Estimated Value: $1,142,598 - $1,310,000

3

Beds

2

Baths

1,924

Sq Ft

$633/Sq Ft

Est. Value

About This Home

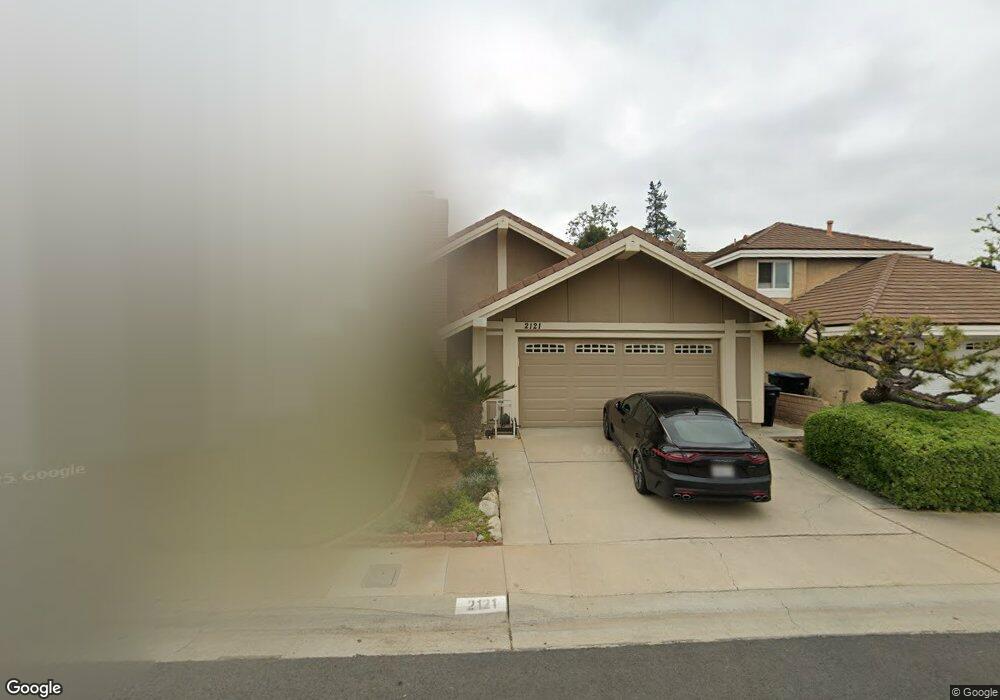

This home is located at 2121 Treeridge Cir, Brea, CA 92821 and is currently estimated at $1,218,650, approximately $633 per square foot. 2121 Treeridge Cir is a home located in Orange County with nearby schools including Brea Country Hills Elementary School, Brea Junior High School, and Brea-Olinda High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 14, 2019

Sold by

Moon Sonya and Moon Sonya Kyung

Bought by

Paik Paul and Paik Lae Oh

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$295,000

Outstanding Balance

$258,895

Interest Rate

3.8%

Mortgage Type

New Conventional

Estimated Equity

$959,755

Purchase Details

Closed on

Jul 9, 2002

Sold by

Kretschmar Gertrude L

Bought by

Moon Fred Young and Moon Sonya Kyung

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

6.6%

Purchase Details

Closed on

Aug 5, 2001

Sold by

Glyer Paul H and Glyer Nancy C

Bought by

Kretschmar Gertrude L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,000

Interest Rate

7.19%

Purchase Details

Closed on

Aug 17, 2000

Sold by

Paul Glyer and Paul Nancy C

Bought by

Glyer Paul H and Glyer Nancy C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Paik Paul | -- | Property Id Title Company | |

| Moon Fred Young | $414,000 | Fidelity National Title | |

| Kretschmar Gertrude L | $353,000 | First American Title Co | |

| Glyer Paul H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Paik Paul | $295,000 | |

| Closed | Moon Fred Young | $300,000 | |

| Previous Owner | Kretschmar Gertrude L | $275,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,758 | $599,600 | $443,755 | $155,845 |

| 2024 | $6,758 | $587,844 | $435,054 | $152,790 |

| 2023 | $6,571 | $576,318 | $426,523 | $149,795 |

| 2022 | $6,508 | $565,018 | $418,160 | $146,858 |

| 2021 | $6,385 | $553,940 | $409,961 | $143,979 |

| 2020 | $6,342 | $548,261 | $405,758 | $142,503 |

| 2019 | $6,170 | $537,511 | $397,802 | $139,709 |

| 2018 | $6,077 | $526,972 | $390,002 | $136,970 |

| 2017 | $5,961 | $516,640 | $382,355 | $134,285 |

| 2016 | $5,842 | $506,510 | $374,858 | $131,652 |

| 2015 | $5,760 | $498,902 | $369,227 | $129,675 |

| 2014 | $5,592 | $489,130 | $361,995 | $127,135 |

Source: Public Records

Map

Nearby Homes

- 2050 Fallingleaf Cir

- 2363 Morning Dew Dr

- 2304 Carrotwood Dr

- 2488 E Kern River Ln

- 2583 Sandpebble Ln

- 2761 E Stearns St

- 2498 E Santa Paula Dr

- 878 N Landa Way

- 688 Buttonwood Dr

- 149 Bluegrass St

- 1796 Ravencrest Dr

- 3112 E Piru Ln

- 500 Silver Canyon Way

- 360 Meadow Ct

- 648 Pepperwood Dr

- 38 Rogers Ct

- 3016 Clearwood Ct

- 2851 Rolling Hills Dr Unit 257

- 2851 Rolling Hills Dr Unit 248

- 2851 Rolling Hills Dr

- 2119 Treeridge Cir

- 2123 Treeridge Cir

- 2117 Treeridge Cir

- 2118 Ironbark Cir

- 2116 Ironbark Cir

- 2114 Ironbark Cir

- 2115 Treeridge Cir

- 2120 Treeridge Cir

- 2118 Treeridge Cir

- 2122 Treeridge Cir

- 2226 Shadetree Cir

- 2116 Treeridge Cir

- 2112 Ironbark Cir

- 2113 Treeridge Cir

- 2217 Shadetree Cir

- 2114 Treeridge Cir

- 2249 Timbercreek Cir

- 2234 Shadetree Cir

- 2110 Ironbark Cir

- 350 Shadyvale Ln

Your Personal Tour Guide

Ask me questions while you tour the home.