2106 Green Watch Way Unit 11/301 Reston, VA 20191

Estimated Value: $401,000

2

Beds

2

Baths

1,170

Sq Ft

$343/Sq Ft

Est. Value

About This Home

This home is located at 2106 Green Watch Way Unit 11/301, Reston, VA 20191 and is currently estimated at $401,000, approximately $342 per square foot. 2106 Green Watch Way Unit 11/301 is a home located in Fairfax County with nearby schools including Terraset Elementary, South Lakes High School, and Sunset Hills Montessori School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 25, 2021

Sold by

Ratta Gregory

Bought by

Chang Grace Lee and Chang Paul Wonki

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,000

Outstanding Balance

$187,157

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$210,843

Purchase Details

Closed on

May 19, 2014

Sold by

Riley Amamda L

Bought by

Ratta Gregory

Purchase Details

Closed on

Mar 1, 2010

Sold by

Viatle Paulette

Bought by

Riley Amanda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Interest Rate

5.11%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 26, 2002

Sold by

Doyle Judith

Bought by

Kloepfer Paulette

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,400

Interest Rate

6.16%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chang Grace Lee | $315,000 | Ekko Title | |

| Ratta Gregory | $272,500 | -- | |

| Riley Amanda L | $235,000 | -- | |

| Kloepfer Paulette | $158,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chang Grace Lee | $252,000 | |

| Previous Owner | Riley Amanda L | $188,000 | |

| Previous Owner | Kloepfer Paulette | $126,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,558 | $381,880 | $76,000 | $305,880 |

| 2024 | $4,558 | $378,100 | $76,000 | $302,100 |

| 2023 | $3,933 | $334,600 | $67,000 | $267,600 |

| 2022 | $3,830 | $321,730 | $64,000 | $257,730 |

| 2021 | $3,636 | $297,900 | $60,000 | $237,900 |

| 2020 | $3,394 | $275,830 | $55,000 | $220,830 |

| 2019 | $3,143 | $255,400 | $48,000 | $207,400 |

| 2018 | $2,745 | $238,690 | $48,000 | $190,690 |

| 2017 | $2,973 | $246,070 | $49,000 | $197,070 |

| 2016 | $3,064 | $254,160 | $51,000 | $203,160 |

| 2015 | $2,956 | $254,160 | $51,000 | $203,160 |

| 2014 | $3,108 | $267,850 | $54,000 | $213,850 |

Source: Public Records

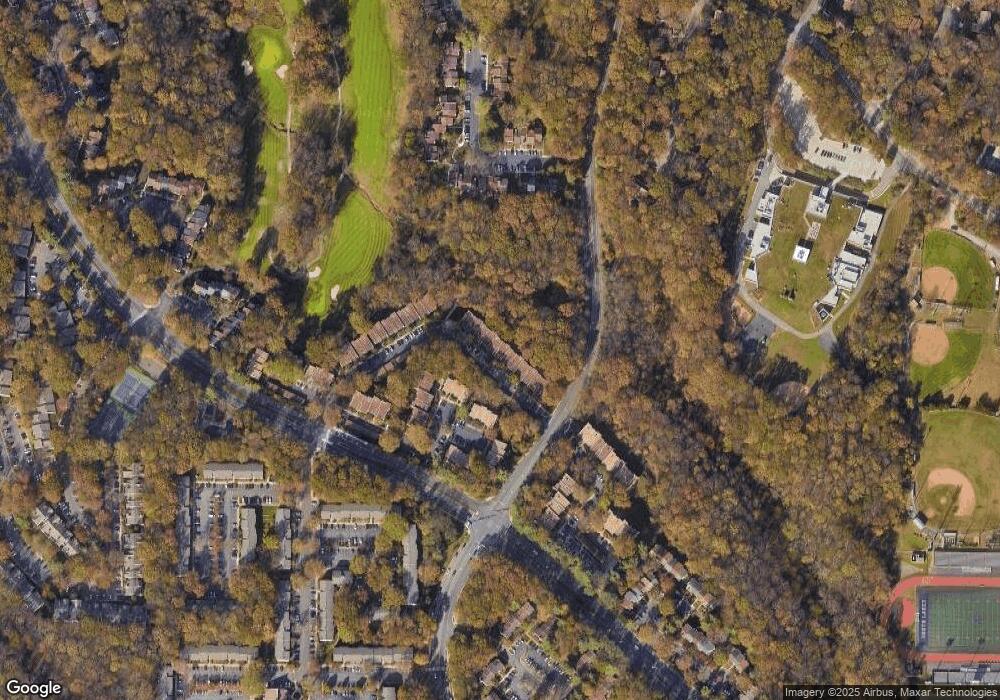

Map

Nearby Homes

- 11604 Ivystone Ct Unit 6

- 2118 Green Watch Way Unit 10/201C

- 2233 Lovedale Ln Unit I

- 11657 Stoneview Square Unit 97/22C

- 11659 Stoneview Square Unit 99/1B

- 11735 Ledura Ct Unit 201

- 11721 Karbon Hill Ct Unit T2

- 11709 Karbon Hill Ct Unit 606A

- 2045 Winged Foot Ct

- 2025 Winged Foot Ct

- 11751 Mossy Creek Ln

- 11817 Coopers Ct

- 2300 Horseferry Ct

- 2369 Old Trail Dr

- 11879 Barrel Cooper Ct

- 2142 Cartwright Place

- 11186 Silentwood Ln

- 11184 Silentwood Ln

- 11200 Silentwood Ln

- 2369 Generation Dr

- 2106 Green Watch Way Unit 200

- 2106 Green Watch Way Unit C

- 2106 Green Watch Way Unit 300

- 2106 Green Watch Way Unit 11/200

- 2106 Green Watch Way Unit 301

- 2106 Green Watch Way Unit 11/201

- 2108 Green Watch Way Unit 201

- 2108 Green Watch Way Unit 200

- 2108 Green Watch Way Unit 11/100B

- 2108 Green Watch Way Unit 101

- 2108 Green Watch Way Unit 105

- 2108 Green Watch Way Unit 100

- 2108 Green Watch Way Unit 11/200

- 2108 Green Watch Way Unit 301

- 2104 Green Watch Way Unit 11/101

- 2104 Green Watch Way Unit 301

- 2104 Green Watch Way Unit 101

- 2104 Green Watch Way Unit 11/201

- 2110 Green Watch Way Unit 100

- 2110 Green Watch Way Unit 201