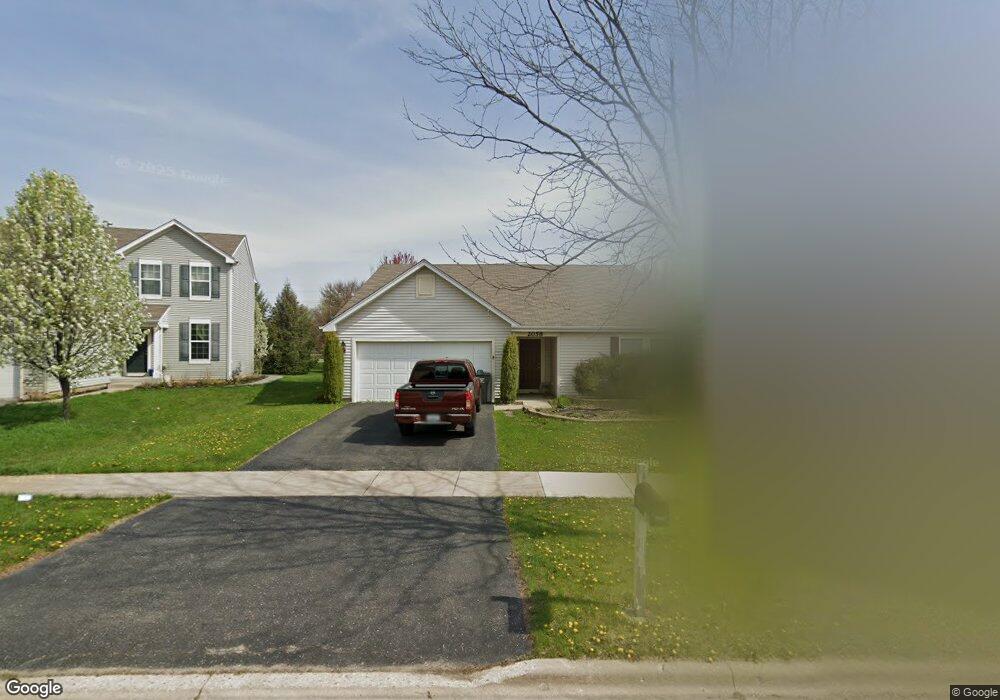

2058 Kate Dr Montgomery, IL 60538

South Montgomery NeighborhoodEstimated Value: $354,851 - $370,000

3

Beds

2

Baths

1,805

Sq Ft

$200/Sq Ft

Est. Value

About This Home

This home is located at 2058 Kate Dr, Montgomery, IL 60538 and is currently estimated at $360,713, approximately $199 per square foot. 2058 Kate Dr is a home located in Kendall County with nearby schools including Lakewood Creek Elementary School, Thompson Jr. High School, and Oswego High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 1, 2017

Sold by

Myers Bebecca M

Bought by

Skelly Jeremy D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,750

Outstanding Balance

$164,719

Interest Rate

4.12%

Mortgage Type

New Conventional

Estimated Equity

$195,994

Purchase Details

Closed on

May 11, 2012

Sold by

Drh Cambridge Homes Inc

Bought by

Myers Rebecca M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,633

Interest Rate

3.75%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 22, 2010

Sold by

Orchard Prairie North Llc

Bought by

Drh Cambridge Homes Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Skelly Jeremy D | $205,000 | None Available | |

| Myers Rebecca M | $169,000 | Chicago Title Insurance Co | |

| Drh Cambridge Homes Inc | $306,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Skelly Jeremy D | $194,750 | |

| Previous Owner | Myers Rebecca M | $165,633 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,895 | $98,844 | $10,241 | $88,603 |

| 2023 | $7,106 | $88,436 | $9,163 | $79,273 |

| 2022 | $7,106 | $80,287 | $8,319 | $71,968 |

| 2021 | $6,872 | $75,579 | $8,319 | $67,260 |

| 2020 | $6,654 | $72,376 | $8,319 | $64,057 |

| 2019 | $6,476 | $69,599 | $8,000 | $61,599 |

| 2018 | $6,169 | $63,463 | $8,000 | $55,463 |

| 2017 | $5,658 | $57,082 | $8,000 | $49,082 |

| 2016 | $5,389 | $53,615 | $8,000 | $45,615 |

| 2015 | $5,560 | $52,569 | $7,204 | $45,365 |

| 2014 | -- | $52,569 | $7,204 | $45,365 |

| 2013 | -- | $52,569 | $7,204 | $45,365 |

Source: Public Records

Map

Nearby Homes

- 2214 Andrew Trail Unit 1

- 2717 Avalon Ln

- 971 Sapphire Ln

- 2267 Margaret Dr

- 2455 Montclair Ln

- 2891 Frances Ln

- 2906 Meadowview Ln

- 2091 Jericho Rd

- 2930 Heather Ln Unit 1

- 424 Grape Vine Trail

- 1 Highway 30

- 2212 Gallant Fox Cir Unit 702

- 3014 Shetland Ln

- 2254 Gallant Fox Cir Unit 303

- 2021 Radcliffe Dr

- 11-13 W Anchor Rd

- 5.43 B-3 Commercial State Route 31

- 19 Brookside Ln

- 17 Basswood Ct

- 7.43 Acres Vacant La State Route 31