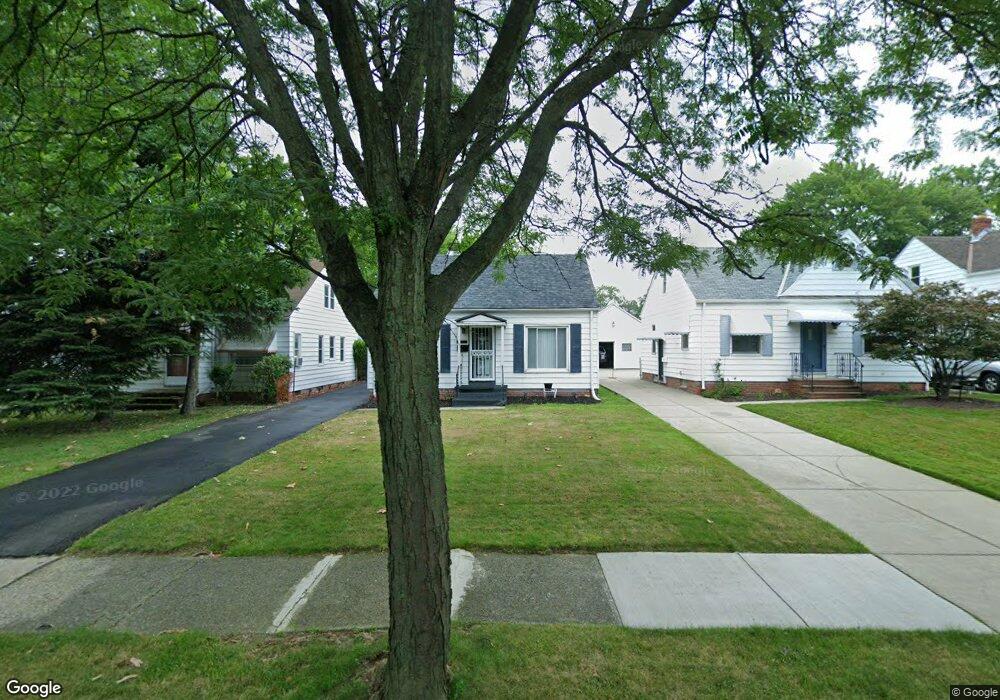

20811 Raymond St Maple Heights, OH 44137

Estimated Value: $94,000 - $112,000

3

Beds

2

Baths

1,092

Sq Ft

$97/Sq Ft

Est. Value

About This Home

This home is located at 20811 Raymond St, Maple Heights, OH 44137 and is currently estimated at $105,555, approximately $96 per square foot. 20811 Raymond St is a home located in Cuyahoga County with nearby schools including Abraham Lincoln Elementary School, Rockside/ J.F. Kennedy School, and Italy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 4, 2023

Sold by

Eiland Raymond

Bought by

Calhoun Nicole A

Current Estimated Value

Purchase Details

Closed on

May 31, 1994

Sold by

Brooks Timothy M

Bought by

Eiland Raymond

Purchase Details

Closed on

Dec 21, 1990

Sold by

Nagy Ronald S

Bought by

Brooks Timothy M

Purchase Details

Closed on

Aug 20, 1985

Sold by

Vanover Geraldine

Bought by

Nagy Ronald S

Purchase Details

Closed on

Mar 30, 1979

Sold by

Vanover Geraldine

Bought by

Vanover Geraldine

Purchase Details

Closed on

Nov 13, 1978

Sold by

Lacy Frances

Bought by

Vanover Geraldine

Purchase Details

Closed on

Jan 1, 1975

Bought by

Lacy Frances

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Calhoun Nicole A | -- | None Listed On Document | |

| Eiland Raymond | $73,900 | -- | |

| Brooks Timothy M | $68,000 | -- | |

| Nagy Ronald S | $52,500 | -- | |

| Vanover Geraldine | $17,500 | -- | |

| Vanover Geraldine | $35,000 | -- | |

| Lacy Frances | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,910 | $31,815 | $6,965 | $24,850 |

| 2023 | $2,098 | $19,180 | $3,990 | $15,190 |

| 2022 | $2,091 | $19,180 | $3,990 | $15,190 |

| 2021 | $2,225 | $19,180 | $3,990 | $15,190 |

| 2020 | $1,909 | $14,530 | $3,010 | $11,520 |

| 2019 | $1,897 | $41,500 | $8,600 | $32,900 |

| 2018 | $1,781 | $14,530 | $3,010 | $11,520 |

| 2017 | $1,815 | $13,550 | $2,800 | $10,750 |

| 2016 | $1,756 | $13,550 | $2,800 | $10,750 |

| 2015 | $1,748 | $13,550 | $2,800 | $10,750 |

| 2014 | $1,748 | $14,880 | $3,080 | $11,800 |

Source: Public Records

Map

Nearby Homes

- 20814 Watson Rd

- 20907 Watson Rd

- 20715 Watson Rd

- 21102 Raymond St

- 21207 Franklin Rd

- 20120 Mccracken Rd

- 20814 Kenyon Dr

- 20701 Kenyon Dr

- 20510 Mountville Dr

- 21416 Gardenview Dr

- 20107 Libby Rd

- 19807 Gardenview Dr

- 19806 Mountville Dr

- 19520 Maple Heights Blvd

- 19812 Stockton Ave

- 19309 Nitra Ave

- 5165 Camden Rd

- 19289 Stafford Ave

- 5285 Mardale Ave

- 5301 Mardale Ave

- 20815 Raymond St

- 20807 Raymond St

- 20819 Raymond St

- 20803 Raymond St

- 20719 Raymond St

- 20810 Watson Rd

- 20903 Raymond St

- 20806 Watson Rd

- 20818 Watson Rd

- 20802 Watson Rd

- 20715 Raymond St

- 20902 Watson Rd

- 20718 Watson Rd

- 20810 Raymond St

- 20806 Raymond St

- 20814 Raymond St

- 20909 Raymond St

- 20802 Raymond St

- 20711 Raymond St

- 20906 Watson Rd