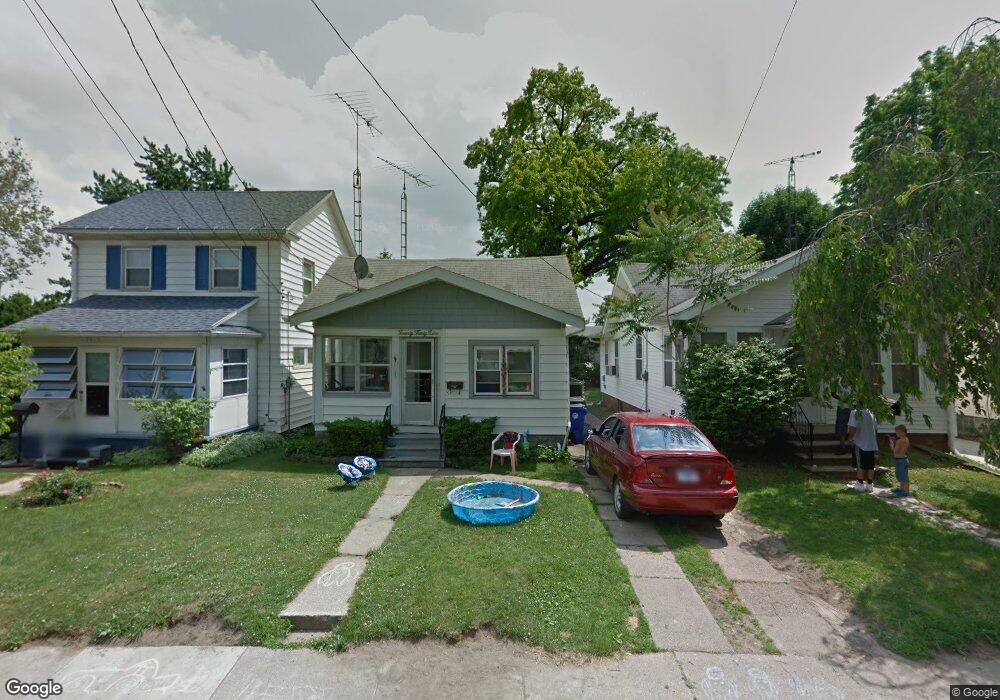

2039 Fairfax Rd Toledo, OH 43613

DeVeaux NeighborhoodEstimated Value: $106,000 - $151,000

2

Beds

1

Bath

750

Sq Ft

$162/Sq Ft

Est. Value

About This Home

This home is located at 2039 Fairfax Rd, Toledo, OH 43613 and is currently estimated at $121,153, approximately $161 per square foot. 2039 Fairfax Rd is a home located in Lucas County with nearby schools including McKinley Stemm Academy, Start High School, and Hope Learning Academy of Toledo.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 6, 2023

Sold by

Lucas County Land Reutilization Corporat

Bought by

Webster Elizabeth A

Current Estimated Value

Purchase Details

Closed on

Apr 19, 2022

Sold by

Forfeited Land

Bought by

Lucas County Land Reutilization Corporation

Purchase Details

Closed on

Apr 7, 2022

Sold by

Stockmaster Nathan

Bought by

Land Forfeited

Purchase Details

Closed on

Apr 20, 2010

Sold by

D&G Preferred Properties Llc

Bought by

Stockmaster Nathan and Stockmaster Laura

Purchase Details

Closed on

Oct 15, 2003

Sold by

Pavlis James L and Pavlis James J

Bought by

D & G Preferred Properties Llc

Purchase Details

Closed on

Nov 4, 1993

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Webster Elizabeth A | -- | None Listed On Document | |

| Lucas County Land Reutilization Corporation | -- | -- | |

| Land Forfeited | -- | -- | |

| Stockmaster Nathan | $47,700 | Attorney | |

| D & G Preferred Properties Llc | $42,400 | Multiple | |

| -- | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | -- | -- | -- |

| 2023 | $84 | $385 | $385 | $0 |

| 2022 | $0 | $385 | $385 | $0 |

| 2021 | $1,326 | $14,910 | $3,360 | $11,550 |

| 2020 | $1,266 | $14,455 | $3,220 | $11,235 |

| 2019 | $1,085 | $14,455 | $3,220 | $11,235 |

| 2018 | $1,090 | $14,455 | $3,220 | $11,235 |

| 2017 | $13,649 | $14,140 | $3,150 | $10,990 |

| 2016 | $11,080 | $40,400 | $9,000 | $31,400 |

| 2015 | $1,108 | $40,400 | $9,000 | $31,400 |

| 2014 | $1,371 | $14,140 | $3,150 | $10,990 |

| 2013 | $914 | $14,140 | $3,150 | $10,990 |

Source: Public Records

Map

Nearby Homes

- 2045 Fairfax Rd

- 2040 Fairfax Rd

- 2056 Fairfax Rd

- 2106 Fairfax Rd

- 1952 Fairfax Rd

- 1929 Marlow Rd

- 2146 Marlow Rd

- 3430 Upton Ave

- 3306 Saint Bernard Dr

- 1935 Talbot St

- 1822 Wychwood St

- 3718 Sherbrooke Rd

- 1939 Balkan Place

- 3621 Sherbrooke Rd

- 1820 Marne Ave

- 3233 Saint Bernard Dr

- 3715 Shelbourne Ave

- 1840 Talbot St

- 3251 Northwood Ave

- 3656 Bellevue Rd

- 2033 Fairfax Rd

- 2041 Fairfax Rd

- 2047 Fairfax Rd

- 2027 Fairfax Rd

- 2051 Fairfax Rd

- 2038 Fairfax Rd

- 2034 Fairfax Rd

- 2053 Fairfax Rd

- 2044 Fairfax Rd

- 2026 Fairfax Rd

- 2023 Fairfax Rd

- 2046 Fairfax Rd

- 2057 Fairfax Rd

- 2050 Fairfax Rd

- 2022 Fairfax Rd

- 2052 Fairfax Rd

- 2059 Fairfax Rd

- 2015 Fairfax Rd

- 2016 Fairfax Rd

- 2058 Fairfax Rd