21 Fox Run Wilton, CT 06897

Estimated Value: $1,192,000 - $1,421,000

4

Beds

3

Baths

3,628

Sq Ft

$368/Sq Ft

Est. Value

About This Home

This home is located at 21 Fox Run, Wilton, CT 06897 and is currently estimated at $1,334,308, approximately $367 per square foot. 21 Fox Run is a home located in Fairfield County with nearby schools including Miller-Driscoll School, Cider Mill School, and Middlebrook School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 23, 2025

Sold by

Felip Ryan W and Felip Jennifer A

Bought by

Early Jeffrey H and Hirsch-Early Emma K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$850,000

Outstanding Balance

$846,227

Interest Rate

6.65%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$488,081

Purchase Details

Closed on

Sep 29, 2011

Sold by

Munrow Roseann and Munroe Jeffrey

Bought by

Felipe Ryan W and Felipe Jennifer A

Purchase Details

Closed on

May 1, 2006

Sold by

Canning Mary E

Bought by

Munrow Roseann and Munrow Jeffrey

Purchase Details

Closed on

Jun 23, 1999

Sold by

Thomas Clifton and Thomas Vicki

Bought by

Canning Paul and Canning Mary

Purchase Details

Closed on

Aug 31, 1998

Sold by

Perlman Edward and Ross Bari

Bought by

Thomas Clifton and Thomas Vicki

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Early Jeffrey H | $1,350,000 | None Available | |

| Early Jeffrey H | $1,350,000 | None Available | |

| Felipe Ryan W | $824,500 | -- | |

| Felipe Ryan W | $824,500 | -- | |

| Munrow Roseann | $940,000 | -- | |

| Munrow Roseann | $940,000 | -- | |

| Canning Paul | $636,000 | -- | |

| Canning Paul | $636,000 | -- | |

| Thomas Clifton | $500,000 | -- | |

| Thomas Clifton | $500,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Early Jeffrey H | $850,000 | |

| Closed | Early Jeffrey H | $850,000 | |

| Previous Owner | Thomas Clifton | $37,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $17,154 | $702,730 | $344,680 | $358,050 |

| 2024 | $16,823 | $702,730 | $344,680 | $358,050 |

| 2023 | $15,773 | $539,070 | $329,560 | $209,510 |

| 2022 | $15,218 | $539,070 | $329,560 | $209,510 |

| 2021 | $15,024 | $539,070 | $329,560 | $209,510 |

| 2020 | $14,803 | $539,070 | $329,560 | $209,510 |

| 2019 | $15,385 | $539,070 | $329,560 | $209,510 |

| 2018 | $15,386 | $545,790 | $346,640 | $199,150 |

| 2017 | $15,157 | $545,790 | $346,640 | $199,150 |

| 2016 | $14,922 | $545,790 | $346,640 | $199,150 |

| 2015 | $14,644 | $545,790 | $346,640 | $199,150 |

| 2014 | $14,469 | $545,790 | $346,640 | $199,150 |

Source: Public Records

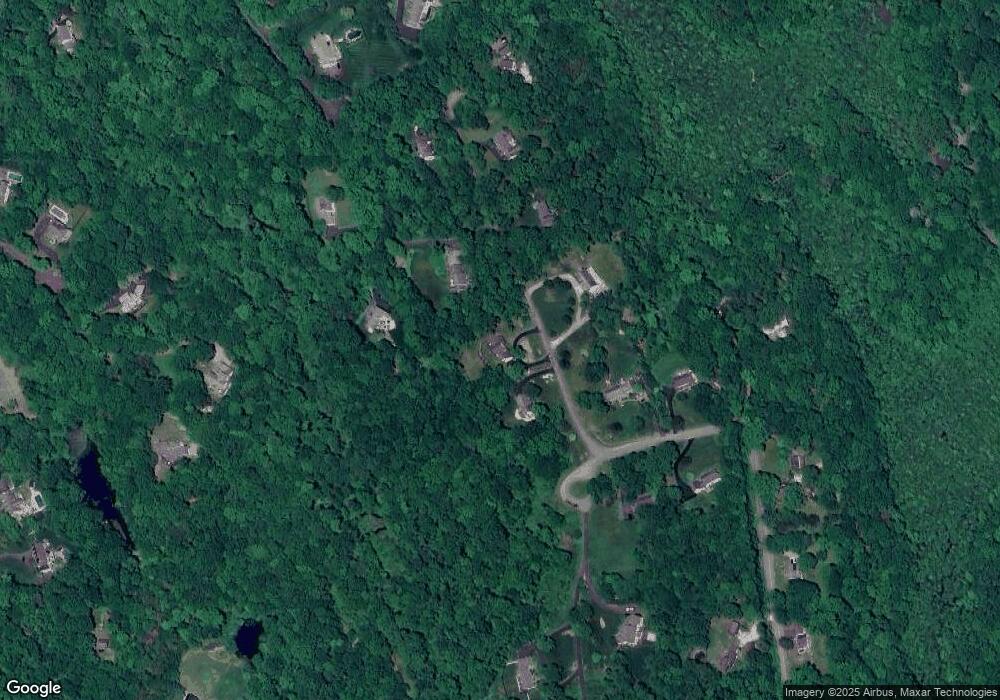

Map

Nearby Homes

- 6 Morganti Ct

- 51 Deer Run Rd

- 87 Silver Hill Rd

- Lot 6 Cattle Pen Ln

- 160 Wilton Rd W

- 164 Wilton Rd W

- 14 Tanners Dr

- 134 Nod Rd

- 78 Ruscoe Rd

- 55 Tanners Dr

- 30 Rising Ridge Rd

- 131 Indian Hill Rd

- 25 Eustis Ln

- 274 Nod Rd

- 17 Tall Oaks Rd

- 78 Pin Oak Ln

- 94 Soundview Rd

- 23 Olmstead Ln

- 174 Branchville Rd

- 84 Olmstead Ln

Your Personal Tour Guide

Ask me questions while you tour the home.