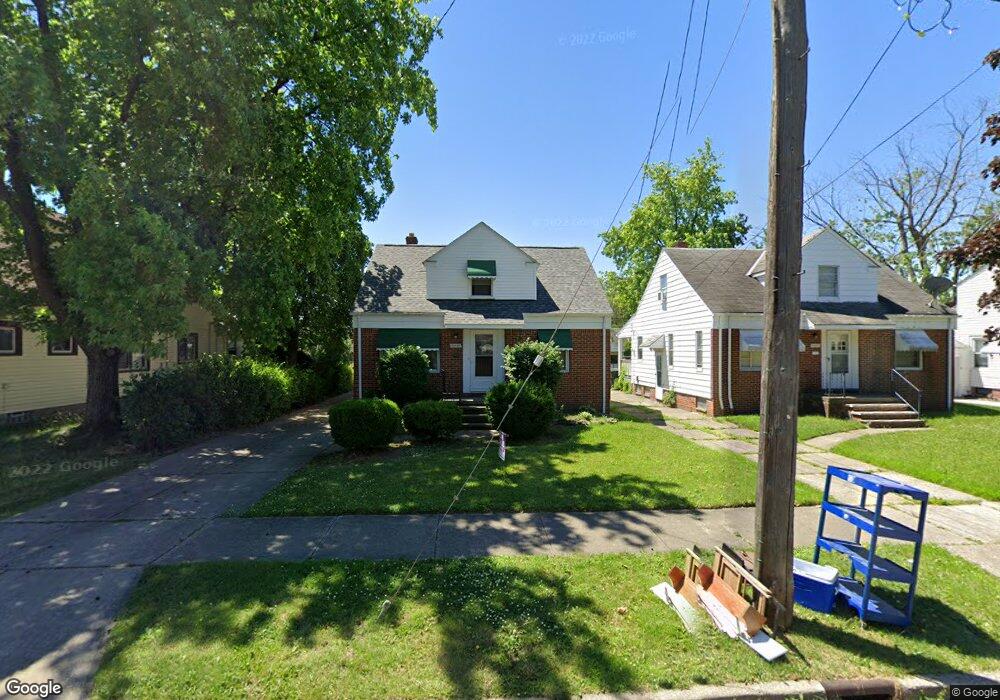

21410 Westport Ave Euclid, OH 44123

Estimated Value: $128,747 - $171,000

3

Beds

1

Bath

1,227

Sq Ft

$119/Sq Ft

Est. Value

About This Home

This home is located at 21410 Westport Ave, Euclid, OH 44123 and is currently estimated at $145,937, approximately $118 per square foot. 21410 Westport Ave is a home located in Cuyahoga County with nearby schools including Arbor Elementary School, Euclid Middle School, and Euclid High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 15, 2022

Sold by

Vogel Christopher A

Bought by

King Saroya Jeanine

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,138

Outstanding Balance

$113,971

Interest Rate

6.95%

Mortgage Type

FHA

Estimated Equity

$31,966

Purchase Details

Closed on

Mar 4, 1987

Sold by

Costello Edward

Bought by

Vogel Bernice

Purchase Details

Closed on

Oct 31, 1985

Sold by

Costello Edward

Bought by

Costello Edward

Purchase Details

Closed on

Apr 29, 1985

Sold by

Costello Dorothy L

Bought by

Costello Edward

Purchase Details

Closed on

Jul 20, 1977

Sold by

Costello Edw J and D L

Bought by

Costello Dorothy L

Purchase Details

Closed on

Jan 1, 1975

Bought by

Costello Edw J and D L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| King Saroya Jeanine | $119,300 | Ohio Real Title | |

| Vogel Bernice | $57,000 | -- | |

| Costello Edward | $35,000 | -- | |

| Costello Edward | -- | -- | |

| Costello Dorothy L | -- | -- | |

| Costello Edw J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | King Saroya Jeanine | $117,138 | |

| Closed | King Saroya Jeanine | $5,965 | |

| Closed | Kim Saroya Jeanine | $117,138 | |

| Closed | King Saroya Jeanine | $5,965 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,792 | $40,390 | $7,525 | $32,865 |

| 2023 | $2,162 | $24,580 | $5,920 | $18,660 |

| 2022 | $2,303 | $24,570 | $5,920 | $18,660 |

| 2021 | $2,392 | $24,570 | $5,920 | $18,660 |

| 2020 | $2,015 | $18,620 | $4,480 | $14,140 |

| 2019 | $1,812 | $53,200 | $12,800 | $40,400 |

| 2018 | $1,778 | $18,620 | $4,480 | $14,140 |

| 2017 | $1,867 | $15,860 | $2,980 | $12,880 |

| 2016 | $1,871 | $15,860 | $2,980 | $12,880 |

| 2015 | $1,710 | $15,860 | $2,980 | $12,880 |

| 2014 | $1,710 | $15,860 | $2,980 | $12,880 |

Source: Public Records

Map

Nearby Homes

- 21481 Ball Ave

- 21170 Wilmore Ave

- 21440 Fuller Ave

- 21181 Ball Ave

- 21051 Westport Ave

- 21030 Priday Ave

- 20801 Morris Ave

- 20760 Westport Ave

- 20671 Wilmore Ave

- 20830 Tracy Ave

- 21251 S Lake Shore Blvd

- 21051 S Lake Shore Blvd

- 21130 Arbor Ave

- 20450 Wilmore Ave

- 362 E 214th St

- 20400 Tracy Ave

- 828 E 216th St

- 22601 Ivan Ave

- 21561 Maydale Ave

- 22301 Milton Dr

- 21390 Westport Ave

- 21420 Westport Ave

- 21370 Westport Ave

- 21460 Westport Ave

- 21301 Wilmore Ave

- 21340 Westport Ave

- 21480 Westport Ave

- S/L 3 Wilmore Ave

- 21351 Wilmore Ave

- 21421 Westport Ave

- 21431 Westport Ave

- 21391 Westport Ave

- 21320 Westport Ave

- 21401 Wilmore Ave

- 21361 Westport Ave

- 21494 Westport Ave

- 21471 Westport Ave

- 21251 Wilmore Ave

- 21290 Westport Ave

- 21327 Westport Ave