Estimated Value: $270,580 - $327,000

3

Beds

2

Baths

1,494

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 210 Isabella Way, Jesup, GA 31546 and is currently estimated at $305,895, approximately $204 per square foot. 210 Isabella Way is a home located in Wayne County with nearby schools including Jesup Elementary School, Arthur Williams Middle School, and Wayne County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 10, 2024

Sold by

Gray Nicole

Bought by

Settles Glynis

Current Estimated Value

Purchase Details

Closed on

Nov 14, 2013

Sold by

Johns James L

Bought by

Landon Nicole S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,000

Interest Rate

4.31%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 30, 2011

Sold by

Prime South Bank

Bought by

Johns James L and Johns Rhonda C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,257

Interest Rate

4.26%

Mortgage Type

VA

Purchase Details

Closed on

May 3, 2011

Sold by

Thompson Norman Alan

Bought by

Primesouth Bank

Purchase Details

Closed on

Mar 18, 2007

Sold by

Mobley Ada Suzanne

Bought by

Thompson Norman Al

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Settles Glynis | $285,000 | -- | |

| Landon Nicole S | $143,000 | -- | |

| Johns James L | $129,000 | -- | |

| Primesouth Bank | -- | -- | |

| Thompson Norman Al | $185,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Landon Nicole S | $74,000 | |

| Previous Owner | Johns James L | $133,257 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,316 | $108,414 | $16,080 | $92,334 |

| 2023 | $2,435 | $82,947 | $10,000 | $72,947 |

| 2022 | $2,360 | $74,964 | $10,000 | $64,964 |

| 2021 | $2,259 | $66,981 | $10,000 | $56,981 |

| 2020 | $2,337 | $66,981 | $10,000 | $56,981 |

| 2019 | $2,128 | $59,234 | $10,000 | $49,234 |

| 2018 | $2,128 | $59,234 | $10,000 | $49,234 |

| 2017 | $1,832 | $59,234 | $10,000 | $49,234 |

| 2016 | $1,772 | $59,234 | $10,000 | $49,234 |

| 2014 | $1,716 | $59,234 | $10,000 | $49,234 |

| 2013 | -- | $59,233 | $10,000 | $49,233 |

Source: Public Records

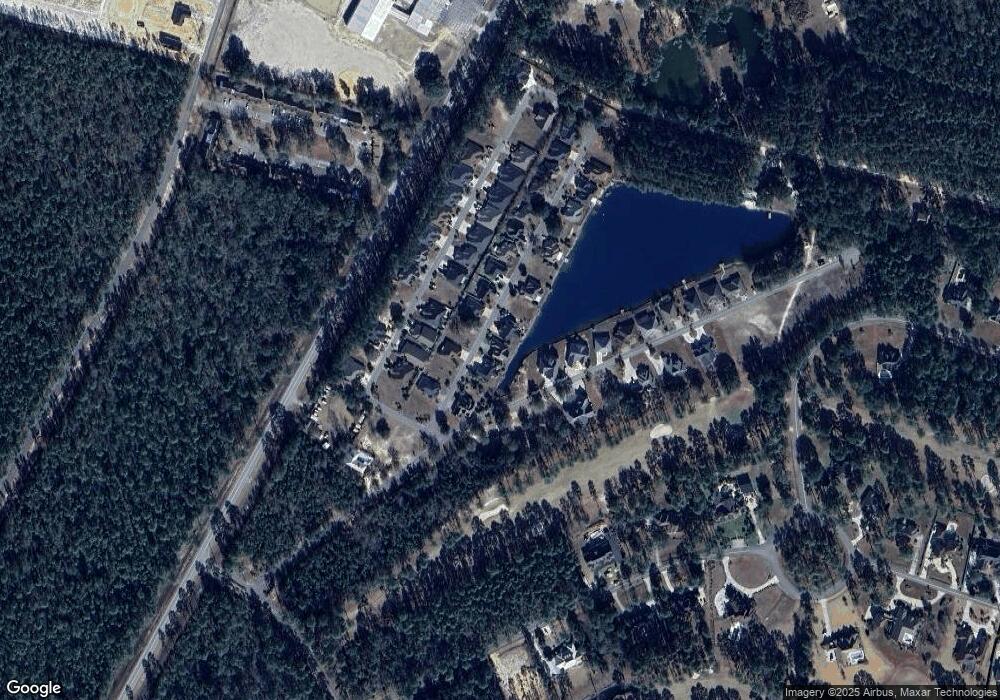

Map

Nearby Homes

- 353 Chase Dr

- 156 Hannah Dr

- 0 U S 301

- 1816 S Palm St

- 1812 S Palm St

- 22 Birdie Dr

- 13 N Eagle Dr

- 210 Purser Dr

- 12 Par Dr

- 49 Pine Forest Dr

- 0 S Palm St Unit 10609054

- 0 S Palm St Unit 1656795

- 50 Ac Hwy 301

- 2903 S Us Hwy 301

- 1300 S Palm St

- 158 N Deborah Cir

- 1101 S Palm St

- 113 Vixenhill Dr

- 112 Vixenhill Dr

- 985 Seven Oaks Rd