205 High Point Blvd Unit D Boynton Beach, FL 33435

Downtown Boynton NeighborhoodEstimated Value: $189,773 - $253,000

2

Beds

2

Baths

1,104

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 205 High Point Blvd Unit D, Boynton Beach, FL 33435 and is currently estimated at $212,193, approximately $192 per square foot. 205 High Point Blvd Unit D is a home located in Palm Beach County with nearby schools including Forest Park Elementary School, Boynton Beach Community High School, and Calf Pen Meadow Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2019

Sold by

Dequartro Eugenia

Bought by

Gubelman Eugenia

Current Estimated Value

Purchase Details

Closed on

Oct 31, 2012

Sold by

Sciametta Carmine and Gubelman Eugenia

Bought by

Sciametta Carmine

Purchase Details

Closed on

Apr 15, 2003

Sold by

Liv Coniglin Marie E and Liv Marie E Coniglin Revocable

Bought by

Sciametta Carmine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,600

Interest Rate

5.62%

Purchase Details

Closed on

Jan 18, 2001

Sold by

Ronald F Hacker Tr

Bought by

Coniglio Marie E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gubelman Eugenia | -- | Attorney | |

| Sciametta Carmine | -- | Attorney | |

| Sciametta Carmine | $79,900 | Gateway Title | |

| Coniglio Marie E | $30,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sciametta Carmine | $61,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,867 | $125,536 | -- | -- |

| 2024 | $2,867 | $114,124 | -- | -- |

| 2023 | $2,596 | $103,749 | $0 | $145,788 |

| 2022 | $2,353 | $94,317 | $0 | $0 |

| 2021 | $2,173 | $105,810 | $0 | $105,810 |

| 2020 | $1,952 | $87,821 | $0 | $87,821 |

| 2019 | $1,851 | $85,000 | $0 | $85,000 |

| 2018 | $1,671 | $79,000 | $0 | $79,000 |

| 2017 | $1,559 | $72,000 | $0 | $0 |

| 2016 | $1,428 | $53,240 | $0 | $0 |

| 2015 | $1,302 | $48,400 | $0 | $0 |

| 2014 | $1,219 | $44,000 | $0 | $0 |

Source: Public Records

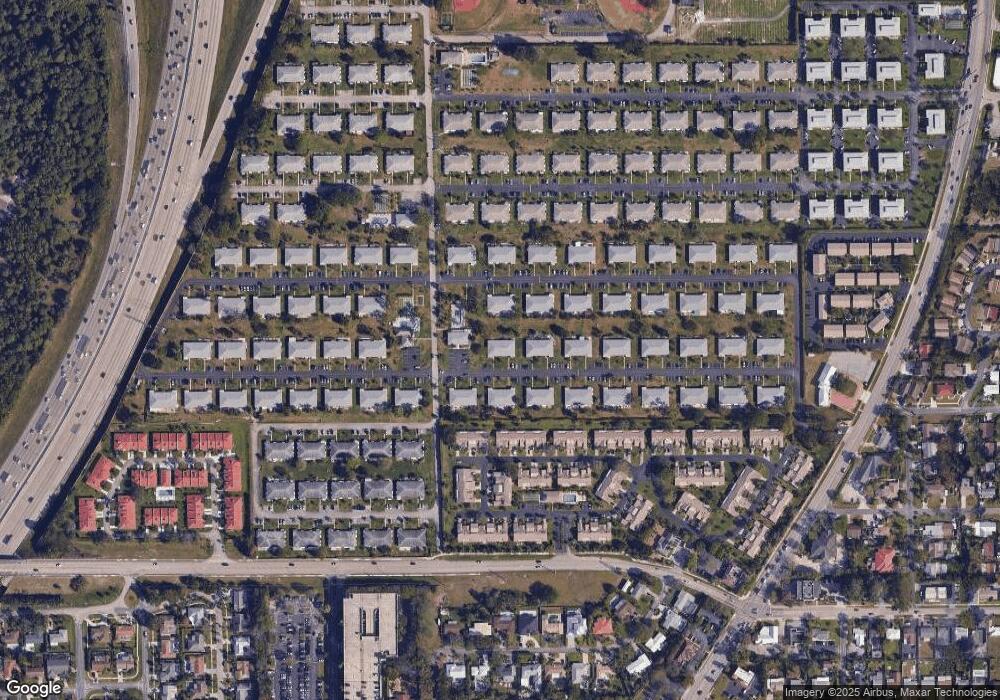

Map

Nearby Homes

- 200 N High Point Blvd Unit C

- 215 N High Point Blvd Unit B

- 280 High Point Blvd Unit C

- 210 South Blvd Unit C

- 215 South Blvd Unit C

- 240 N High Point Blvd Unit C

- 290 Main Blvd Unit C

- 330 Main Blvd Unit A

- 155 N High Point Blvd Unit A

- 260 High Point Blvd Unit C

- 260 South Blvd Unit A

- 245 High Point Ct Unit C

- 255 High Point Ct Unit C

- 360 Main Blvd Unit B

- 145 South Blvd Unit D

- 355 Main Blvd Unit C

- 355 Main Blvd Unit B

- 285 N High Point Blvd Unit A

- 270 High Point Ct Unit D

- 135 South Blvd Unit A

- 265 High Point Blvd

- 280 High Point Blvd Unit 280D

- 270 High Point Blvd Unit 270A

- 130 High Point Blvd Unit D

- 250 High Point Blvd Unit D

- 270 High Point Blvd Unit D

- 205 High Point Blvd Unit B

- 270 High Point Blvd Unit C

- 245 High Point Blvd Unit D

- 140 High Point Blvd Unit A

- 130 High Point Blvd Unit D

- 245 High Point Blvd Unit C

- 250 High Point Blvd Unit A

- 130 High Point Blvd Unit C

- 130 High Point Blvd Unit B

- 130 High Point Blvd Unit A

- 205 High Point Blvd Unit C

- 140 High Point Blvd Unit D

- 140 High Point Blvd Unit C

- 140 High Point Blvd Unit B