22 Kestral Way Unit 238 Key West, FL 33040

Estimated Value: $553,200 - $644,000

2

Beds

2

Baths

810

Sq Ft

$742/Sq Ft

Est. Value

About This Home

This home is located at 22 Kestral Way Unit 238, Key West, FL 33040 and is currently estimated at $601,300, approximately $742 per square foot. 22 Kestral Way Unit 238 is a home located in Monroe County with nearby schools including Gerald Adams Elementary School, Key West High School, and Grace Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2021

Sold by

Key To Paradise Llc

Bought by

Barry Jeffrey S

Current Estimated Value

Purchase Details

Closed on

Aug 5, 2018

Sold by

Herman Jeffrey R and Herman Sommer J

Bought by

Keys Too Paradise Llc

Purchase Details

Closed on

May 12, 2017

Sold by

Chiuchiarelli Carlo and Chiuchiarelli Kathleen A

Bought by

Herman Jerry R and Digioia Nick

Purchase Details

Closed on

May 7, 2004

Sold by

Key Too Paradise Llc

Bought by

Herman Jerry R and Digioia Nick

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Interest Rate

5.49%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 19, 1997

Sold by

Herman Gerald R and Herman Czack W

Bought by

Key Too Paradise L L C

Purchase Details

Closed on

Jun 9, 1997

Sold by

Key West Golf Club Development Inc

Bought by

Herman Gerald R and Czack Michael W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,000

Interest Rate

8.13%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barry Jeffrey S | $445,000 | Attorney | |

| Keys Too Paradise Llc | -- | Attorney | |

| Herman Jerry R | -- | Attorney | |

| Herman Jerry R | $188,000 | First American Title Ins Co | |

| Key Too Paradise L L C | -- | -- | |

| Herman Gerald R | $205,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Herman Jerry R | $188,000 | |

| Previous Owner | Herman Gerald R | $164,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,445 | $536,745 | $383,685 | $153,060 |

| 2023 | $4,445 | $530,357 | $383,685 | $146,672 |

| 2022 | $3,800 | $406,310 | $255,790 | $150,520 |

| 2021 | $3,223 | $319,161 | $175,094 | $144,067 |

| 2020 | $3,290 | $328,438 | $182,707 | $145,731 |

| 2019 | $3,229 | $319,561 | $170,527 | $149,034 |

| 2018 | $3,073 | $305,862 | $153,525 | $152,337 |

| 2017 | $2,951 | $300,928 | $0 | $0 |

| 2016 | $2,723 | $265,926 | $0 | $0 |

| 2015 | $2,490 | $217,445 | $0 | $0 |

| 2014 | $2,705 | $235,432 | $0 | $0 |

Source: Public Records

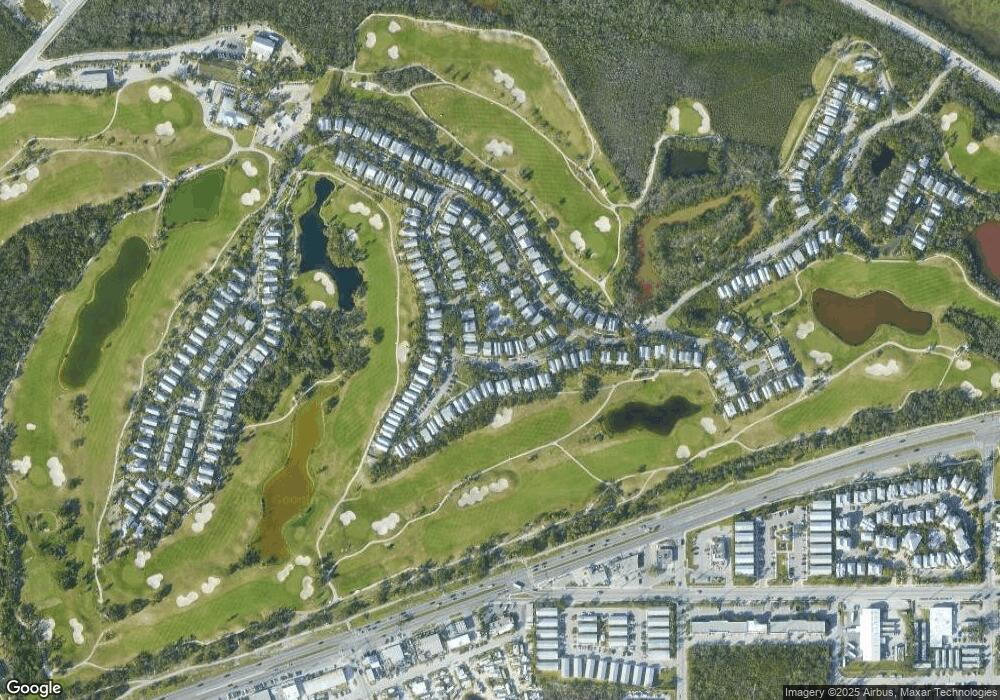

Map

Nearby Homes

- 45 Spoonbill Way

- 26 Spoonbill Way

- 90 Golf Club Dr

- 8 Kestral Way

- 11 Kestral Way

- 60 Golf Club Dr

- 3 Spoonbill Way

- 1 Spoonbill Way

- 138 Golf Club Dr

- 58 Golf Club Dr

- 14 Kingfisher Ln

- 263 Golf Club Dr

- 247 Golf Club Dr

- 224 Golf Club Dr

- 243 Golf Club Dr

- 18 Golf Club Dr

- 2 Merganser Ln

- 22 Merganser Ln

- 30 Whistling Duck Ln

- 55 Coral Way

- 20 Kestral Way Unit 239

- 20 Kestral Way

- 20 Kestral - Pink Way Unit 20

- 24 Kestral Way Unit 237

- 24 Kestral Way

- 26 Kestral Way

- 18 Kestral Way Unit 240

- 18 Kestral Way

- 28 Kestral Way Unit 235

- 28 Kestral Way

- 16 Kestral Way

- 14 Kestral Way Unit 242

- 14 Kestral Way

- 12 Kestral Way Unit 243

- 12 Kestral Way

- 47 Spoonbill Way Unit 232

- 47 Spoonbill Way

- 45 Spoonbill Way Unit 331

- 43 Spoonbill Way Unit 230

- 43 Spoonbill Way