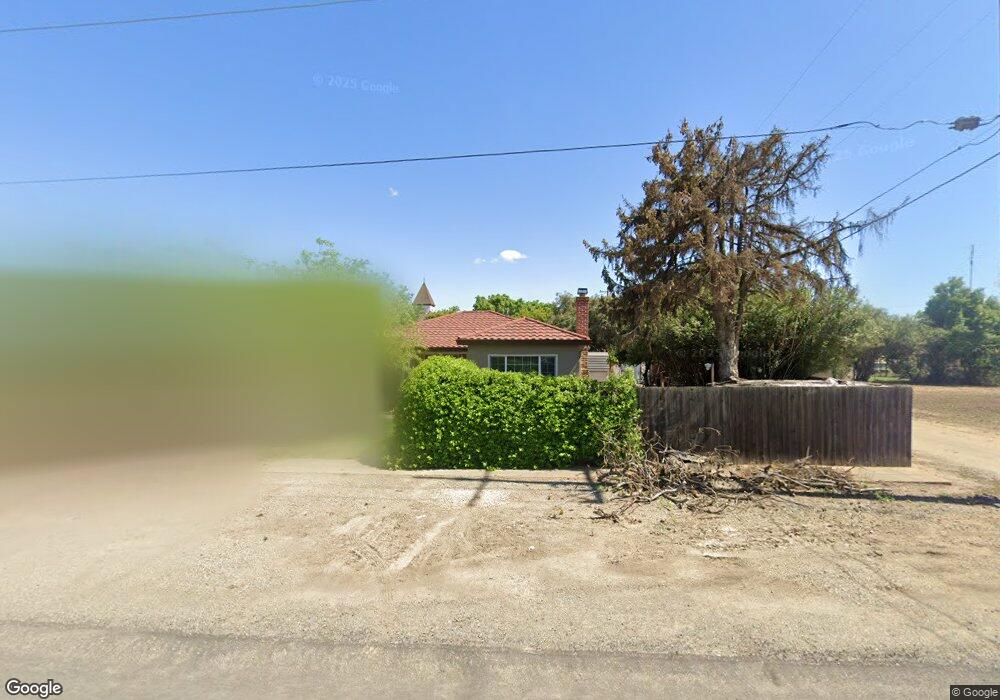

212 W 5th St Crows Landing, CA 95313

Estimated Value: $305,000 - $390,953

4

Beds

3

Baths

2,011

Sq Ft

$164/Sq Ft

Est. Value

About This Home

This home is located at 212 W 5th St, Crows Landing, CA 95313 and is currently estimated at $330,488, approximately $164 per square foot. 212 W 5th St is a home with nearby schools including Orestimba High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2001

Sold by

Norwest Bank Minnesota Na

Bought by

Garcia Juan and Garcia Crystal

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,250

Outstanding Balance

$38,271

Interest Rate

7.19%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$292,217

Purchase Details

Closed on

Sep 12, 2000

Sold by

Teresa Garza

Bought by

Solomon Brothers Mtg Securities Vii Inc

Purchase Details

Closed on

Jul 30, 1996

Sold by

Garza Hector Robles

Bought by

Garza Teresa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,800

Interest Rate

8.2%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 29, 1996

Sold by

The Crows Landing Baca Children Trust and Baca Mary E

Bought by

Garza Teresa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,800

Interest Rate

8.2%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 16, 1995

Sold by

Baca Maria Deescobar

Bought by

Baca Mary E and The Crows Landing Baca Childrens Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garcia Juan | $115,000 | First American Title Ins Co | |

| Solomon Brothers Mtg Securities Vii Inc | $104,797 | Chicago Title | |

| Garza Teresa | -- | Chicago Title Co | |

| Garza Teresa | $96,000 | Chicago Title Co | |

| Baca Mary E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Garcia Juan | $109,250 | |

| Previous Owner | Garza Teresa | $76,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,311 | $184,856 | $74,579 | $110,277 |

| 2024 | $2,253 | $181,232 | $73,117 | $108,115 |

| 2023 | $2,191 | $177,680 | $71,684 | $105,996 |

| 2022 | $2,152 | $174,197 | $70,279 | $103,918 |

| 2021 | $2,111 | $170,782 | $68,901 | $101,881 |

| 2020 | $2,069 | $169,032 | $68,195 | $100,837 |

| 2019 | $2,077 | $165,718 | $66,858 | $98,860 |

| 2018 | $1,945 | $162,470 | $65,548 | $96,922 |

| 2017 | $2,107 | $159,285 | $64,263 | $95,022 |

| 2016 | $1,740 | $144,000 | $30,000 | $114,000 |

| 2015 | $1,685 | $132,500 | $22,000 | $110,500 |

| 2014 | $1,555 | $120,500 | $20,000 | $100,500 |

Source: Public Records

Map

Nearby Homes

- 19054 California 33

- 24 Armstrong Rd

- 0 Anderson Rd

- 18401 Davis Rd

- 1137 Apricot Ave

- 13807 Carpenter Rd

- 0 E Stuhr Rd

- 572 St Helena Dr

- 737 Orestimba Peak Dr

- 662 Cedar Mountain Dr

- 728 R St

- 449 D Arpino Ct

- 604 Kinshire Way

- 1059 Q St

- 559 S Del Puerto Ave

- 0 Orange Ave

- 1441 Kern St

- 613 Ranee Ct

- 548 Hansen Ct

- 407 Northampton Way

Your Personal Tour Guide

Ask me questions while you tour the home.