22 Terraza Del Mar Dana Point, CA 92629

Dana Hills NeighborhoodEstimated Value: $2,349,620 - $2,957,000

4

Beds

4

Baths

2,984

Sq Ft

$856/Sq Ft

Est. Value

About This Home

This home is located at 22 Terraza Del Mar, Dana Point, CA 92629 and is currently estimated at $2,555,405, approximately $856 per square foot. 22 Terraza Del Mar is a home located in Orange County with nearby schools including Del Obispo Elementary School, Marco Forster Middle School, and Dana Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 15, 2024

Sold by

Gardea Anthony Ray and Tracy Nicole

Bought by

Gardea Family Joint Revocable Trust and Gardea

Current Estimated Value

Purchase Details

Closed on

Jun 15, 2018

Sold by

Gardean Anthony Ray and Gardean Tracy Nicole

Bought by

Gardea Anthony Ray and Gardea Tracy Nicole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$946,400

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 12, 2007

Sold by

Gardea Tony Ray

Bought by

Gardea Tony Ray and Gardea Tracy Nicole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$335,000

Interest Rate

6.16%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

May 28, 2002

Sold by

Sabatello James D and Sabatello Sally Ann L

Bought by

Gardea Tony Ray and Gardea Tracy Nicole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$650,000

Interest Rate

6.74%

Purchase Details

Closed on

Jun 1, 2001

Sold by

Sabatello James D

Bought by

Sabatello James D and Sabatello Sally Ann L

Purchase Details

Closed on

May 1, 2001

Sold by

Sabatello Sally Ann L

Bought by

Sabatello James D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$615,000

Interest Rate

6.87%

Purchase Details

Closed on

Mar 20, 2001

Sold by

Caton Michael Wayne and Caton Cassandra Louize

Bought by

Sabatello James D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$615,000

Interest Rate

6.87%

Purchase Details

Closed on

Jun 18, 1999

Sold by

Caton Michael W and Caton Cassandra L

Bought by

Caton Michael Wayne and Caton Cassandra Louize

Purchase Details

Closed on

Mar 4, 1999

Sold by

Obenberger Robert L and Obenberger Mary

Bought by

Caton Michael W and Caton Cassandra L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$450,000

Interest Rate

6.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gardea Family Joint Revocable Trust | -- | None Listed On Document | |

| Gardea Anthony Ray | -- | Wfg National Title | |

| Gardea Tony Ray | -- | Magnus Title Agency | |

| Gardea Tony Ray | -- | Civic Center Title Services | |

| Gardea Tony Ray | $882,000 | Southland Title Corporation | |

| Sabatello James D | -- | Fidelity National Title Ins | |

| Sabatello James D | -- | Fidelity National Title Co | |

| Sabatello James D | $885,000 | Equity Title Company | |

| Caton Michael Wayne | -- | -- | |

| Caton Michael W | $700,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gardea Anthony Ray | $946,400 | |

| Previous Owner | Gardea Tony Ray | $335,000 | |

| Previous Owner | Gardea Tony Ray | $650,000 | |

| Previous Owner | Sabatello James D | $615,000 | |

| Previous Owner | Caton Michael W | $450,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,296 | $1,345,898 | $885,466 | $460,432 |

