214 Linden Ave Glendive, MT 59330

Estimated Value: $183,000 - $263,339

3

Beds

1

Bath

1,232

Sq Ft

$188/Sq Ft

Est. Value

About This Home

This home is located at 214 Linden Ave, Glendive, MT 59330 and is currently estimated at $232,085, approximately $188 per square foot. 214 Linden Ave is a home located in Dawson County with nearby schools including Dawson High School and Valley View Seventh-day Adventist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2024

Sold by

Stinnett Brett R

Bought by

Cornell Matthew L and Baer Alleea C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,830

Outstanding Balance

$166,190

Interest Rate

0.65%

Mortgage Type

FHA

Estimated Equity

$65,895

Purchase Details

Closed on

Jun 11, 2021

Sold by

Crane and Alleea

Bought by

Stinnett Brett R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,740

Interest Rate

2.9%

Mortgage Type

Construction

Purchase Details

Closed on

Aug 18, 2016

Sold by

Follmer Ervin B and Follmer Bonita R

Bought by

Crane Tyler and Crane Alleea

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cornell Matthew L | $173,548 | Flying S Title & Escrow | |

| Stinnett Brett R | $172,175 | First American Title | |

| Crane Tyler | $126,250 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cornell Matthew L | $171,830 | |

| Previous Owner | Stinnett Brett R | $137,740 | |

| Closed | Crane Tyler | $101,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,113 | $202,700 | $0 | $0 |

| 2024 | $3,387 | $145,200 | $0 | $0 |

| 2023 | $3,279 | $145,200 | $0 | $0 |

| 2022 | $2,877 | $126,800 | $0 | $0 |

| 2021 | $1,132 | $125,500 | $0 | $0 |

| 2020 | $2,285 | $148,800 | $0 | $0 |

| 2019 | $2,306 | $148,800 | $0 | $0 |

| 2018 | $2,867 | $163,300 | $0 | $0 |

| 2017 | $2,803 | $163,300 | $0 | $0 |

| 2016 | $1,735 | $179,300 | $0 | $0 |

| 2015 | $349 | $179,300 | $0 | $0 |

| 2014 | $196 | $57,187 | $0 | $0 |

Source: Public Records

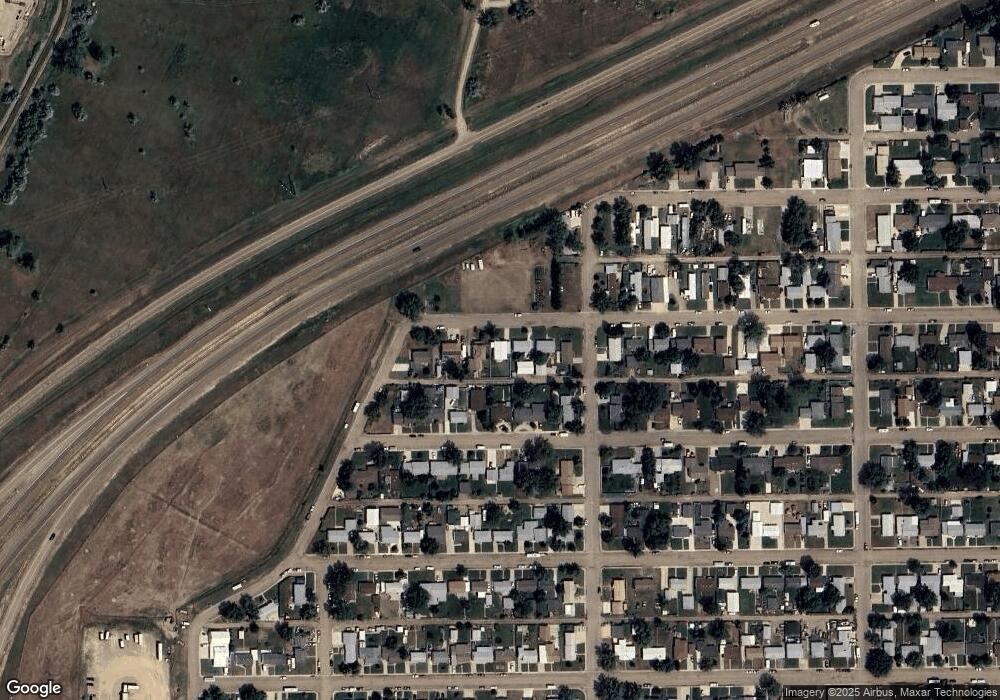

Map

Nearby Homes

Your Personal Tour Guide

Ask me questions while you tour the home.