20207 20th Ave E Unit RG61 Spanaway, WA 98387

Estimated Value: $609,856 - $635,000

4

Beds

4

Baths

360

Sq Ft

$1,724/Sq Ft

Est. Value

About This Home

This home is located at 20207 20th Ave E Unit RG61, Spanaway, WA 98387 and is currently estimated at $620,464, approximately $1,723 per square foot. 20207 20th Ave E Unit RG61 is a home located in Pierce County with nearby schools including Shining Mountain Elementary School, Bethel Middle School, and Bethel High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 20, 2018

Sold by

Ross Raymond Irving and Simon Lynnique

Bought by

Sullivan Dale D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$356,500

Outstanding Balance

$301,619

Interest Rate

3.95%

Mortgage Type

VA

Estimated Equity

$318,845

Purchase Details

Closed on

Jan 19, 2017

Sold by

Soundbuilt Homes Llc

Bought by

Ross Raymond Irving and Simon Lynnique

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$324,785

Interest Rate

4.13%

Mortgage Type

VA

Purchase Details

Closed on

Apr 14, 2016

Sold by

Southwood Investment Llc

Bought by

Soundbuilt Homes Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sullivan Dale D | $356,219 | First American Title Company | |

| Ross Raymond Irving | $317,669 | F A T C O | |

| Soundbuilt Homes Llc | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sullivan Dale D | $356,500 | |

| Previous Owner | Ross Raymond Irving | $324,785 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,312 | $589,000 | $143,900 | $445,100 |

| 2024 | $6,312 | $579,500 | $139,600 | $439,900 |

| 2023 | $6,312 | $544,000 | $143,900 | $400,100 |

| 2022 | $6,087 | $573,200 | $136,500 | $436,700 |

| 2021 | $5,675 | $406,300 | $91,700 | $314,600 |

| 2019 | $3,996 | $375,400 | $80,000 | $295,400 |

| 2018 | $2,281 | $330,500 | $72,500 | $258,000 |

| 2017 | $2,485 | $296,100 | $64,000 | $232,100 |

Source: Public Records

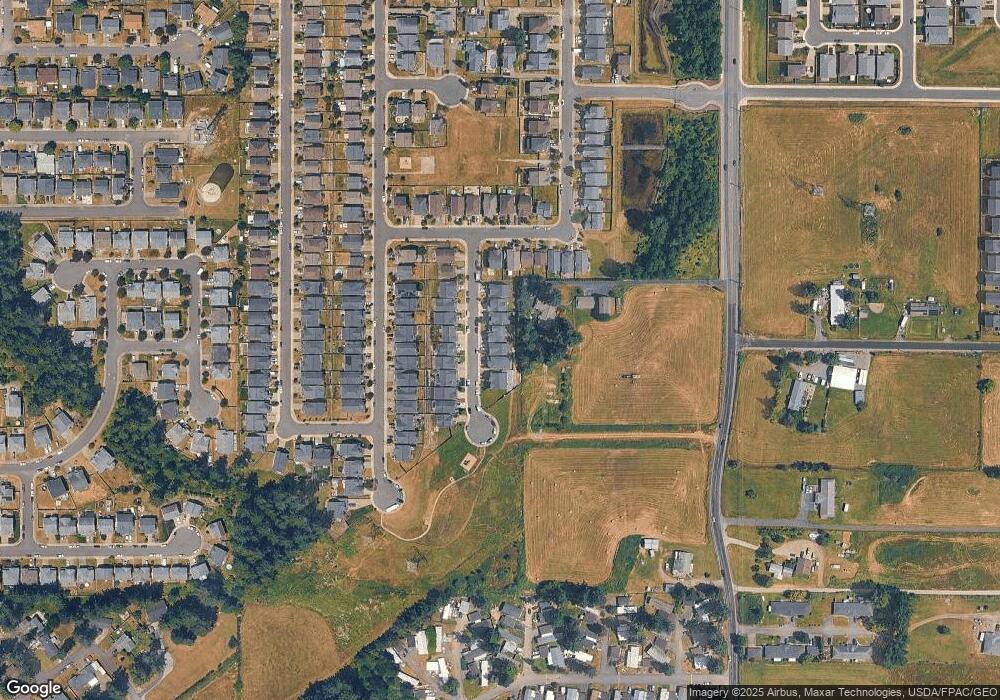

Map

Nearby Homes

- 19932 20th Avenue Ct E

- 20315 22nd Ave E

- 1708 201st Street Ct E

- 1609 200th Street Ct E

- 19841 22nd Avenue Ct E

- 1524 200th Street Ct E

- 2510 201st Street Ct E

- 1524 199th St E

- 19518 19th Avenue Ct E

- 20201 13th Street Ct E

- 19503 22nd Ave E

- 200th 256th St E

- 19508 24th Ave E

- 19805 13th Avenue Ct E

- 19528 26th Avenue Ct E

- 20511 12th Avenue Ct E

- 1407 196th St E

- 208th 231st St E

- 20402 11th Avenue Ct E

- 1108 206th St E