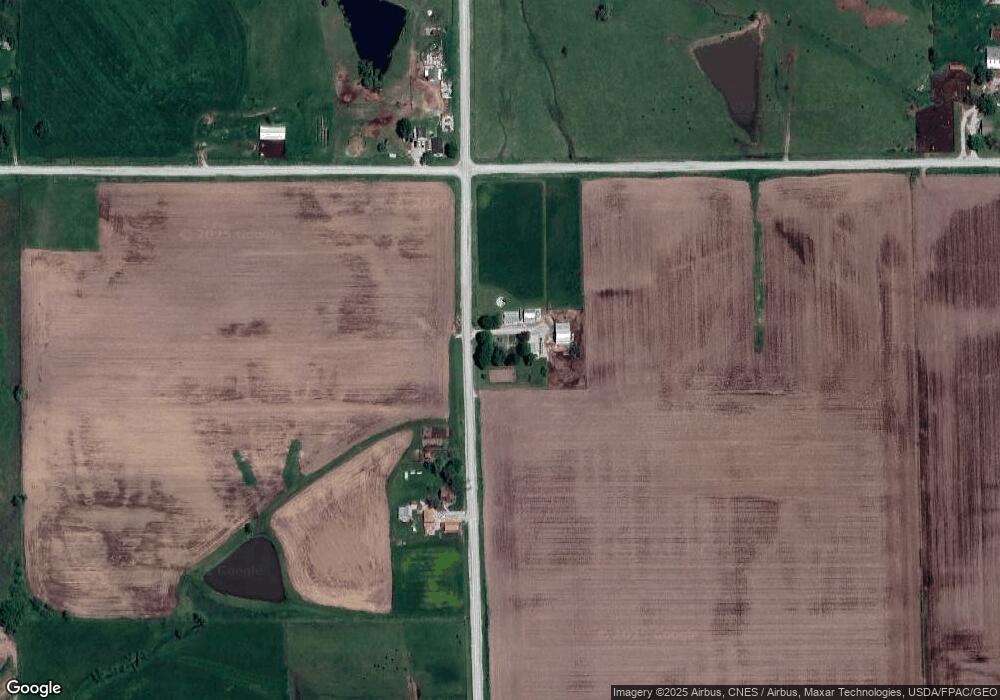

21074 163rd Ave Sigourney, IA 52591

Estimated Value: $160,000 - $262,337

--

Bed

--

Bath

2,008

Sq Ft

$106/Sq Ft

Est. Value

About This Home

This home is located at 21074 163rd Ave, Sigourney, IA 52591 and is currently estimated at $212,334, approximately $105 per square foot. 21074 163rd Ave is a home located in Keokuk County with nearby schools including Sigourney Elementary School and Sigourney Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 4, 2015

Sold by

Shipley Justin J and Shipley Jennier L

Bought by

Clubb Benjamin P and Van Otegham Jessica L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,160

Outstanding Balance

$59,937

Interest Rate

4.87%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$152,397

Purchase Details

Closed on

Dec 13, 2011

Sold by

Appleget Clarence A and Appleget Rosemary E

Bought by

Shipley Justin J and Shipley Jennifer E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,000

Interest Rate

5.75%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clubb Benjamin P | $92,700 | None Available | |

| Shipley Justin J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Clubb Benjamin P | $74,160 | |

| Previous Owner | Shipley Justin J | $54,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,964 | $201,500 | $31,630 | $169,870 |

| 2024 | $1,964 | $173,660 | $26,750 | $146,910 |

| 2023 | $1,512 | $173,660 | $26,750 | $146,910 |

| 2022 | $1,588 | $117,690 | $26,750 | $90,940 |

| 2021 | $1,588 | $122,640 | $26,750 | $95,890 |

| 2020 | $1,478 | $111,750 | $22,750 | $89,000 |

| 2019 | $1,322 | $111,750 | $0 | $0 |

| 2018 | $1,264 | $95,910 | $0 | $0 |

| 2017 | $1,264 | $92,350 | $0 | $0 |

| 2016 | $1,298 | $92,690 | $0 | $0 |

| 2015 | $1,298 | $92,690 | $0 | $0 |

| 2014 | $1,340 | $92,690 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 20177 173rd Ave

- 19980 173rd Ave

- 19773 Iowa 21

- TBD Iowa 21

- 18542 173rd Ave

- 502 W 3rd St

- 19773 Highway 21

- Tbd Highway 21

- 1007 W Spring St

- 321 Keller St

- 603 W Pleasant Valley St

- 202 N West St

- 309 W Walnut St

- 220 W Washington St

- 105 1/2 W Washington St

- 314 N Jefferson St

- 118 W Hickory St

- 415 S Main St

- 215 E Elm St

- 315 E Jackson St