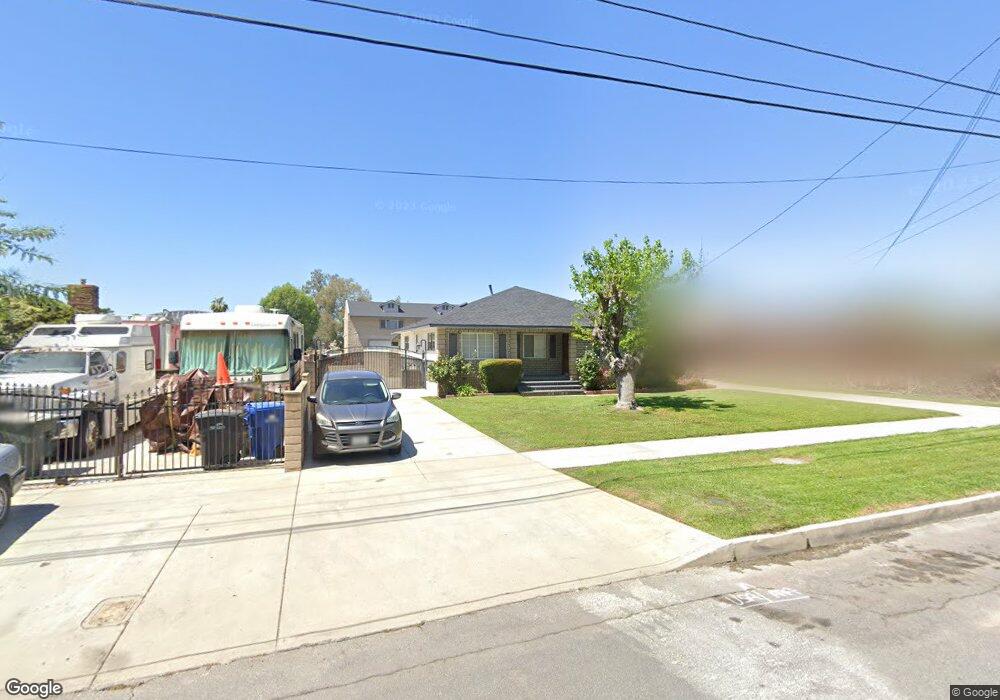

2134 Magnolia Ave Ontario, CA 91762

Downtown Ontario NeighborhoodEstimated Value: $736,000 - $889,000

3

Beds

2

Baths

1,501

Sq Ft

$540/Sq Ft

Est. Value

About This Home

This home is located at 2134 Magnolia Ave, Ontario, CA 91762 and is currently estimated at $810,356, approximately $539 per square foot. 2134 Magnolia Ave is a home located in San Bernardino County with nearby schools including Vista Grande Elementary School, Oaks Middle, and Ontario High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 26, 2024

Sold by

Martins Frank Teotonio

Bought by

Frank Teotonio Martins Living Trust and Martins

Current Estimated Value

Purchase Details

Closed on

Dec 2, 2016

Sold by

Martins Frank Teotonio

Bought by

Martins Frank Teotonio and Martins Margaret M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$277,500

Interest Rate

3.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 3, 2011

Sold by

Martins Frank Teotonio

Bought by

Martins Frank Teotonio

Purchase Details

Closed on

Apr 3, 2008

Sold by

Cellier Eugene D

Bought by

Martins Frank Teotonio and Martins Joe

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$323,023

Interest Rate

6.05%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 1, 2006

Sold by

Cellier Eugene Debs

Bought by

Cellier Eugene D and Cellier Christine M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$414,000

Interest Rate

6.38%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 21, 2006

Sold by

Cellier Eugene Debs

Bought by

Cellier Eugene D and Cellier Christine M

Purchase Details

Closed on

Sep 14, 2004

Sold by

Devries John

Bought by

Cellier Eugene Debs and Cellier Christine Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 23, 2003

