2130 Elm Tree Knoll Charlottesville, VA 22911

Piney Mountain NeighborhoodEstimated Value: $362,000 - $381,000

3

Beds

3

Baths

1,777

Sq Ft

$210/Sq Ft

Est. Value

About This Home

This home is located at 2130 Elm Tree Knoll, Charlottesville, VA 22911 and is currently estimated at $372,613, approximately $209 per square foot. 2130 Elm Tree Knoll is a home located in Albemarle County with nearby schools including Baker-Butler Elementary School, Lakeside Middle School, and Albemarle High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 16, 2015

Sold by

Williams Benjamin J and Williams Tiffany L

Bought by

Lennon Suzanne M D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,000

Outstanding Balance

$134,632

Interest Rate

3.9%

Mortgage Type

New Conventional

Estimated Equity

$237,981

Purchase Details

Closed on

Feb 27, 2014

Sold by

Nvr Inc

Bought by

Williams Benjamin J and Williams Tiffany L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,223

Interest Rate

4.37%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 3, 2013

Sold by

Woodbriar Associates

Bought by

Nvr Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lennon Suzanne M D | $228,000 | -- | |

| Williams Benjamin J | $233,204 | -- | |

| Nvr Inc | $445,838 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lennon Suzanne M D | $171,000 | |

| Previous Owner | Williams Benjamin J | $198,223 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,151 | $352,500 | $110,000 | $242,500 |

| 2024 | $3,023 | $354,000 | $115,500 | $238,500 |

| 2023 | $2,792 | $326,900 | $106,200 | $220,700 |

| 2022 | $2,574 | $301,400 | $101,800 | $199,600 |

| 2021 | $2,319 | $271,500 | $88,000 | $183,500 |

| 2020 | $2,249 | $263,400 | $88,000 | $175,400 |

| 2019 | $2,302 | $269,500 | $88,000 | $181,500 |

| 2018 | $2,077 | $246,700 | $77,000 | $169,700 |

| 2017 | $2,085 | $248,500 | $71,500 | $177,000 |

| 2016 | $1,952 | $232,700 | $71,500 | $161,200 |

| 2015 | $932 | $227,600 | $71,500 | $156,100 |

| 2014 | -- | $20,000 | $20,000 | $0 |

Source: Public Records

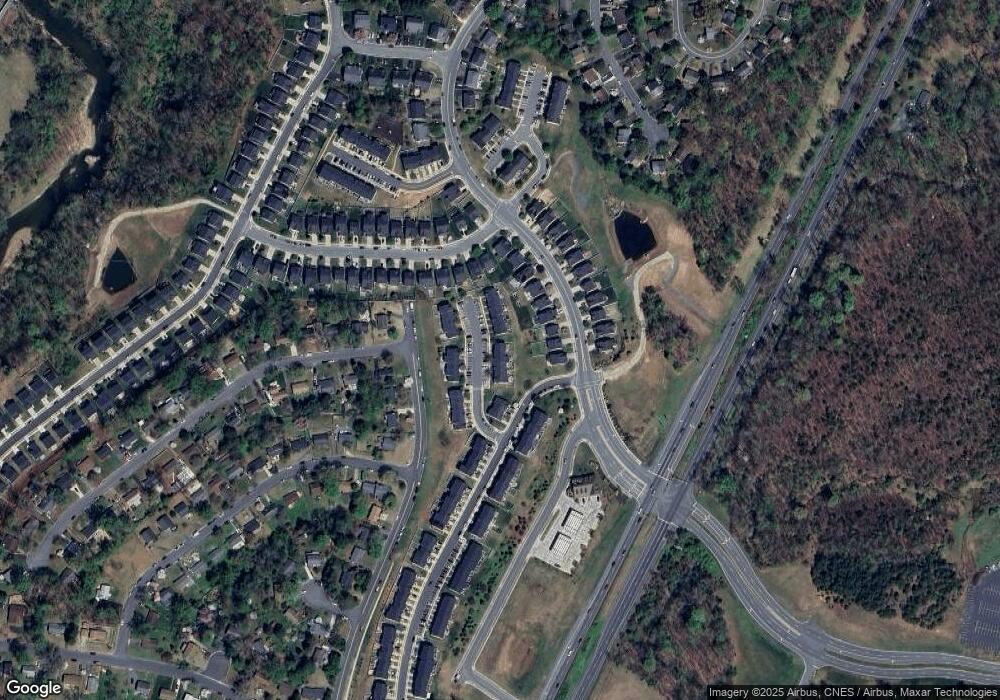

Map

Nearby Homes

- 2049 Elm Tree Ct

- 4517 Briarwood Dr

- TBD3 Camelot Dr Unit 3

- TBD3 Camelot Dr

- TBD Barnsdale Rd

- TBD28 Barnsdale Rd Unit 28

- TBD28 Barnsdale Rd

- TBD27 Barnsdale Rd Unit 27

- TBD27 Barnsdale Rd

- TBD Barnsdale Rd Unit 3, 27, 28

- 824 Wesley Ln Unit B

- 828 Wesley Ln Unit A

- 2307 Finch Ct

- 4710 Dickerson Rd

- 2328 Austin Dr

- 2390 Lonicera Way

- 2362 Lonicera Way

- 0 Dickerson Rd Unit 669651

- The Kempton Plan at North Pointe

- The Azalea Plan at North Pointe

- 2128 Elm Tree Knoll

- 2136 Elm Tree Knoll

- 2126 Elm Tree Knoll

- 2124 Elm Tree Knoll

- 2138 Elm Tree Knoll

- 2171 Elm Tree Knoll

- 2122 Elm Tree Knoll

- 2142 Elm Tree Knoll

- 2120 Elm Tree Knoll

- 2144 Elm Tree Knoll

- 806 Elm Tree Knoll Unit D

- 804F Elm Tree Knoll

- 806E Elm Tree Knoll

- 804B Elm Tree Knoll

- 804D Elm Tree Knoll

- 806 F Elm Tree Knoll

- 804C Elm Tree Knoll

- 806 B Elm Tree Knoll

- 806C Elm Tree Knoll

- 803 G Elm Tree Knoll