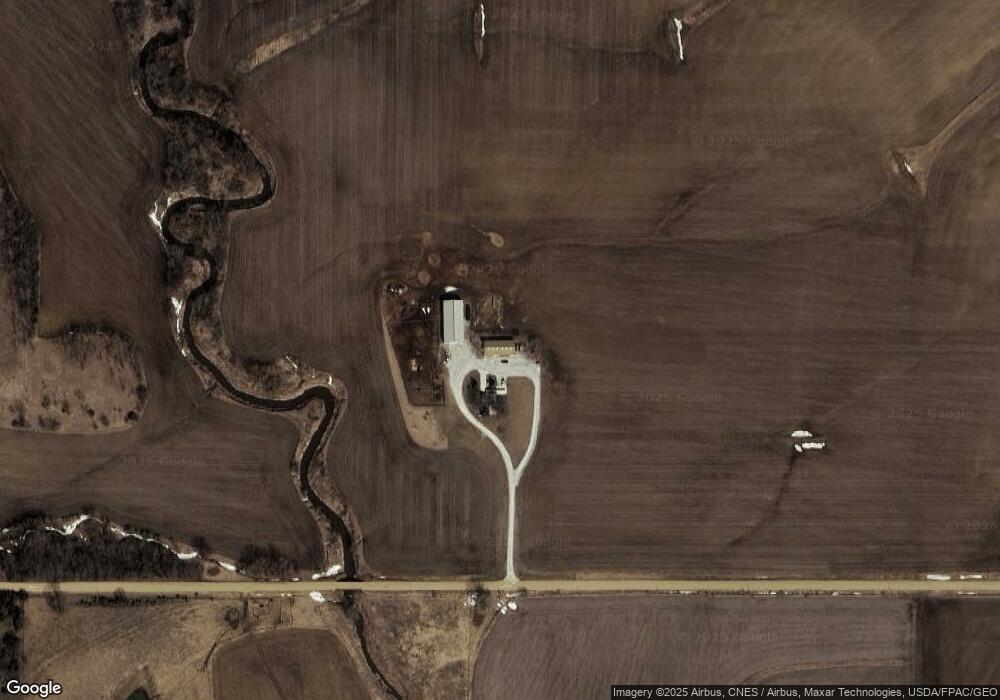

2153 330th St Casey, IA 50048

Guthrie County NeighborhoodEstimated Value: $302,000 - $517,000

3

Beds

2

Baths

2,424

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 2153 330th St, Casey, IA 50048 and is currently estimated at $420,891, approximately $173 per square foot. 2153 330th St is a home located in Guthrie County with nearby schools including Adair-Casey Elementary School and Adair-Casey & Guthrie Center Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 6, 2025

Sold by

Ilah F Rumple Revocable Trust and Rumple Brian A

Bought by

Rumple Brian A

Current Estimated Value

Purchase Details

Closed on

Mar 25, 2011

Sold by

Kading Jack A and Kading Susan

Bought by

Rumple Justin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,000

Interest Rate

5.04%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Apr 2, 2009

Sold by

Walters Robert and Walters Mary Kay

Bought by

Rumple Brian A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

5.11%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rumple Brian A | -- | None Listed On Document | |

| Rumple Justin | $215,000 | None Available | |

| Rumple Brian A | $300,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rumple Justin | $95,000 | |

| Previous Owner | Rumple Brian A | $240,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,720 | $324,400 | $104,100 | $220,300 |

| 2024 | $2,676 | $204,200 | $78,700 | $125,500 |

| 2023 | $2,488 | $204,200 | $78,700 | $125,500 |

| 2022 | $2,464 | $154,800 | $58,500 | $96,300 |

| 2021 | $2,464 | $158,000 | $61,700 | $96,300 |

| 2020 | $2,246 | $150,300 | $57,500 | $92,800 |

| 2019 | $2,138 | $172,000 | $0 | $0 |

| 2018 | $1,740 | $159,600 | $0 | $0 |

| 2017 | $1,602 | $154,700 | $0 | $0 |

| 2016 | $1,602 | $154,700 | $0 | $0 |

| 2015 | $1,608 | $171,427 | $0 | $0 |

| 2014 | $1,738 | $171,427 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

Your Personal Tour Guide

Ask me questions while you tour the home.