Sold by

Spaletta Louis H

Bought by

Spaletta Louis H and Spaletta Mary L

Purchase Details

Closed on

Aug 21, 2003

Sold by

Spaletta Louis H

Bought by

Devries John and Devries Jo Ellen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$287,100

Interest Rate

6.14%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 15, 2003

Sold by

Spaletta Louis H

Bought by

Spaletta Louis H and Spaletta Mary L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$287,100

Interest Rate

6.14%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Frank Teotonio Martins Living Trust | -- | None Listed On Document | |

| Margaret Maria Martins Living Trust | -- | None Listed On Document | |

| Martins Frank Teotonio | -- | First American Title Company | |

| Martins Frank Teotonio | -- | None Available | |

| Martins Frank Teotonio | $335,000 | Chicago Title | |

| Cellier Eugene D | -- | Accommodation | |

| Cellier Eugene Debs | -- | Old Republic Title Company | |

| Cellier Eugene D | -- | None Available | |

| Cellier Eugene Debs | $400,000 | American Title-Orange | |

| Spaletta Louis H | $319,000 | -- | |

| Devries John | -- | -- | |

| Spaletta Louis H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Martins Frank Teotonio | $277,500 | |

| Previous Owner | Martins Frank Teotonio | $323,023 | |

| Previous Owner | Cellier Eugene Debs | $414,000 | |

| Previous Owner | Cellier Eugene Debs | $320,000 | |

| Previous Owner | Devries John | $287,100 | |

| Closed | Cellier Eugene Debs | $80,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,195 | $482,798 | $128,818 | $353,980 |

| 2024 | $5,195 | $473,331 | $126,292 | $347,039 |

| 2023 | $5,049 | $464,050 | $123,816 | $340,234 |

| 2022 | $4,983 | $454,951 | $121,388 | $333,563 |

| 2021 | $4,628 | $416,620 | $119,007 | $297,613 |

| 2020 | $4,547 | $412,348 | $117,787 | $294,561 |

| 2019 | $4,508 | $404,262 | $115,477 | $288,785 |

| 2018 | $4,446 | $396,336 | $113,213 | $283,123 |

| 2017 | $4,287 | $388,565 | $110,993 | $277,572 |

| 2016 | $4,118 | $380,946 | $108,817 | $272,129 |

| 2015 | $4,090 | $375,223 | $107,182 | $268,041 |

| 2014 | $3,184 | $295,000 | $100,000 | $195,000 |

Source: Public Records

Map

Nearby Homes

- 1162 W Philadelphia St

- 2321 S Magnolia Ave Unit 6E

- 12321 Gardenia Place

- 926 W Philadelphia St Unit 49

- 926 W Philadelphia St Unit R99

- 926 W Philadelphia St Unit 10

- 1726 S Mountain Ave Unit C

- 1712 S Mountain Ave Unit E

- 1706 S Mountain Ave

- 12351 Twin Gables Dr

- 1604 S Mountain Ave Unit D

- 12524 Ross Ave

- 5610 Guardian Way

- 2022 S San Antonio Ave

- 11782 Vernon Ave

- 1620 S Cypress Ave

- 558 W Philadelphia St

- 5500 Francis Ave

- 1849 S San Antonio Ave

- 12638 Verdugo Ave

- 2124 Magnolia Ave

- 2140 Magnolia Ave

- 2116 Magnolia Ave

- 1208 W Philadelphia St

- 1220 W Philadelphia St

- 2135 S Magnolia Ave

- 2135 Magnolia Ave Unit 50

- 2135 Magnolia Ave

- 2133 Magnolia Ave

- 2157 S Magnolia Ave

- 2157 Magnolia Ave

- 2159 S Magnolia Ave

- 2159 Magnolia Ave

- 2137 S Magnolia Ave

- 2110 S Magnolia Ave

- 2110 S Magnolia Ave

- 2139 S Magnolia Ave

- 2139 Magnolia Ave

- 2137 Magnolia Ave

- 1172 W Philadelphia St