Estimated Value: $820,580 - $1,435,000

4

Beds

3

Baths

3,642

Sq Ft

$332/Sq Ft

Est. Value

About This Home

This home is located at 21401 Larkin Rd, Hamel, MN 55340 and is currently estimated at $1,210,527, approximately $332 per square foot. 21401 Larkin Rd is a home located in Hennepin County with nearby schools including Rockford Elementary Arts Magnet School, Rockford Middle School - Center for Environmental Studies, and Rockford High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2021

Sold by

Great Investments Llc

Bought by

Wawra Jonathan G and Wawra Brittni K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$509,150

Outstanding Balance

$317,879

Interest Rate

4.1%

Mortgage Type

New Conventional

Estimated Equity

$892,648

Purchase Details

Closed on

Jan 28, 2014

Sold by

Ebert Gregory R

Bought by

Great Investments Llc

Purchase Details

Closed on

Oct 24, 2007

Sold by

Soligny William John

Bought by

Ebert Gregory R

Purchase Details

Closed on

Aug 30, 2001

Sold by

Proehl Donald R

Bought by

Soligny William John and Soligny Mary Kristine

Purchase Details

Closed on

Nov 22, 1996

Sold by

Proehl Donald R and Proehl Linda M

Bought by

Soligny William John and Soligny Mary Kristine

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wawra Jonathan G | $599,000 | Custom Home Builders Ttl Llc | |

| Great Investments Llc | -- | None Available | |

| Ebert Gregory R | $600,000 | -- | |

| Soligny William John | $195,000 | -- | |

| Soligny William John | $195,000 | -- | |

| Wawra Jonathan Jonathan | $599,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wawra Jonathan G | $509,150 | |

| Closed | Soligny William John | -- | |

| Closed | Wawra Jonathan Jonathan | $589,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,866 | $1,073,100 | $381,100 | $692,000 |

| 2023 | $10,714 | $1,044,700 | $349,700 | $695,000 |

| 2022 | $3,222 | $223,000 | $137,000 | $86,000 |

| 2021 | $3,584 | $190,800 | $144,500 | $46,300 |

| 2020 | $2,901 | $331,000 | $246,900 | $84,100 |

| 2019 | $3,140 | $200,900 | $160,100 | $40,800 |

| 2018 | $3,112 | $199,000 | $155,000 | $44,000 |

| 2017 | $3,622 | $254,100 | $210,100 | $44,000 |

| 2016 | $3,970 | $278,000 | $234,000 | $44,000 |

| 2015 | $3,675 | $250,300 | $205,300 | $45,000 |

| 2014 | -- | $222,600 | $177,600 | $45,000 |

Source: Public Records

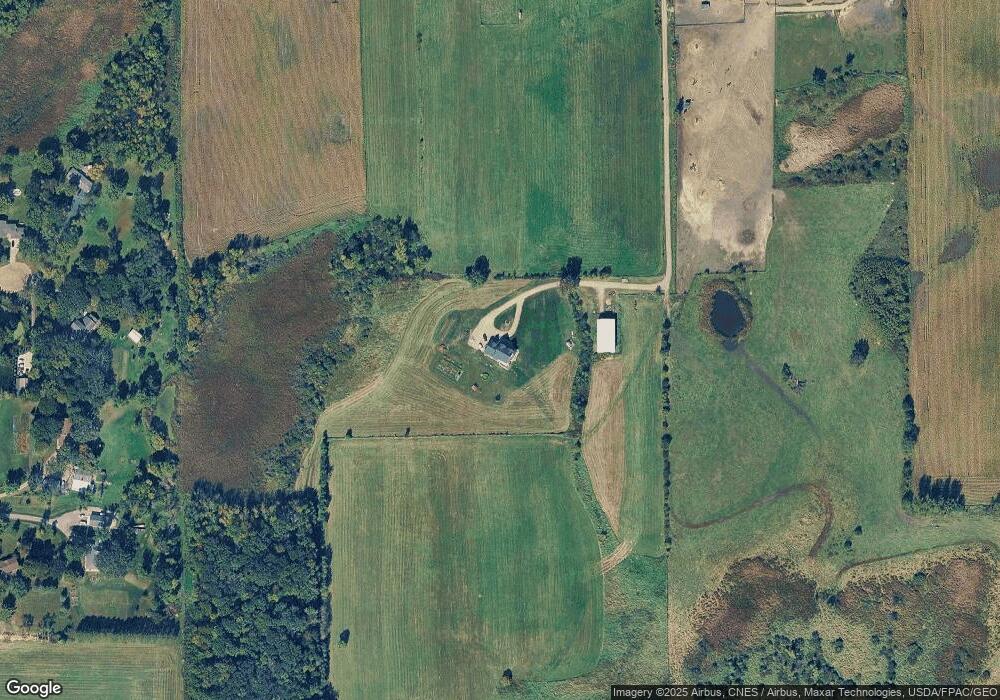

Map

Nearby Homes

- 4302 Hillside Dr

- 6294 Bluestem Rd S

- 20417 Larkin Rd

- 6857 Zenwood Ln

- 6855 Zenwood Ln

- 1910 Katrinka Rd

- 6682 Zenwood Ln

- 6686 Zenwood Ln

- 20170 68th Place

- Cordoba Plan at Tavera - Lifestyle Villa Collection

- Brisbane Plan at Tavera - Lifestyle Villa Collection

- Salerno Plan at Tavera - Lifestyle Villa Collection

- Birmingham Plan at Tavera - Lifestyle Villa Collection

- Buckingham Plan at Tavera - Lifestyle Villa Collection

- Brighton Plan at Tavera - Lifestyle Villa Collection

- Salem Plan at Tavera - Lifestyle Villa Collection

- Corsica Plan at Tavera - Lifestyle Villa Collection

- 20173 68th Ave

- 8017 Walnut Ln

- 8018 Walnut Ln

- BLK 1 LOT 5 County Road 50

- BLK 1 LOT 7 County Road 50

- BLK 1 LOT 4 County Road 50

- BLK 1 LOT 6 County Road 50

- 21527 Homestead Trail

- 21201 Larkin Rd

- 21525 Nystrom Ln

- 21528 Nystrom Ln

- 21524 Homestead Trail

- 21300 Larkin Rd

- 21536 Homestead Trail

- 21539 Homestead Trail

- 21539 Homestead Trail

- 21535 Nystrom Ln

- 4595 Pioneer Trail

- 4305 Hillside Dr

- Lot 13 Meander Ct

- Lot 7 Meander Ct

- Lot 6 Meander Ct

- Lot 5 Meander Ct