2113 Fall Trail Ct Placerville, CA 95667

Estimated Value: $683,000 - $807,000

4

Beds

3

Baths

2,749

Sq Ft

$270/Sq Ft

Est. Value

About This Home

This home is located at 2113 Fall Trail Ct, Placerville, CA 95667 and is currently estimated at $743,129, approximately $270 per square foot. 2113 Fall Trail Ct is a home located in El Dorado County with nearby schools including El Dorado High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2008

Sold by

Crowley Investments

Bought by

Vankampen Russell J and Vankampen Van Kampen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$167,734

Interest Rate

6.07%

Mortgage Type

Unknown

Estimated Equity

$575,395

Purchase Details

Closed on

Apr 9, 2008

Sold by

Ortiz David and Lopez Rocio Del Pilar

Bought by

Crowley Investments

Purchase Details

Closed on

Jul 7, 2006

Sold by

Ortiz Carmen

Bought by

Ortiz David

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$494,400

Interest Rate

7.17%

Mortgage Type

Balloon

Purchase Details

Closed on

Jun 27, 2006

Sold by

Escobar John R

Bought by

Ortiz David and Lopez Rocio Del Pilar

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$494,400

Interest Rate

7.17%

Mortgage Type

Balloon

Purchase Details

Closed on

Jun 28, 2004

Sold by

Escobar Tara

Bought by

Escobar John R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$333,700

Interest Rate

6.27%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Jun 8, 2004

Sold by

Wilkinson Kenneth L

Bought by

Kfrd Investment Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$333,700

Interest Rate

6.27%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Mar 26, 2002

Sold by

Keller Edward E and Keller Mildred B

Bought by

Wilkinson Kenneth L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,000

Interest Rate

6.84%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jul 23, 2001

Sold by

Keller Edward E and Keller Mildred B

Bought by

Keller Edward E and Keller Mildred B

Purchase Details

Closed on

Jun 27, 2001

Sold by

Keller Edward E and Keller Mildred B

Bought by

Keller Edward E and Keller Mildred B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vankampen Russell J | $440,000 | Placer Title Company | |

| Crowley Investments | $371,086 | Placer Title Co | |

| Ortiz David | -- | Financial Title Company | |

| Ortiz David | $618,000 | Financial Title Company | |

| Escobar John R | -- | Inter County Title Co | |

| Escobar John R | $536,500 | Inter County Title Co | |

| Kfrd Investment Inc | -- | -- | |

| Wilkinson Kenneth L | $65,000 | Inter County Title Co | |

| Keller Edward E | -- | -- | |

| Keller Edward E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vankampen Russell J | $260,000 | |

| Previous Owner | Ortiz David | $494,400 | |

| Previous Owner | Escobar John R | $333,700 | |

| Previous Owner | Wilkinson Kenneth L | $52,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,795 | $566,591 | $141,643 | $424,948 |

| 2024 | $5,795 | $555,482 | $138,866 | $416,616 |

| 2023 | $5,726 | $544,592 | $136,144 | $408,448 |

| 2022 | $5,644 | $533,915 | $133,475 | $400,440 |

| 2021 | $5,578 | $523,447 | $130,858 | $392,589 |

| 2020 | $5,494 | $518,081 | $129,517 | $388,564 |

| 2019 | $5,426 | $507,924 | $126,978 | $380,946 |

| 2018 | $5,260 | $497,966 | $124,489 | $373,477 |

| 2017 | $5,181 | $488,203 | $122,049 | $366,154 |

| 2016 | $5,100 | $478,631 | $119,656 | $358,975 |

| 2015 | $4,953 | $471,443 | $117,859 | $353,584 |

| 2014 | $3,153 | $300,100 | $66,500 | $233,600 |

Source: Public Records

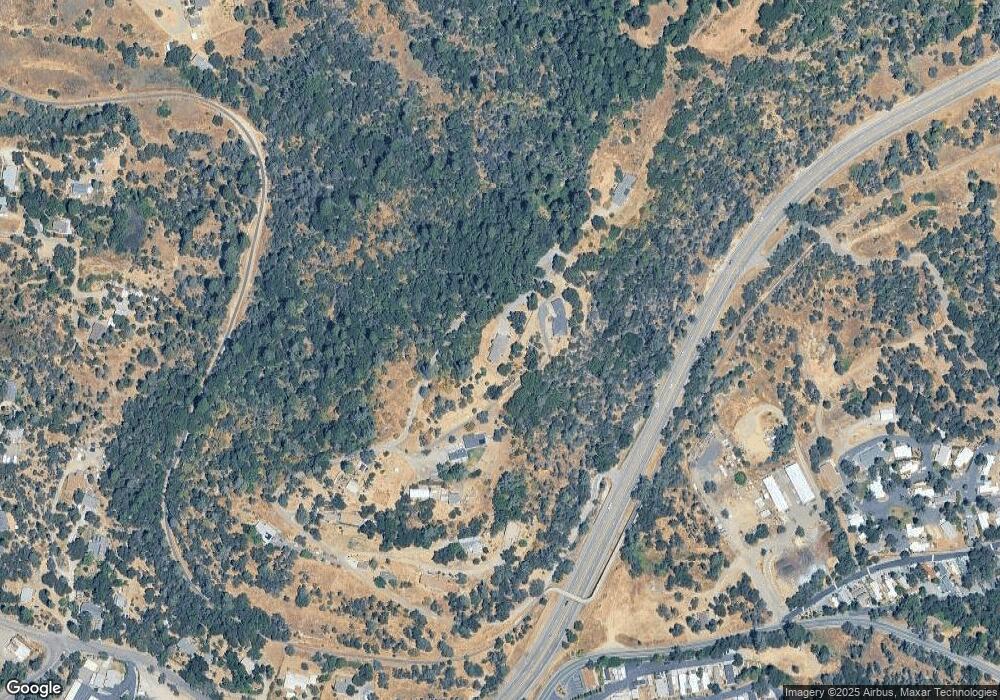

Map

Nearby Homes

- 3020 Newtown Rd Unit C

- 3020 Newtown Rd Unit 31

- 2500 Highway 50

- 2360 Union Ridge Rd

- 2970 Texas Hill Rd

- 3353 Airport Rd

- 2990 Sippy Ln

- 2984 Sippy Ln Unit A

- 1812 Mary Ct

- 1720 Jacobs Way

- 3300 Hassler Rd

- 1764 Country Club Dr

- 2399 Kingsgate Rd

- 3930 Cedar Ravine Rd

- 3128 Verde Robles Dr

- 1540 Barrett Dr

- 3087 Camino Ct

- 2700 Dancing Oaks Rd

- 1531 Jeffrey Ln

- 1436 Cypress Ln

- 2109 Fall Trail Ct

- 2120 Fall Trail Ct

- 2235 Fall Trail Ct

- 2141 Fall Trail Ct

- 2105 Fall Trail Ct

- 2221 Fall Trail Ct

- 2201 Fall Trail Ct

- 2200 Fall Trail Ct

- 2199 Fall Trail Ct

- 2199 Fall Trail Rd

- 2180 Fall Trail Ct

- 3079 Newtown Rd

- 3073 Newtown Rd

- 3051 Newtown Rd

- 3030 Newtown Rd

- 2161 Smith Flat Rd

- 2861 Smith Flat School Rd

- 2145 Smith Flat Rd

- 2791 Smith Flat School Rd

- 2133 Smith Flat Rd