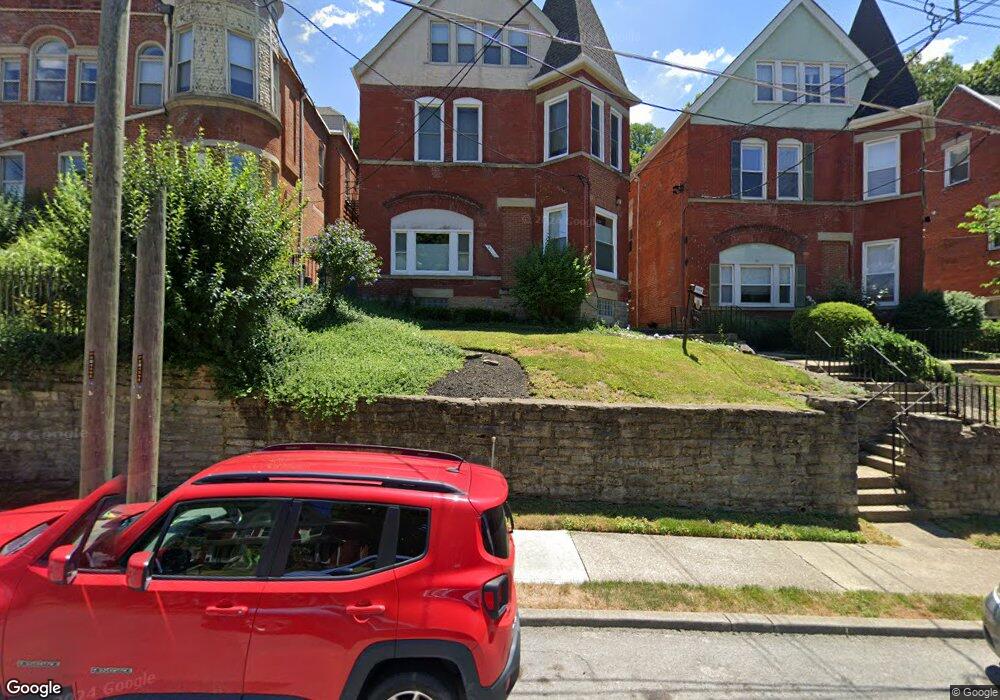

2110 Fulton Ave Unit 2 Cincinnati, OH 45206

Walnut Hills NeighborhoodEstimated Value: $121,000 - $157,000

1

Bed

1

Bath

520

Sq Ft

$277/Sq Ft

Est. Value

About This Home

This home is located at 2110 Fulton Ave Unit 2, Cincinnati, OH 45206 and is currently estimated at $144,269, approximately $277 per square foot. 2110 Fulton Ave Unit 2 is a home located in Hamilton County with nearby schools including Frederick Douglass Elementary School, Robert A. Taft Information Technology High School, and Clark Montessori High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2024

Sold by

2110-2 Fulton Land Trust and Shell Anera

Bought by

Kindl Gabriel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,500

Outstanding Balance

$135,539

Interest Rate

6.79%

Mortgage Type

New Conventional

Estimated Equity

$8,730

Purchase Details

Closed on

Jan 31, 2022

Sold by

Brown and Patricia

Bought by

2110-2 Fulton Land Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$43,000

Interest Rate

3.55%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jun 21, 2004

Sold by

Lm Real Estate Investments Llc

Bought by

Brown Michael and Brown Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,000

Interest Rate

1.95%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kindl Gabriel | $147,500 | None Listed On Document | |

| 2110-2 Fulton Land Trust | $100,000 | Fingerman Debra M | |

| Brown Michael | $90,000 | Custom Land Title Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kindl Gabriel | $137,500 | |

| Previous Owner | 2110-2 Fulton Land Trust | $43,000 | |

| Previous Owner | Brown Michael | $72,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,214 | $35,000 | $7,140 | $27,860 |

| 2023 | $2,218 | $35,000 | $7,140 | $27,860 |

| 2022 | $1,814 | $26,677 | $7,140 | $19,537 |

| 2021 | $1,747 | $26,677 | $7,140 | $19,537 |

| 2020 | $1,798 | $26,677 | $7,140 | $19,537 |

| 2019 | $1,927 | $26,156 | $7,000 | $19,156 |

| 2018 | $1,928 | $26,156 | $7,000 | $19,156 |

| 2017 | $1,832 | $26,156 | $7,000 | $19,156 |

| 2016 | $1,874 | $26,390 | $7,000 | $19,390 |

| 2015 | $1,689 | $26,390 | $7,000 | $19,390 |

| 2014 | $701 | $26,390 | $7,000 | $19,390 |

| 2013 | $714 | $26,390 | $7,000 | $19,390 |

Source: Public Records

Map

Nearby Homes

- 2110 Fulton Ave

- 2110 Fulton Ave Unit 5

- 2114 Fulton Ave

- 2100 Fulton Ave

- 2100 Sinton Ave

- 964 Auburnview Dr

- 964 Auburnview Dr Unit 3E

- 2121 Alpine Place

- 2232 Fulton Ave

- 2226 Kenton St

- 967 Windsor St

- 965 Windsor St

- 2106 Kemper Ln

- 2228 Kemper Ln

- 2230 Kemper Ln

- 2191 Victory Pkwy

- 2195 Victory Pkwy

- 2356 Concord St

- 2199 Victory Pkwy

- 2358 Concord St

- 2110 Fulton Ave Unit D5

- 2110 Fulton Ave Unit D3

- 2110 Fulton Ave Unit D1

- 2110 Fulton Ave Unit D4

- 2110 Fulton Ave Unit D2

- 2110 Fulton Ave Unit 1

- 2110 Fulton Ave Unit 3

- 2110 Fulton Ave Unit 4

- 2112 Fulton Ave Unit E2

- 2112 Fulton Ave Unit E3

- 2112 Fulton Ave Unit E1

- 2112 Fulton Ave Unit E4

- 2112 Fulton Ave

- 2112 Fulton Ave Unit 4

- 2112 Fulton Ave Unit 2

- 2112 Fulton Ave Unit 3

- 2104 Fulton Ave Unit B5

- 2100 Fulton Ave Unit A4

- 2114 Fulton Ave Unit F3

- 2100 Fulton Ave Unit A6