2055 Twin Creeks Place Hayward, CA 94541

Estimated Value: $1,201,000 - $1,538,000

5

Beds

4

Baths

2,786

Sq Ft

$489/Sq Ft

Est. Value

About This Home

This home is located at 2055 Twin Creeks Place, Hayward, CA 94541 and is currently estimated at $1,363,133, approximately $489 per square foot. 2055 Twin Creeks Place is a home located in Alameda County with nearby schools including Fairview Elementary School, Bret Harte Middle School, and Hayward High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 18, 2013

Sold by

Neumann Kara

Bought by

Lee Daniela and Lee Devin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$277,600

Interest Rate

3.33%

Mortgage Type

New Conventional

Estimated Equity

$1,085,533

Purchase Details

Closed on

Nov 26, 2008

Sold by

Neumann Jonathan

Bought by

Neumann Kara

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$585,000

Interest Rate

6.04%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Nov 25, 2008

Sold by

United American Bank

Bought by

Neumann Kara

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$585,000

Interest Rate

6.04%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Mar 6, 2008

Sold by

Gerard Twin Creeks Llc

Bought by

United American Bank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lee Daniela | $605,000 | North American Title Company | |

| Neumann Kara | -- | Old Republic Title Company | |

| Neumann Kara | $650,000 | Old Republic Title Company | |

| United American Bank | $4,427,549 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lee Daniela | $400,000 | |

| Previous Owner | Neumann Kara | $585,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,519 | $836,494 | $253,048 | $590,446 |

| 2024 | $10,519 | $819,958 | $248,087 | $578,871 |

| 2023 | $10,391 | $810,744 | $243,223 | $567,521 |

| 2022 | $10,162 | $787,853 | $238,456 | $556,397 |

| 2021 | $10,052 | $772,268 | $233,780 | $545,488 |

| 2020 | $9,909 | $771,281 | $231,384 | $539,897 |

| 2019 | $9,966 | $756,164 | $226,849 | $529,315 |

| 2018 | $9,342 | $741,340 | $222,402 | $518,938 |

| 2017 | $9,111 | $726,804 | $218,041 | $508,763 |

| 2016 | $8,603 | $712,557 | $213,767 | $498,790 |

| 2015 | $8,418 | $701,857 | $210,557 | $491,300 |

| 2014 | $7,992 | $688,108 | $206,432 | $481,676 |

Source: Public Records

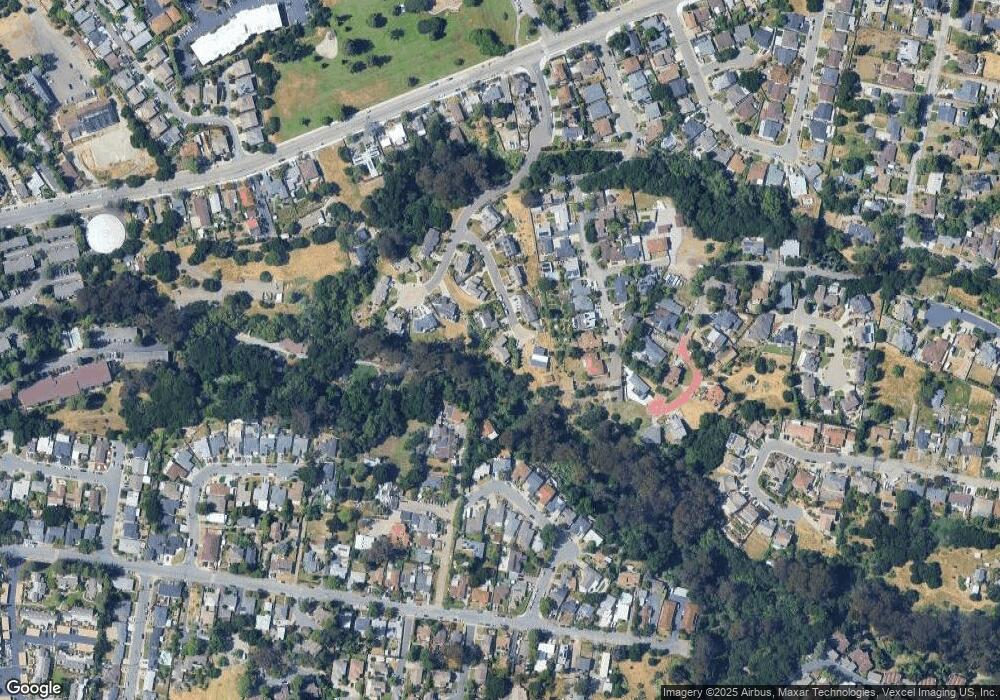

Map

Nearby Homes

- 23868 Fairlands Rd

- 1923 E St

- 2468 Hidden Ln

- 2207 Dexter Ct

- 1775 Panda Way Unit 337

- 2209 Romey Ln

- 23661 Glenbrook Ln

- 23920 Mayville Dr

- 23022 Palazzo Del Kayla

- 2272 Kelly St

- 2980 D St

- 1 Nina St

- 24946 Bland St

- 1641 B St

- 24930 2nd St

- 23066 Maud Ave

- 22537 Center St Unit 207

- 2936 Pickford Way

- 24498 2nd St

- 24948 Campus Dr

- 2049 Twin Creeks Place

- 2060 Twin Creeks Place

- 2052 Twin Creeks Place

- 23824 Twin Creeks Ct

- 24027 Wilcox Ln

- 1922 Hillsdale St

- 2041 Twin Creeks Place

- 23836 Twin Creeks Ct

- 2044 Twin Creeks Place

- 24009 Fairlands Rd

- 23981 Fairlands Rd

- 23943 Fairlands Rd

- 24013 Fairlands Rd

- 23915 Fairlands Rd

- 23794 Twin Creeks Ct

- 23863 Fairlands Rd

- 1930 Hillsdale St

- 24015 Wilcox Ln

- 2036 Twin Creeks Place

- 1926 Hillsdale St