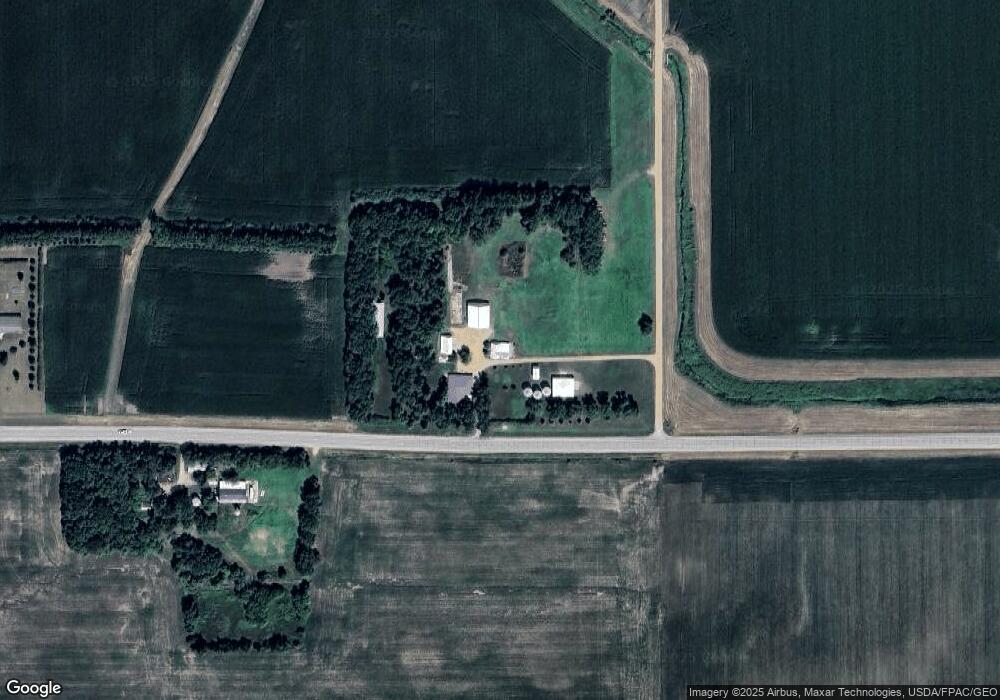

2188 State Highway 19 Marshall, MN 56258

Estimated Value: $561,000 - $768,566

5

Beds

3

Baths

4,448

Sq Ft

$142/Sq Ft

Est. Value

About This Home

This home is located at 2188 State Highway 19, Marshall, MN 56258 and is currently estimated at $631,522, approximately $141 per square foot. 2188 State Highway 19 is a home located in Lyon County with nearby schools including Park Side Elementary School, West Side Elementary School, and Marshall Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2020

Sold by

Steinbeisser Maggie and Steinbeisser Jason

Bought by

Mahoney Kevin J and Mahoney Alyssa L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$358,123

Interest Rate

3.75%

Mortgage Type

New Conventional

Estimated Equity

$273,399

Purchase Details

Closed on

Jun 20, 2016

Sold by

Aufenthie Charles and Aufenthie Heidi

Bought by

Steinbeisser Maggie and Steinbeisser Jason

Purchase Details

Closed on

Mar 8, 2013

Sold by

Aufenthie Charles and Aufenthie Heidi

Bought by

Aufenthie Charles and Aufenthie Heidi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$309,000

Interest Rate

3.5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mahoney Kevin J | $400,000 | Title & Abstract Services | |

| Steinbeisser Maggie | $425,000 | None Available | |

| Aufenthie Charles | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mahoney Kevin J | $400,000 | |

| Previous Owner | Aufenthie Charles | $309,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,188 | $742,500 | $135,700 | $606,800 |

| 2024 | $4,816 | $705,700 | $133,700 | $572,000 |

| 2023 | $5,066 | $678,600 | $104,200 | $574,400 |

| 2022 | $4,640 | $620,300 | $78,200 | $542,100 |

| 2021 | $4,390 | $525,800 | $71,500 | $454,300 |

| 2020 | $3,966 | $489,500 | $67,200 | $422,300 |

| 2019 | $3,526 | $452,200 | $67,200 | $385,000 |

| 2018 | $3,374 | $426,900 | $65,200 | $361,700 |

| 2017 | $3,374 | $418,300 | $68,200 | $350,100 |

| 2016 | $5,774 | $0 | $0 | $0 |

| 2015 | -- | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 2555 River Rd

- Xxx Leaf Point

- XXXX Leaf Point

- 414 Berlin Cir

- 807 Elizabeth St

- 805 Elizabeth St

- 902 Cheryl Ave

- 627 Southview Dr

- 1104 Cheryl Ave

- 704 Andrew St

- 702 Donald St

- 700 Donald St

- 705 Andrew St

- 614 Andrew St

- 615 Andrew St

- 612 Andrew St

- 611 Andrew St

- 704 Elizabeth St

- 609 Andrew St

- tbd Savannah Heights Blvd