2118 Adams St Rolling Meadows, IL 60008

Plum Grove Village NeighborhoodEstimated Value: $486,000 - $540,000

4

Beds

3

Baths

2,132

Sq Ft

$241/Sq Ft

Est. Value

About This Home

This home is located at 2118 Adams St, Rolling Meadows, IL 60008 and is currently estimated at $514,234, approximately $241 per square foot. 2118 Adams St is a home located in Cook County with nearby schools including Central Road Elementary School, Galatia Junior High School, and William Fremd High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 14, 2003

Sold by

Miller James J and Miller Violet C

Bought by

Grinshteyn Boris

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,000

Outstanding Balance

$109,718

Interest Rate

5.96%

Mortgage Type

Stand Alone First

Estimated Equity

$404,516

Purchase Details

Closed on

Apr 15, 1997

Sold by

Newsom Larry J

Bought by

Miller James J and Miller Violet C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,850

Interest Rate

7.92%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grinshteyn Boris | $320,000 | Burnet Title Llc | |

| Miller James J | $200,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Grinshteyn Boris | $256,000 | |

| Previous Owner | Miller James J | $192,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,634 | $37,001 | $7,270 | $29,731 |

| 2023 | $10,207 | $37,001 | $7,270 | $29,731 |

| 2022 | $10,207 | $37,001 | $7,270 | $29,731 |

| 2021 | $10,435 | $33,855 | $3,634 | $30,221 |

| 2020 | $10,346 | $33,855 | $3,634 | $30,221 |

| 2019 | $10,325 | $37,575 | $3,634 | $33,941 |

| 2018 | $10,206 | $33,918 | $3,375 | $30,543 |

| 2017 | $10,016 | $33,918 | $3,375 | $30,543 |

| 2016 | $9,591 | $33,918 | $3,375 | $30,543 |

| 2015 | $9,440 | $31,555 | $3,115 | $28,440 |

| 2014 | $9,254 | $31,555 | $3,115 | $28,440 |

| 2013 | $9,007 | $31,555 | $3,115 | $28,440 |

Source: Public Records

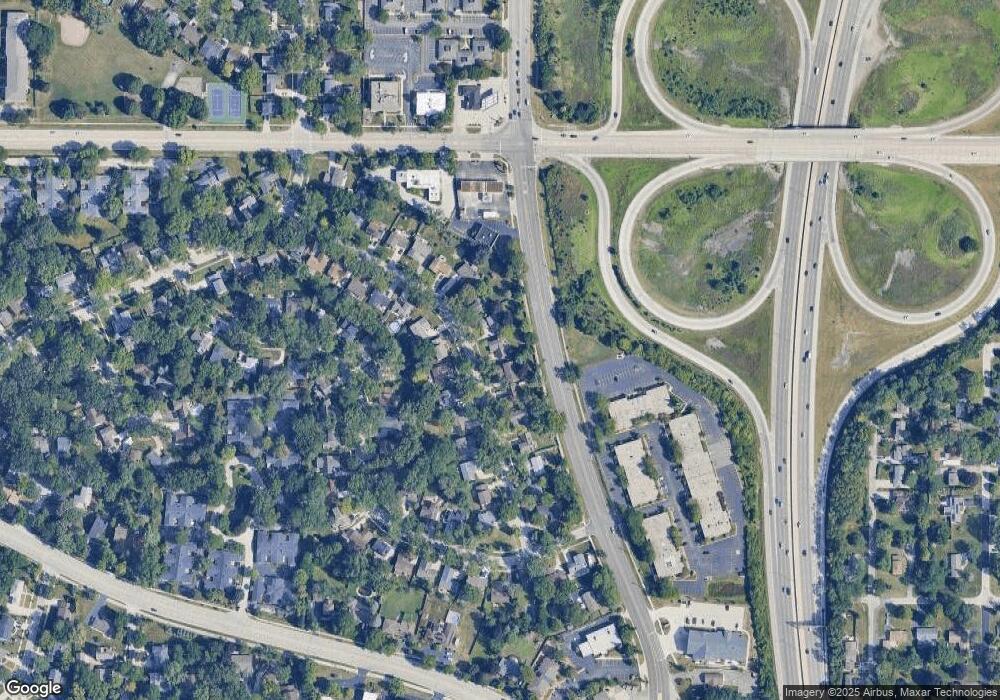

Map

Nearby Homes

- 4301 Euclid Ave

- 2041 Vermont St

- 4 Eton on Oxford

- 2 Croydon on Duxbury

- 2600 Brookwood Way Dr Unit 316

- 2600 Brookwood Way Dr Unit 305

- 2600 Brookwood Way Dr Unit 214

- 2600 Brookwood Unit 314

- 2600 Brookwood Way Dr Unit 212

- 4512 Kings Walk Dr Unit 1D

- 2401 Rohlwing Rd

- 3805 Fairfax Ave

- 4602 Euclid Ave Unit 2A

- 1808 Plum Grove Rd Unit 1B

- 160 E Forest Ln

- 1 Foxcroft on Auburn

- 4941 Emerson Ave

- 805 S Benton St

- 912 S Plum Grove Rd Unit 321

- 904 S Plum Grove Rd Unit 301