,110 |

| 2022 | $2,879 | $136,197 | $18,000 | $118,197 |

| 2021 | $2,818 | $123,744 | $18,000 | $105,744 |

| 2020 | $2,642 | $116,493 | $18,000 | $98,493 |

| 2019 | $1,771 | $76,394 | $16,000 | $60,394 |

| 2018 | $303 | $12,800 | $12,800 | $0 |

| 2017 | $222 | $11,040 | $11,040 | $0 |

| 2016 | $206 | $10,240 | $10,240 | $0 |

| 2015 | $106 | $4,480 | $4,480 | $0 |

| 2014 | $80 | $3,280 | $3,280 | $0 |

| 2013 | -- | $5,440 | $5,440 | $0 |

Source: Public Records

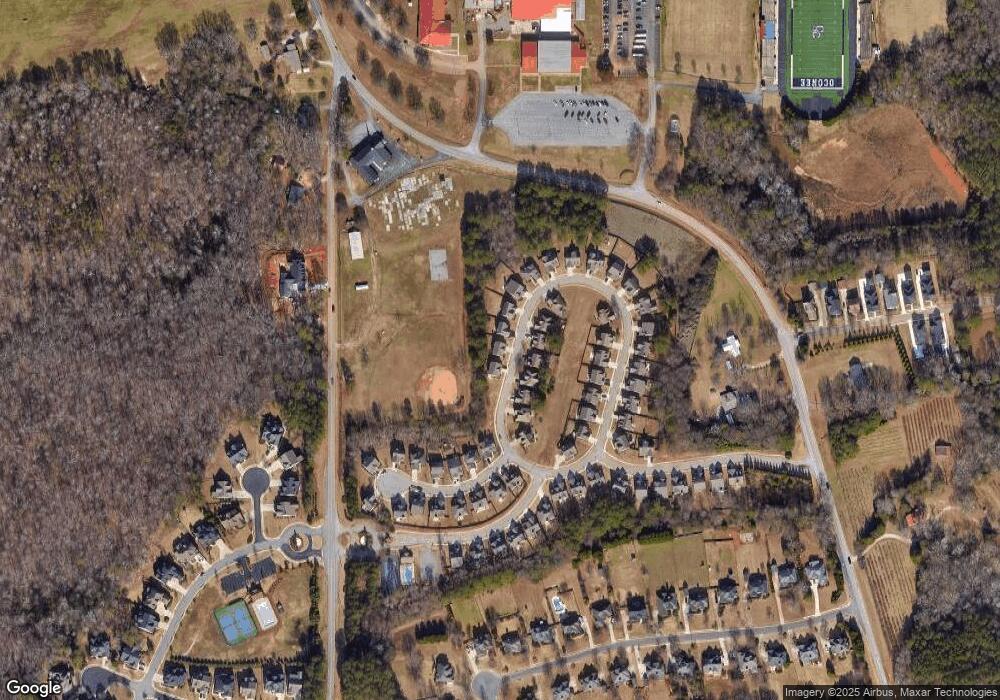

Map

Nearby Homes

- 1355 Cold Tree Ln

- 1015 Turtle Pond Dr

- 1805 Stonewood Field Rd

- 1295 Stonewood Field Rd

- 1025 Stonewood Field Rd

- 4340 Willow Creek Dr

- 4381 Willow Creek Dr

- 4621 Willow Creek Dr

- 1040 & 1020 Woodbine Dr

- 1360 Longleaf Ct

- 1550 Longleaf Ct

- Fairmont with Basement Plan at Willow Creek

- Everett with Crawl Space Plan at Willow Creek

- Everett with Basement Plan at Willow Creek

- Bristol with Basement Plan at Willow Creek

- Bristol with Crawl Space Plan at Willow Creek

- Fairmont with Crawl Space Plan at Willow Creek

- 1011 Sharon Place

- 1221 Echo Trail

- 1698 Shoal Creek Way

- 2010 Cold Tree Ln

- 1944 Cold Tree Ln Unit 34A

- 1944 Cold Tree Ln

- 2106 Cold Tree Ln

- 1884 Cold Tree Ln Unit 35A

- 1884 Cold Tree Ln

- 2017 Cold Tree Ln

- 1955 Cold Tree Ln

- 2181 Cold Tree Ln

- 00 Cold Tree Ln

- 48A Cold Tree Ln

- 15B Cold Tree Ln

- 000 Cold Tree Ln

- 13B Cold Tree Ln

- 49A Cold Tree Ln

- 1893 Cold Tree Ln

- 2143 Cold Tree Ln

- 1832 Cold Tree Ln Unit 36A

- 1832 Cold Tree Ln

- 2207 Cold Tree Ln