2118 Saint Andrews Cir Bettendorf, IA 52722

Estimated Value: $1,127,000 - $1,748,000

5

Beds

7

Baths

5,384

Sq Ft

$270/Sq Ft

Est. Value

About This Home

This home is located at 2118 Saint Andrews Cir, Bettendorf, IA 52722 and is currently estimated at $1,452,590, approximately $269 per square foot. 2118 Saint Andrews Cir is a home located in Scott County with nearby schools including Grant Wood Elementary School, Bettendorf Middle School, and Bettendorf High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 13, 2013

Sold by

Lujack Mary J and Pohlmann Mary L

Bought by

Lujack Mary J and Mary J Lujack Revocable Trust

Current Estimated Value

Purchase Details

Closed on

May 18, 2012

Sold by

Schick Julia S

Bought by

Pohlmann Mary L and Mary L Pohlmann Revocable Trust

Purchase Details

Closed on

Jul 13, 2005

Sold by

Schick Julie E

Bought by

Schick Julie E and Schick Ford P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$359,650

Interest Rate

4%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Mar 2, 2005

Sold by

Schick Ford P and Schick Julia E

Bought by

The Julia E Schick Revocable Trust and Schick Julia E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lujack Mary J | -- | None Available | |

| Pohlmann Mary L | $1,200,000 | None Available | |

| Schick Julie E | -- | None Available | |

| The Julia E Schick Revocable Trust | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Schick Julie E | $359,650 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $18,828 | $1,326,300 | $371,700 | $954,600 |

| 2024 | $18,682 | $1,217,300 | $320,600 | $896,700 |

| 2023 | $20,192 | $1,217,300 | $320,600 | $896,700 |

| 2022 | $19,988 | $1,156,080 | $320,600 | $835,480 |

| 2021 | $19,988 | $1,156,080 | $320,600 | $835,480 |

| 2020 | $19,830 | $1,101,470 | $320,600 | $780,870 |

| 2019 | $20,412 | $1,101,470 | $320,600 | $780,870 |

| 2018 | $20,410 | $1,101,470 | $320,600 | $780,870 |

| 2017 | $6,126 | $1,101,470 | $320,600 | $780,870 |

| 2016 | $19,476 | $1,052,750 | $0 | $0 |

| 2015 | $19,476 | $1,009,620 | $0 | $0 |

| 2014 | $18,900 | $1,009,620 | $0 | $0 |

| 2013 | $18,492 | $0 | $0 | $0 |

| 2012 | -- | $1,002,810 | $190,090 | $812,720 |

Source: Public Records

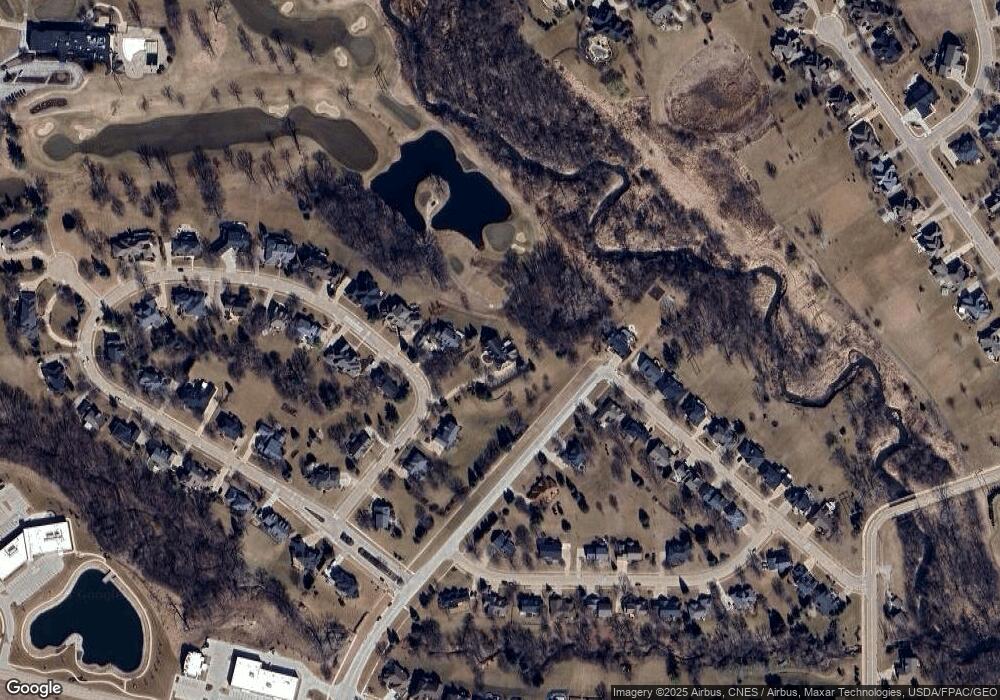

Map

Nearby Homes

- 2614 Heather Glen Cir

- 6202 Crow Valley Dr

- 2744 Rosehill Ave

- 6559 Cardinal Rd

- 6547 Cardinal Rd

- 3271 Valleywynds Dr

- 3347 Glenbrook Cir N

- 3115 Meridith Way

- 2605 Hunter Rd

- 2946 Summertree Ave

- 6501 Blackbird Ln

- 6589 Blackbird Ln

- Lot 17 Blackbird Ln

- Lot 23 Blackbird Ln

- Lot 10 Blackbird Ln

- 4906 Fox Ridge Rd

- 3405 Marynoel Ave

- 4150 E 60th St Unit 1004

- 6401 Utica Ridge Rd Unit 4

- 3179 Meridith Way

- 2118 St Andrews Cir

- 2132 Saint Andrews Cir

- 2132 St Andrews Cir

- 2031 Saint Andrews Cir

- 2140 Saint Andrews Cir

- 5725 Barcelona St

- 5710 Barcelona St

- 2133 Saint Andrews Cir

- 2133 St Andrews

- 5695 18th St

- 2019 Saint Andrews Cir

- 5673 18th St

- 5715 Barcelona St

- 5700 Barcelona St

- 2022 Saint Andrews Cir

- 5705 Barcelona St

- 5690 Barcelona St

- 2520 Buckingham Ave

- 2151 Saint Andrews Cir

- 2003 Saint Andrews Cir