21013 Reserve Ct Unit D121 Cleveland, OH 44126

Estimated Value: $173,730 - $182,000

2

Beds

3

Baths

1,368

Sq Ft

$129/Sq Ft

Est. Value

About This Home

This home is located at 21013 Reserve Ct Unit D121, Cleveland, OH 44126 and is currently estimated at $175,933, approximately $128 per square foot. 21013 Reserve Ct Unit D121 is a home located in Cuyahoga County with nearby schools including Gilles-Sweet Elementary School, Lewis F Mayer Middle School, and Fairview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 15, 2016

Sold by

Varga Richard R and Gallagher Lucille C

Bought by

Branicky Beth A

Current Estimated Value

Purchase Details

Closed on

Aug 30, 2016

Sold by

Kay Valerie L

Bought by

Varga Richard R and Gallagher Lucille C

Purchase Details

Closed on

May 7, 2010

Sold by

Estes Ronald V and Estes Janice A

Bought by

Kay Valerie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,600

Interest Rate

5.05%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 6, 2005

Sold by

Estes Janice A and Nash Janice A

Bought by

Estes Ronald V and Estes Janice A

Purchase Details

Closed on

Jul 31, 1992

Sold by

Erzen Kathleen N

Bought by

Nash Janice A

Purchase Details

Closed on

Jul 24, 1984

Sold by

Zappone Alberta B

Bought by

Erzen Kathleen N

Purchase Details

Closed on

Mar 1, 1984

Sold by

Zappone James N

Bought by

Zappone Alberta B

Purchase Details

Closed on

Aug 27, 1979

Sold by

Bennett Donald E and F E

Bought by

Zappone James N

Purchase Details

Closed on

Jan 1, 1975

Bought by

Bennett Donald E and F E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Branicky Beth A | $81,000 | None Available | |

| Varga Richard R | $54,656 | Northstar Title Agency | |

| Kay Valerie L | $77,000 | Ohio Title & Escrow | |

| Estes Ronald V | -- | Public | |

| Nash Janice A | $85,000 | -- | |

| Erzen Kathleen N | $70,000 | -- | |

| Zappone Alberta B | -- | -- | |

| Zappone James N | $67,500 | -- | |

| Bennett Donald E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kay Valerie L | $61,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,676 | $51,450 | $5,145 | $46,305 |

| 2023 | $3,208 | $38,260 | $3,820 | $34,440 |

| 2022 | $3,129 | $38,260 | $3,820 | $34,440 |

| 2021 | $3,182 | $38,260 | $3,820 | $34,440 |

| 2020 | $2,705 | $28,350 | $2,840 | $25,520 |

| 2019 | $2,417 | $81,000 | $8,100 | $72,900 |

| 2018 | $2,341 | $28,350 | $2,840 | $25,520 |

| 2017 | $2,417 | $26,220 | $2,630 | $23,590 |

| 2016 | $2,346 | $26,220 | $2,630 | $23,590 |

| 2015 | $2,261 | $26,220 | $2,630 | $23,590 |

| 2014 | $2,715 | $30,840 | $3,080 | $27,760 |

Source: Public Records

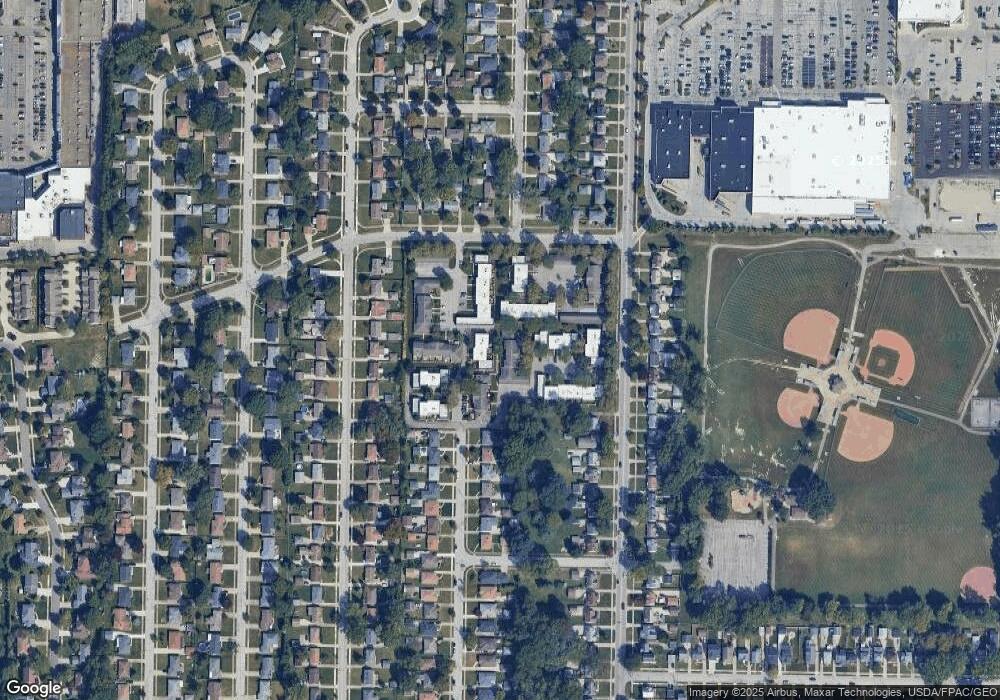

Map

Nearby Homes

- 3826 W 210th St

- 3712 Addington Ct

- 3959 W 210th St

- 20688 Belvidere Ave

- 3420 W 210th St

- 20778 Woodstock Ave

- 3340 W 210th St

- 21236 Northwood Ave

- 21872 Addington Blvd Unit 15

- 21143 Westwood Rd

- 2888 Pease Dr Unit 110

- 3733 River Ln

- 2885 Pease Dr Unit 106

- 21237 Westwood Rd

- 2829 Pease Dr Unit 412

- 4243 W 212th St

- 3167 Linden Rd Unit 503

- 3167 Linden Rd Unit 508

- 3167 Linden Rd Unit 103

- 3167 Linden Rd Unit 309

- 21001 Reserve Ct Unit D115

- 21003 Reserve Ct Unit D116

- 21007 Reserve Ct Unit D118

- 21017 Reserve Ct Unit D123

- 21009 Reserve Ct Unit D119

- 21015 Reserve Ct

- 21011 Reserve Ct

- 21005 Reserve Ct

- 21011 Reserve Ct Unit D120

- 3816 W 210th St

- 21018 Reserve Ct Unit F129

- 21016 Reserve Ct Unit F130

- 21014 Reserve Ct

- 21014 Reserve Ct Unit F131

- 21010 Reserve Ct

- 21002 Reserve Ct Unit E128

- 21004 Reserve Ct Unit E127

- 21006 Reserve Ct

- 21008 Reserve Ct

- 21010 Reserve Ct Unit E124