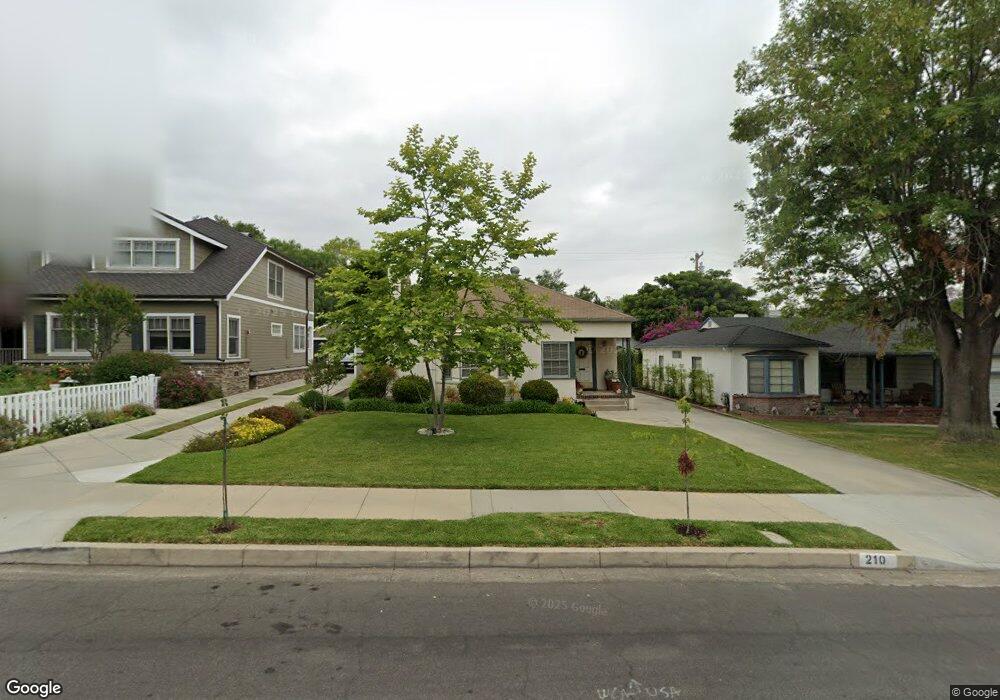

210 Stedman Place Monrovia, CA 91016

Estimated Value: $1,095,023 - $1,263,000

3

Beds

2

Baths

1,564

Sq Ft

$769/Sq Ft

Est. Value

About This Home

This home is located at 210 Stedman Place, Monrovia, CA 91016 and is currently estimated at $1,203,006, approximately $769 per square foot. 210 Stedman Place is a home located in Los Angeles County with nearby schools including Mayflower Elementary School, Clifton Middle School, and Monrovia High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 27, 2001

Sold by

Berger Davis Joseph

Bought by

Groves Damon and Groves Miesha

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,700

Outstanding Balance

$124,016

Interest Rate

7.17%

Estimated Equity

$1,078,990

Purchase Details

Closed on

Oct 12, 1998

Sold by

Cragoe Tim

Bought by

Berger Davis Joseph and Berger Davis Tracey A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$270,750

Interest Rate

6.69%

Purchase Details

Closed on

Feb 2, 1996

Sold by

Cragoe Tim

Bought by

Cragoe Tim and Cragoe Robin

Purchase Details

Closed on

Oct 18, 1993

Sold by

Cragoe Tim

Bought by

Cragoe Tim and Ellsworth Hald Separate Property Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

7.5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Groves Damon | $385,000 | Chicago Title Co | |

| Berger Davis Joseph | $285,000 | Equity Title Company | |

| Cragoe Tim | -- | -- | |

| Cragoe Tim | -- | Title Land Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Groves Damon | $300,700 | |

| Previous Owner | Berger Davis Joseph | $270,750 | |

| Previous Owner | Cragoe Tim | $120,000 | |

| Closed | Groves Damon | $65,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,677 | $568,741 | $333,713 | $235,028 |

| 2024 | $7,677 | $557,590 | $327,170 | $230,420 |

| 2023 | $7,501 | $546,657 | $320,755 | $225,902 |

| 2022 | $7,283 | $535,939 | $314,466 | $221,473 |

| 2021 | $7,138 | $525,431 | $308,300 | $217,131 |

| 2019 | $6,799 | $509,848 | $299,156 | $210,692 |

| 2018 | $6,598 | $499,852 | $293,291 | $206,561 |

| 2016 | $6,338 | $480,444 | $281,903 | $198,541 |

| 2015 | $6,199 | $473,228 | $277,669 | $195,559 |

| 2014 | $6,135 | $463,959 | $272,230 | $191,729 |

Source: Public Records

Map

Nearby Homes

- 347 Stedman Place

- 220 W Hillcrest Blvd

- 314 May Ave

- 235 E Foothill Blvd Unit B

- 116 N Canyon Blvd

- 375 N Canyon Blvd

- 411 Sierra Vista Ave

- 425 N Canyon Blvd

- 453 N Alta Vista Ave

- 277 Aspen Dr

- 430 N Canyon Blvd

- 208 Highland Place

- 550 W Foothill Blvd Unit C

- 516 Linwood Ave

- 135 N Shamrock Ave

- 327 E Lemon Ave

- 52 Hidden Valley Rd

- 711 Ocean View Ave

- 733 Crescent Dr

- 582 N Alta Vista Ave

- 206 Stedman Place

- 214 Stedman Place

- 184 Stedman Place

- 218 Stedman Place

- 209 N Myrtle Ave

- 180 Stedman Place

- 205 N Myrtle Ave

- 215 Stedman Place

- 215 N Myrtle Ave

- 201 Stedman Place

- 134 Oaks Ave

- 174 Stedman Place

- 228 Stedman Place

- 181 Stedman Place

- 175 N Myrtle Ave

- 138 Oaks Ave

- 227 N Myrtle Ave

- 232 Stedman Place

- 172 Stedman Place

- 177 Stedman Place