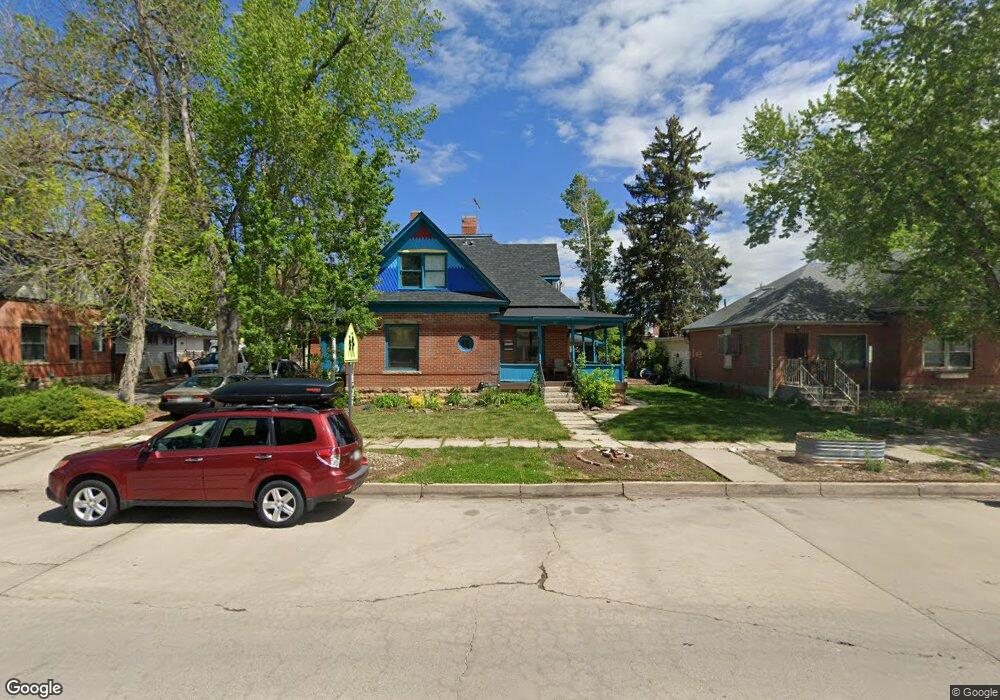

217 W 4th St Loveland, CO 80537

Estimated Value: $874,611

11

Beds

11

Baths

5,508

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 217 W 4th St, Loveland, CO 80537 and is currently estimated at $874,611, approximately $158 per square foot. 217 W 4th St is a home located in Larimer County with nearby schools including Truscott Elementary School, Bill Reed Middle School, and Loveland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 29, 2019

Sold by

Liv Leland R Sharpes and Liv Jocelyn B Sharpes

Bought by

Dbc1 Llc

Current Estimated Value

Purchase Details

Closed on

Mar 19, 2013

Sold by

Sharpes Realty Vestors and Sharpes Leland Robert

Bought by

Sharpes Leland R and Liv Jocelyn B Sharpes

Purchase Details

Closed on

Sep 13, 2006

Sold by

Sharpes Leland R

Bought by

Sharpes Realty Vestors Llc and Sharpes Leland R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,000

Interest Rate

6.64%

Mortgage Type

Commercial

Purchase Details

Closed on

Nov 18, 2005

Sold by

Corporate Properties Inc

Bought by

Sharpes Leland R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,000

Interest Rate

6.04%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Oct 4, 2002

Sold by

Smith Gary E and Smith Lauren E

Bought by

Corporate Properties Inc

Purchase Details

Closed on

Mar 20, 1997

Sold by

Wiltgen Robert L Marilyn L

Bought by

Smith Gary E and Smith Lauren E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$566,000

Interest Rate

7.74%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dbc1 Llc | $615,000 | First American Title | |

| Sharpes Leland R | -- | None Available | |

| Sharpes Realty Vestors Llc | -- | None Available | |

| Sharpes Leland R | $455,000 | -- | |

| Corporate Properties Inc | -- | -- | |

| Smith Gary E | $850,000 | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sharpes Realty Vestors Llc | $170,000 | |

| Previous Owner | Sharpes Leland R | $55,000 | |

| Previous Owner | Smith Gary E | $566,000 | |

| Closed | Smith Gary E | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,823 | $51,590 | $20,100 | $31,490 |

| 2024 | $3,687 | $51,590 | $20,100 | $31,490 |

| 2022 | $3,401 | $42,743 | $13,900 | $28,843 |

| 2021 | $3,495 | $43,973 | $14,300 | $29,673 |

| 2020 | $3,496 | $43,973 | $14,300 | $29,673 |

| 2019 | $3,437 | $43,973 | $14,300 | $29,673 |

| 2018 | $4,385 | $53,280 | $4,910 | $48,370 |

| 2017 | $3,776 | $53,280 | $4,910 | $48,370 |

| 2016 | $3,211 | $43,780 | $5,429 | $38,351 |

| 2015 | $3,185 | $43,780 | $5,430 | $38,350 |

| 2014 | $2,836 | $37,710 | $5,430 | $32,280 |

Source: Public Records

Map

Nearby Homes

- 143 W 2nd St

- 625 Harrison Ave

- 205 E 6th St Unit 300

- 205 E 6th St Unit 301

- 205 E 6th St Unit 200

- 205 E 6th St Unit 400

- 205 E 6th St Unit 204

- 205 E 6th St Unit 305

- 205 E 6th St Unit 202

- 205 E 6th St Unit 303

- 205 E 6th St Unit 205

- 205 E 6th St Unit 302

- 205 E 6th St Unit 304

- 108 S Cleveland Ave

- 720 Roosevelt Ave

- 610 W 5th St

- 203 N Jefferson Ave

- 116 S Lincoln Ave

- 633 W 6th St

- 905 Harrison Ave

- 205 W 4th St

- 231 W 4th St

- 409 N Garfield Ave

- 402 Grant Ave

- 245 W 4th St

- 437 Garfield Ave

- 341 Garfield Ave

- 218 W 5th St

- 436 Grant Ave

- 216 W 4th St

- 220 W 4th St

- 341 N Garfield Ave Unit d7

- 341 N Garfield Ave Unit d1

- 341 N Garfield Ave

- 232 W 4th St

- 141 W 4th St

- 446 Grant Ave

- 135 W 4th St

- 337 Garfield Ave

- 240 W 4th St