217 Drake Landing New Bern, NC 28560

Estimated Value: $543,574 - $600,000

4

Beds

3

Baths

2,853

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 217 Drake Landing, New Bern, NC 28560 and is currently estimated at $574,144, approximately $201 per square foot. 217 Drake Landing is a home located in Craven County with nearby schools including W. Jesse Gurganus Elementary School, Tucker Creek Middle School, and Havelock High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 4, 2019

Sold by

Sherrill Jimmy

Bought by

Sherill Jimmy and Reynolds Wanda K

Current Estimated Value

Purchase Details

Closed on

Dec 3, 2013

Sold by

Hunter Jason

Bought by

Hunter Jason and Hunter Krystyna Ludwika

Purchase Details

Closed on

Jul 11, 2006

Sold by

Arthur Twin Inc

Bought by

Hunter Jason

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$365,000

Interest Rate

6.6%

Mortgage Type

Construction

Purchase Details

Closed on

May 3, 2006

Sold by

Bunting Johnavieve and Bunting Norman C

Bought by

Arthur Twins Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,500

Interest Rate

6.39%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sherill Jimmy | -- | -- | |

| Hunter Jason | -- | -- | |

| Hunter Jason | $90,000 | None Available | |

| Arthur Twins Inc | $85,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hunter Jason | $365,000 | |

| Previous Owner | Arthur Twins Inc | $85,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,297 | $478,800 | $60,000 | $418,800 |

| 2024 | $2,297 | $478,800 | $60,000 | $418,800 |

| 2023 | $2,285 | $478,800 | $60,000 | $418,800 |

| 2022 | $2,207 | $367,010 | $50,000 | $317,010 |

| 2021 | $2,207 | $367,010 | $50,000 | $317,010 |

| 2020 | $2,168 | $367,010 | $50,000 | $317,010 |

| 2019 | $2,168 | $367,010 | $50,000 | $317,010 |

| 2018 | $2,107 | $367,010 | $50,000 | $317,010 |

| 2017 | $2,115 | $367,010 | $50,000 | $317,010 |

| 2016 | $2,095 | $396,400 | $60,000 | $336,400 |

| 2015 | $1,964 | $396,400 | $60,000 | $336,400 |

| 2014 | $1,959 | $396,400 | $60,000 | $336,400 |

Source: Public Records

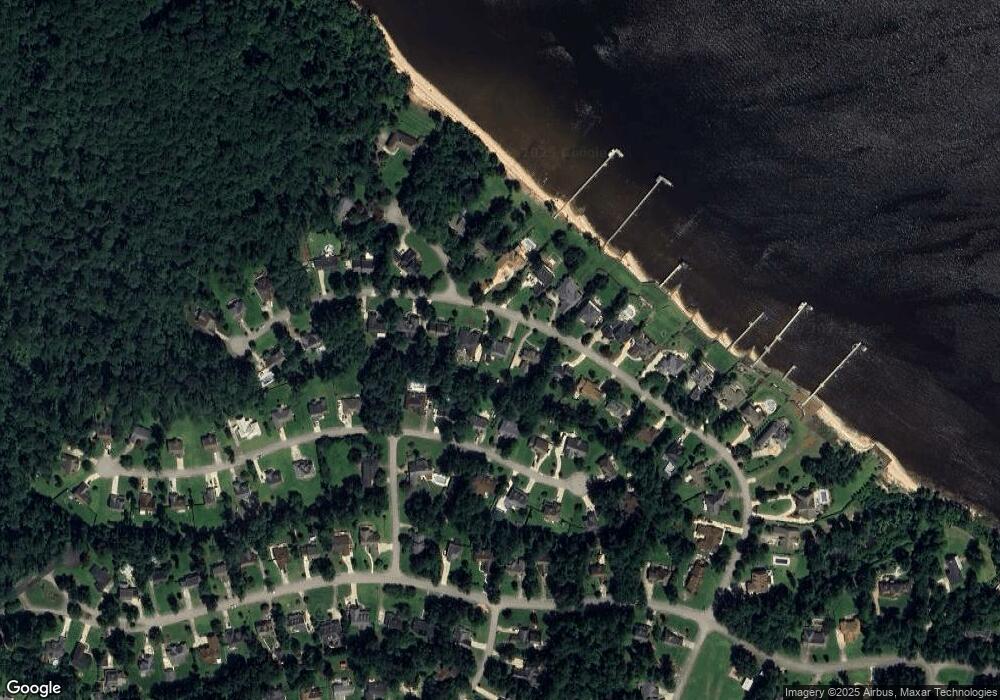

Map

Nearby Homes

- 308 Lafitte Way

- 219 Drake Landing

- 216 Drake Landing

- 222 Drake Landing

- 228 Drake Landing

- 110 Balboa Ct

- 240 Drake Landing

- 305 Drake Landing

- 113 Palisades Way

- 116 Palisades Way

- 302 Palisades Way

- 110 Kenmore Ct

- 304 Palisades Way

- 115 Kenmore Ct

- 108 Lynden Ln

- 303 Calico Dr

- 140 Crooked Run Dr

- 105 Serenity Ct

- 211 Bear Trail

- 5694 County Line Rd

- 215 Drake Landing

- 221 Drake Landing

- 213 Drake Landing

- 310 Lafitte Way

- 306 Lafitte Way

- 312 Lafitte Way

- 211 Drake Landing

- 223 Drake Landing

- 304 Lafitte Way

- 218 Drake Landing

- 220 Drake Landing

- 102 Balboa Ct

- 209 Drake Landing

- 302 Lafitte Way

- 104 Balboa Ct

- 101 Balboa Ct

- 225 Drake Landing

- 224 Drake Landing

- 309 Lafitte Way

- 404 Grenville Ave