2195 Tarryall Way Franktown, CO 80116

Estimated Value: $853,351 - $1,089,000

5

Beds

3

Baths

3,545

Sq Ft

$268/Sq Ft

Est. Value

About This Home

This home is located at 2195 Tarryall Way, Franktown, CO 80116 and is currently estimated at $950,838, approximately $268 per square foot. 2195 Tarryall Way is a home located in Douglas County with nearby schools including Franktown Elementary School, Sagewood Middle School, and Ponderosa High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 14, 2017

Sold by

Sargent Kenneth W and Sargent Erica R

Bought by

Durrant Leo D and Durrant Kelley E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$375,000

Outstanding Balance

$313,404

Interest Rate

3.93%

Mortgage Type

New Conventional

Estimated Equity

$637,434

Purchase Details

Closed on

Aug 2, 2013

Sold by

The Smith Family Revocable Trust

Bought by

Sargent Kenneth W and Sargent Erica R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$383,714

Interest Rate

3.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 21, 2004

Sold by

Smith Everett F and Smith Virginia M

Bought by

The Smith Family Revocable Trust

Purchase Details

Closed on

Jun 29, 1981

Sold by

Unavailable

Bought by

Unavailable

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Durrant Leo D | $564,900 | Land Title Guarantee Co | |

| Sargent Kenneth W | $35,600 | None Available | |

| The Smith Family Revocable Trust | -- | -- | |

| Unavailable | $100,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Durrant Leo D | $375,000 | |

| Previous Owner | Sargent Kenneth W | $383,714 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,598 | $30,150 | $90 | $30,060 |

| 2023 | $4,947 | $60,460 | $31,760 | $28,700 |

| 2022 | $3,798 | $45,360 | $20,720 | $24,640 |

| 2021 | $3,935 | $45,360 | $20,720 | $24,640 |

| 2020 | $3,687 | $43,480 | $18,710 | $24,770 |

| 2019 | $3,704 | $43,480 | $18,710 | $24,770 |

| 2018 | $3,195 | $36,840 | $14,350 | $22,490 |

| 2017 | $2,975 | $36,840 | $14,350 | $22,490 |

| 2016 | $2,601 | $31,590 | $9,430 | $22,160 |

| 2015 | $2,660 | $31,590 | $9,430 | $22,160 |

| 2014 | $2,484 | $27,560 | $9,150 | $18,410 |

Source: Public Records

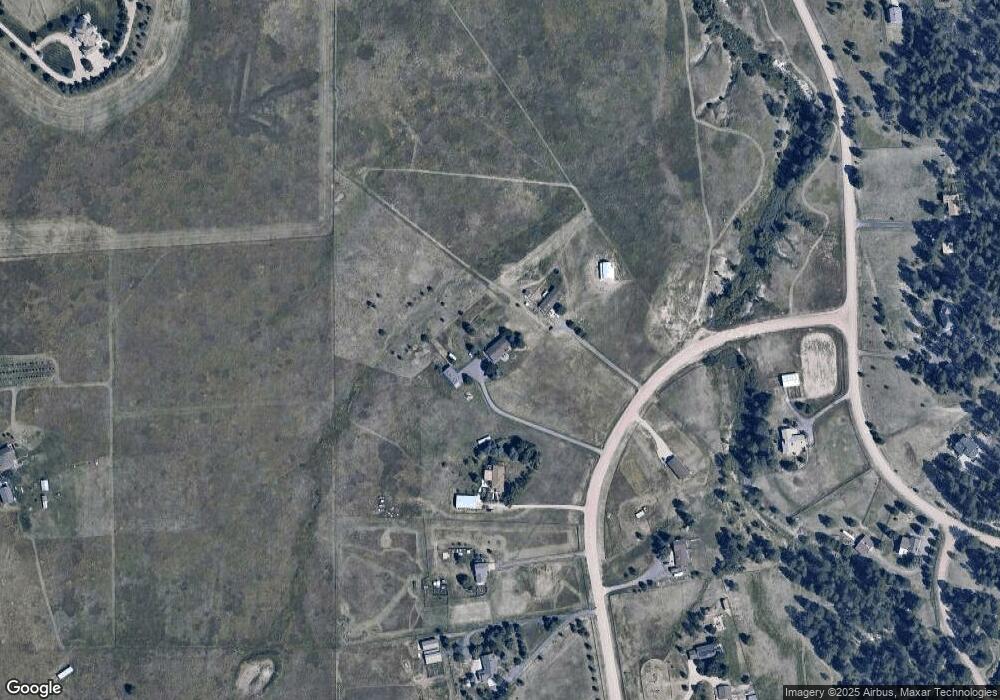

Map

Nearby Homes

- 1972 Gold Camp Way

- 1559 Apex Rd

- 1571 Arrowpoint Ct

- 1561 Arrowpoint Ct

- 1555 Arrowpoint Ct

- 11274 E Manitou Rd

- 2072 Summit St

- 10400 Pine Valley Dr

- 1750 Arrowpoint Ct

- 1721 Arrowpoint Ct

- 1724 Arrowpoint Ct

- 9250 Steeplechase Dr

- 1341 Tomichi Dr

- 11044 Conestoga Place

- 1133 Tomichi Dr

- 8780 Steeplechase Dr

- 856 Woodridge Rd

- 210 High Meadows Loop

- 30999 Kootney St

- 230 S Big Meadow Trail

- 2151 Tarryall Way

- 2207 S Tarryall Way

- 2233 Tarryall Way

- 2208 S Tarryall Way

- 1859 Gold Camp Way

- 2275 S Tarryall Way

- 2288 S Tarryall Way

- 2335 Tarryall Way

- 1856 Gold Camp Way

- 1901 Gold Camp Way

- 1812 Gold Camp Way

- 1922 Gold Camp Way

- 2340 S Tarryall Way

- 2320 S Russellville Rd

- 2126 S Russellville Rd

- 1776 Gold Camp Way

- 2401 S Tarryall Way

- 1726 Gold Camp Way

- 1726 Gold Camp Way

- 2275 S Evans Way