| 2024 | $13,296 | $1,319,508 | $868,104 | $451,404 |

| 2023 | $13,013 | $1,293,636 | $851,083 | $442,553 |

| 2022 | $12,764 | $1,268,271 | $834,395 | $433,876 |

| 2021 | $12,116 | $1,203,747 | $818,034 | $385,713 |

| 2020 | $11,995 | $1,191,405 | $809,647 | $381,758 |

| 2019 | $12,001 | $1,168,045 | $793,772 | $374,273 |

| 2018 | $12,047 | $1,145,143 | $778,208 | $366,935 |

| 2017 | $11,699 | $1,122,690 | $762,949 | $359,741 |

| 2016 | $11,787 | $1,100,677 | $747,989 | $352,688 |

| 2015 | $11,380 | $1,084,144 | $736,753 | $347,391 |

| 2014 | $11,212 | $1,062,908 | $722,321 | $340,587 |

Source: Public Records

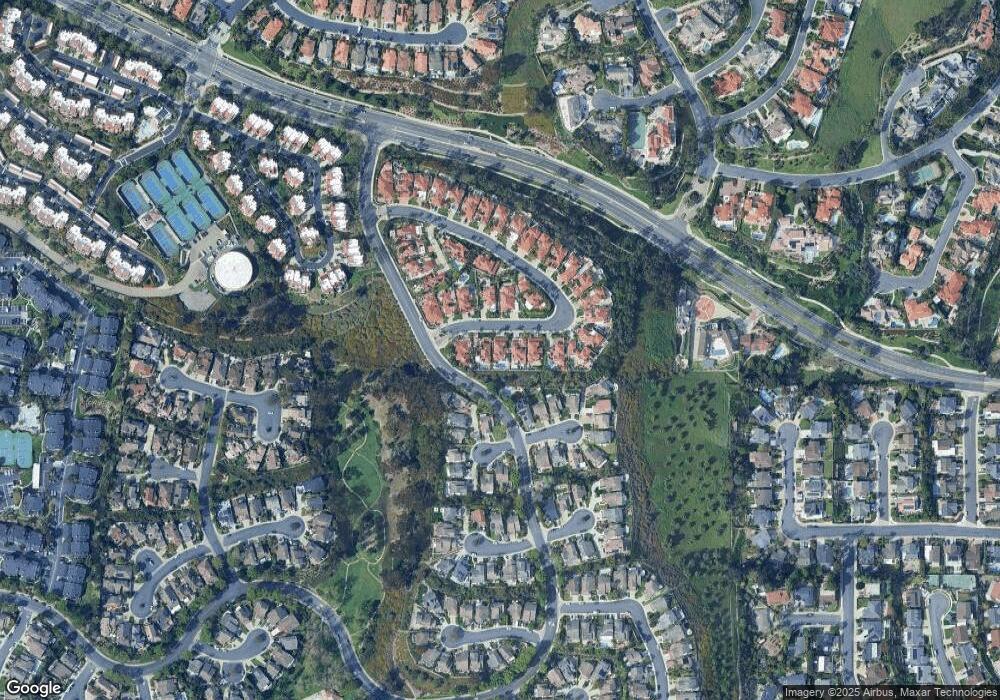

Map

Nearby Homes

- 15 Glastonbury Place

- 31 La Paloma

- 32862 Bluffside Dr

- 25392 Neptune Dr

- 5 Old Ranch Rd

- 46 Terra Vista

- 32672 Alta Pine Ln

- 32791 Del Obispo St

- 32602 Deadwood Dr

- 25572 Purple Sage Ln

- 33121 Ocean Ridge

- 33144 Ocean Ridge

- 24 Bright Water Dr

- 2 Point Catalina

- 25571 Via Inez Rd

- 32481 Spyglass Ct

- 32972 Paseo Miraflores

- 94 Shorebreaker Dr

- 226 Shorebreaker Dr

- 24 Costa Brava

- 21 Terraza Del Mar

- 23 Terraza Del Mar

- 20 Terraza Del Mar

- 24 Terraza Del Mar

- 29 Terraza Del Mar

- 19 Terraza Del Mar

- 25131 Danapepper

- 28 Terraza Del Mar

- 25141 Danapepper

- 27 Terraza Del Mar

- 25095 Danapepper

- 26 Terraza Del Mar

- 25151 Danapepper

- 25101 Danapepper

- 25093 Danapepper

- 25 Terraza Del Mar

- 18 Terraza Del Mar

- 25161 Danapepper

- 25091 Danapepper

- 17 Terraza Del Mar