208 Saint Simons Cove Peachtree City, GA 30269

Estimated Value: $625,271 - $680,000

4

Beds

3

Baths

2,781

Sq Ft

$239/Sq Ft

Est. Value

About This Home

This home is located at 208 Saint Simons Cove, Peachtree City, GA 30269 and is currently estimated at $663,818, approximately $238 per square foot. 208 Saint Simons Cove is a home located in Fayette County with nearby schools including Kedron Elementary School, Booth Middle School, and McIntosh High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 14, 2021

Sold by

Lakeshore Trust Inc

Bought by

James Asantewa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$438,300

Outstanding Balance

$396,588

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$267,230

Purchase Details

Closed on

Jul 2, 2019

Sold by

White-Crowell Amelia Patricia

Bought by

Lakeshore Trust Inc

Purchase Details

Closed on

May 15, 1998

Sold by

Bob Adams Homes

Bought by

Crowell William D and White Crowell Amelia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$206,000

Interest Rate

7.1%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| James Asantewa | $487,000 | -- | |

| Lakeshore Trust Inc | $350,000 | -- | |

| Crowell William D | $230,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | James Asantewa | $438,300 | |

| Previous Owner | Crowell William D | $206,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,829 | $233,048 | $26,600 | $206,448 |

| 2023 | $7,419 | $287,720 | $26,600 | $261,120 |

| 2022 | $5,900 | $194,800 | $19,680 | $175,120 |

| 2021 | $6,861 | $223,320 | $26,600 | $196,720 |

| 2020 | $6,236 | $200,840 | $26,600 | $174,240 |

| 2019 | $2,315 | $215,840 | $26,600 | $189,240 |

| 2018 | $2,096 | $192,440 | $26,600 | $165,840 |

| 2017 | $2,055 | $185,200 | $26,600 | $158,600 |

| 2016 | $1,934 | $160,720 | $26,600 | $134,120 |

| 2015 | $1,808 | $147,360 | $26,600 | $120,760 |

| 2014 | $1,760 | $138,720 | $26,600 | $112,120 |

| 2013 | -- | $136,000 | $0 | $0 |

Source: Public Records

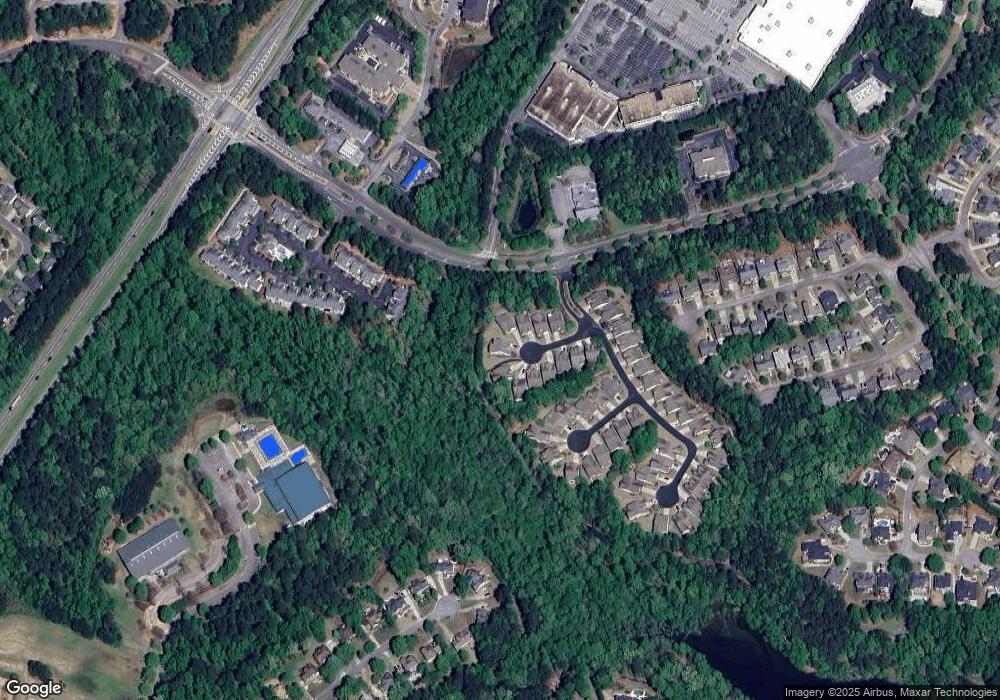

Map

Nearby Homes

- 512 Las Brasis Ct

- 132 Sea Island Dr

- 133 Sea Island Dr

- 206 Las Brasis Ct

- 404 Las Brasis Ct

- 103 Ardenlee Dr

- 308 Dalston Way

- 718 Avalon Way

- 231 Clifton Ln

- 105 Farmington Dr

- 100 Leisure Trail

- 249 Clifton Ln

- 117 N Cove Dr

- 134 Mellington Ln

- 203 Birkhill

- 544 Colebrook Way

- 308 Corrigan Trace

- 301 Abercorn Square

- 319 Corrigan Trace

- 112 Bridgewater Dr

- 206 Saint Simons Cove

- 210 St Simons Cove

- 210 Saint Simons Cove

- 204 St Simons Cove

- 204 St Simons Cove Unit 31

- 204 Saint Simons Cove

- 202 Saint Simons Cove

- 211 Saint Simons Cove

- 209 Saint Simons Cove

- 209 St Simons Cove

- 209 St Simons Cove Unit 26

- 207 Saint Simons Cove

- 200 St Simons Cove

- 200 Saint Simons Cove

- 205 Saint Simons Cove

- 203 Saint Simons Cove

- 308 Turtle Bay

- 310 Turtle Bay

- 0 Saint Simons Cove Unit 7438801

- 0 Saint Simons Cove Unit 8354913