2061 W Atkinson Rd Othello, WA 99344

Estimated Value: $506,452 - $550,000

5

Beds

3

Baths

2,480

Sq Ft

$214/Sq Ft

Est. Value

About This Home

This home is located at 2061 W Atkinson Rd, Othello, WA 99344 and is currently estimated at $530,613, approximately $213 per square foot. 2061 W Atkinson Rd is a home located in Adams County with nearby schools including Othello High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 14, 2019

Sold by

Conrad Michael A and Conrad Vikki L

Bought by

Gonzalez Amado Suarez and Gonzalez Diana Monica

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$283,765

Outstanding Balance

$250,084

Interest Rate

4.62%

Mortgage Type

FHA

Estimated Equity

$280,529

Purchase Details

Closed on

Nov 17, 2016

Sold by

Conrad Michael A and Conrad Vikki L

Bought by

Conrad Michael A and Conrad Vikki L

Purchase Details

Closed on

Dec 11, 2012

Sold by

Gearheart David and Gearheart Kristin

Bought by

Conrad Michael A and Conrad Vikki L

Purchase Details

Closed on

Aug 24, 2006

Sold by

Gearheart David and Gearheart Kristen

Bought by

Gearheart David

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$199,955

Interest Rate

6.7%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gonzalez Amado Suarez | $289,000 | Frontier Title Moses Lake | |

| Conrad Michael A | -- | None Available | |

| Conrad Michael A | $255,000 | Chicago Title | |

| Gearheart David | -- | Frontier Title & Escrow | |

| Gearheart David | $208,000 | Frontier Title & Escrow |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gonzalez Amado Suarez | $283,765 | |

| Previous Owner | Gearheart David | $199,955 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,537 | $338,000 | $40,900 | $297,100 |

| 2023 | $3,537 | $315,100 | $37,800 | $277,300 |

| 2022 | $3,369 | $282,200 | $34,600 | $247,600 |

| 2021 | $3,371 | $282,200 | $34,600 | $247,600 |

| 2020 | $2,799 | $269,200 | $31,500 | $237,700 |

| 2019 | $2,737 | $224,900 | $31,500 | $193,400 |

| 2018 | $2,737 | $224,900 | $31,500 | $193,400 |

| 2017 | $2,889 | $224,900 | $31,500 | $193,400 |

| 2016 | $3,094 | $234,400 | $31,400 | $203,000 |

| 2015 | $3,094 | $236,100 | $33,100 | $203,000 |

| 2014 | $3,094 | $236,100 | $33,100 | $203,000 |

| 2012 | $3,094 | $236,100 | $33,100 | $203,000 |

Source: Public Records

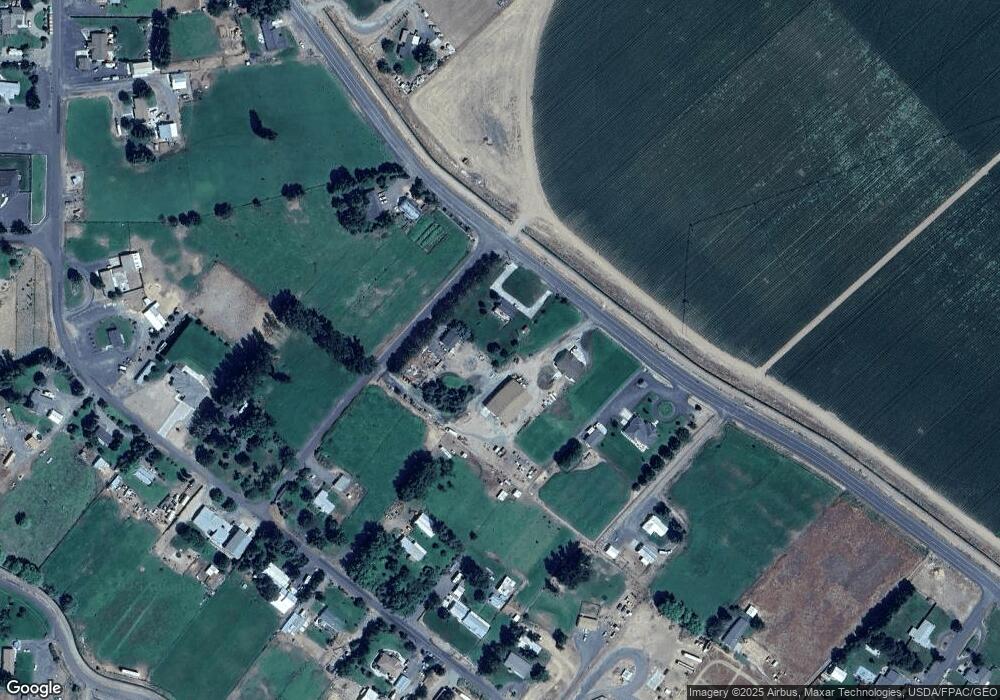

Map

Nearby Homes

- 0 S Pancho Villa Ln

- 31 Rangeview Rd

- 2007 W Joanna Ln

- 2004 W Joanna Ln

- 984 S Steele Rd

- 2229 W Bench Rd

- 828 S Skylark Way

- 826 S Skylark Way

- 907 E Cascade St

- 0 S Nka McKinney Rd

- 849 S Mckinney Rd

- 0 NKA S Broadway Ave

- 1045 Sandstone St

- 1070 S 4th Ave

- 1315 Gemstone St

- 1005 S 3rd Ave

- 980 Capstone Ave

- 415 Sylvan Dr

- 1175 Cypress St

- 940 Capstone Ave

- 2064 W Horacio Ln

- 831 Garza Rd

- 1051 S Harley Ln

- 2053 W Atkinson Rd

- 2065 W Atkinson Rd

- 2051 W Atkinson Rd

- 1081 S Hi lo Dr

- 2045 W Atkinson Rd

- 1077 S Hi lo Dr

- 2078 W Atkinson Rd

- 1071 S Hi lo Dr

- 1085 S Hi lo Dr

- 1085 S Hi-Lo Dr

- 1095 S Hi lo Dr

- 1089 S Hi lo Dr

- 1067 S Hi lo Dr

- 1094 S Hi lo Dr

- 2078 B W Atkinson Rd

- 1059 S Hi lo Dr

- 1080 S Hi lo Dr