211 Whieldon Ln Unit 15 Worthington, OH 43085

Olentangy Highlands NeighborhoodEstimated Value: $395,304 - $614,000

3

Beds

2

Baths

1,725

Sq Ft

$282/Sq Ft

Est. Value

About This Home

This home is located at 211 Whieldon Ln Unit 15, Worthington, OH 43085 and is currently estimated at $486,826, approximately $282 per square foot. 211 Whieldon Ln Unit 15 is a home located in Franklin County with nearby schools including Evening Street Elementary School, Kilbourne Middle School, and Thomas Worthington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 5, 2010

Sold by

Knox David and Knox Barbara D

Bought by

Popa Nicholas L and Popa Sally M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Outstanding Balance

$150,138

Interest Rate

5.05%

Mortgage Type

New Conventional

Estimated Equity

$336,688

Purchase Details

Closed on

Nov 19, 2004

Sold by

Knox David and Knox Barbara D

Bought by

Knox David and Knox Barbara D

Purchase Details

Closed on

Jan 15, 2003

Sold by

Wasem Susan and Coate Charles R

Bought by

Knox David and Knox Barbara D

Purchase Details

Closed on

Aug 14, 2000

Sold by

Estate Of Benjamin D Coate

Bought by

Coate Virginia

Purchase Details

Closed on

Jul 21, 1983

Bought by

Coate Benjamin D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Popa Nicholas L | $280,000 | Attorney | |

| Knox David | -- | -- | |

| Knox David | $242,900 | Midland Celtic Title | |

| Coate Virginia | -- | -- | |

| Coate Benjamin D | $150,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Popa Nicholas L | $224,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,778 | $138,320 | $22,050 | $116,270 |

| 2023 | $8,406 | $138,320 | $22,050 | $116,270 |

| 2022 | $7,529 | $98,990 | $18,380 | $80,610 |

| 2021 | $6,962 | $98,990 | $18,380 | $80,610 |

| 2020 | $6,713 | $98,990 | $18,380 | $80,610 |

| 2019 | $7,417 | $98,990 | $18,380 | $80,610 |

| 2018 | $6,997 | $98,990 | $18,380 | $80,610 |

| 2017 | $6,735 | $98,990 | $18,380 | $80,610 |

| 2016 | $6,802 | $93,100 | $15,750 | $77,350 |

| 2015 | $6,803 | $93,100 | $15,750 | $77,350 |

| 2014 | $6,801 | $93,100 | $15,750 | $77,350 |

| 2013 | $3,384 | $93,100 | $15,750 | $77,350 |

Source: Public Records

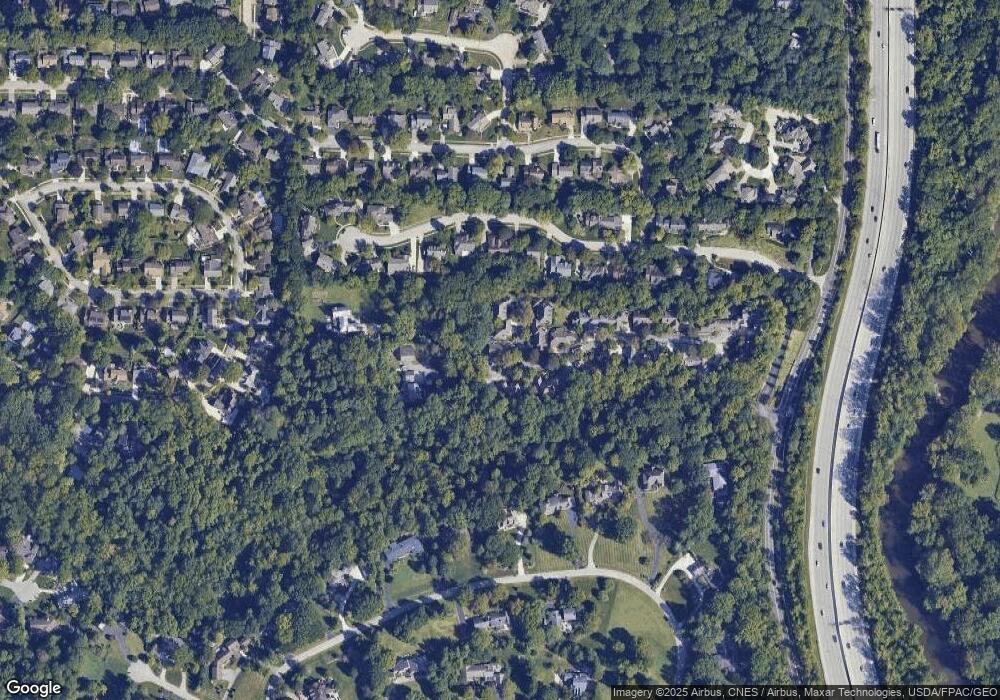

Map

Nearby Homes

- 784 Pinecliff Place

- 1037 Ravine Ridge Dr

- 1118 Ravine Ridge Dr

- 6105 Flora Villa Dr

- 6908 Perry Dr

- 1307 Lakeside Ct

- 1041 Rosebank Dr

- 6550 Winston Ct E

- 7164 Durness Place

- 5881 Rocky Rill Rd

- 1380 Tiehack Ct

- 301 W Riverglen Dr

- 2687 Snouffer Rd

- 5938 Aqua Bay Dr

- 5936 Aqua Bay Dr

- 123 W South St

- 7522 Acela St

- 210 Saint Antoine St Unit 25D

- 1101 Bluffway Dr

- 5854 Aqua Bay Dr Unit 5854

- 221 Marlow Dr

- 221 Marlow Dr Unit 16

- 201 Whieldon Ln Unit 14

- 190 Marlow Dr

- 190 Marlow Dr Unit 21

- 231 Marlow Dr

- 231 Marlow Dr Unit 17

- 241 Marlow Dr

- 200 Marlow Dr

- 191 Whieldon Ln

- 210 Marlow Dr

- 210 Marlow Dr Unit 19

- 181 Whieldon Ln Unit 12

- 180 Whieldon Ln

- 180 Whieldon Ln Unit 22

- 171 Whieldon Ln Unit 11

- 170 Whieldon Ln Unit 23

- 873 Robbins Way

- 861 Robbins Way

- 6561 Olentangy River Rd